PO3 + MMXM + SMT + STDV | ICT Concepts | DexterLab

Summary

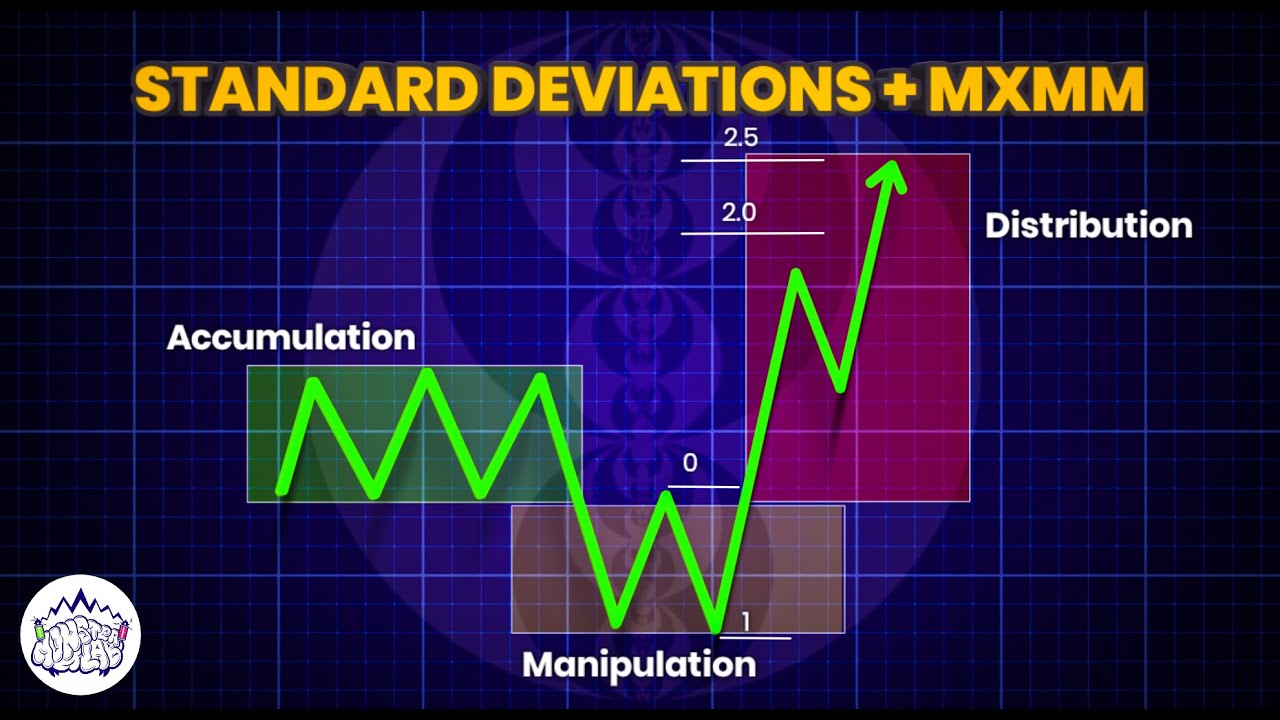

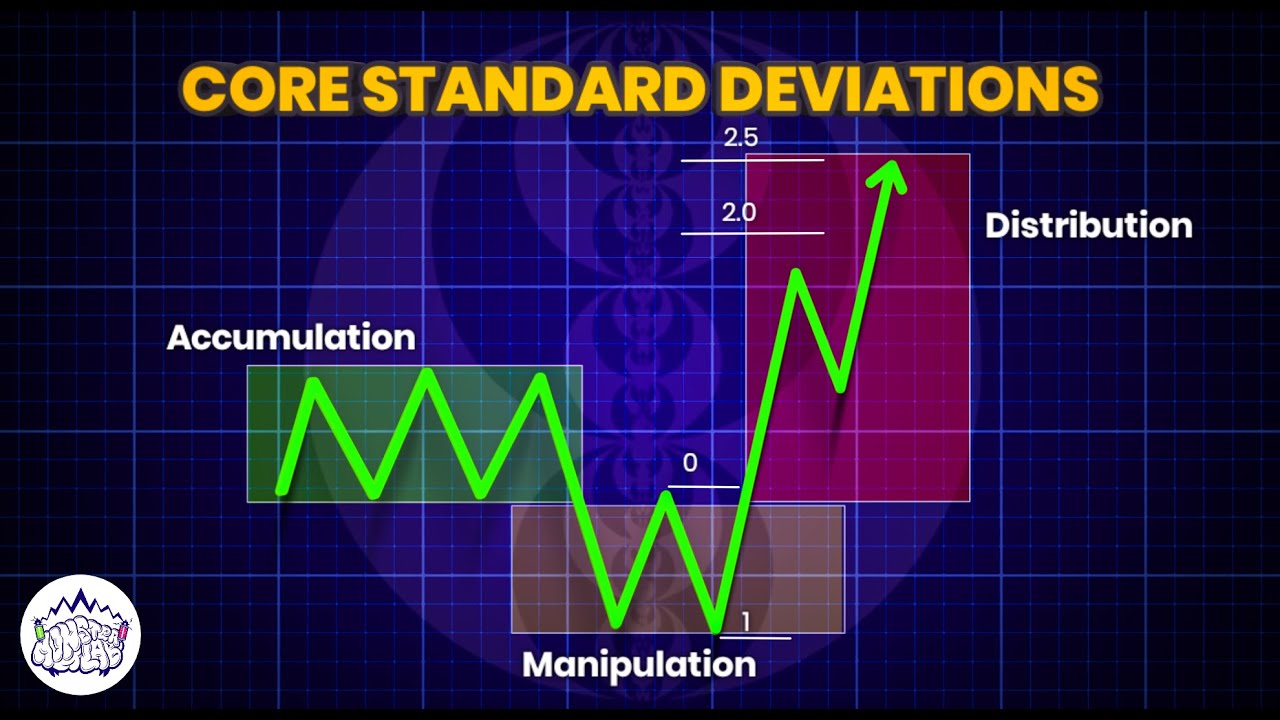

TLDRThis video explores the application of Smart Money Tactics (SMT) and standard deviations in understanding market movements, particularly focusing on the phases of accumulation, manipulation, and distribution. It emphasizes the importance of aligning lower time-frame trades with higher time-frame trends to avoid false signals. The concept of market maker buy/sell models, with key zones defined by deviations, helps traders identify high-probability entry points. Key techniques such as using liquidity zones, fair value gaps, and order blocks are also discussed to make informed decisions in a bearish or bullish market.

Takeaways

- 😀 The Power of Three model (accumulation, manipulation, and distribution) is essential for understanding market movements.

- 😀 Standard Deviations play a significant role in determining key price levels where potential reversals or continuations may occur.

- 😀 The two and two-and-a-half Standard Deviation levels are used for identifying reaccumulation or redistribution zones.

- 😀 Having a higher time frame premise (e.g., daily chart analysis) is crucial for determining the overall market bias (e.g., bearish or bullish).

- 😀 Smart Money Traps (SMT) are an important confirmation tool, especially when paired with fair value gaps and order blocks.

- 😀 The higher time frame market premise should guide lower time frame trades, helping traders avoid counter-trend positions.

- 😀 At the two and two-and-a-half Standard Deviation levels, reaccumulation or redistribution typically occurs, depending on the overall market trend.

- 😀 Traders should not anticipate bullish reversals at key deviation levels if the higher time frame premise suggests a bearish trend.

- 😀 SMT confirmations in other markets (e.g., SP) help to validate the likelihood of a trend continuation or reversal.

- 😀 When executing trades, pay attention to buy-side or sell-side liquidity, such as buy stops or sell stops, especially in the accumulation or distribution phases.

Q & A

What is the significance of using standard deviations in trading analysis?

-Standard deviations are used to identify key levels for potential market reversals or continuation points. They help traders understand price volatility and set expectations for market movements, often aligning with major support and resistance areas.

What role do 'smart money reversals' play in market analysis?

-Smart money reversals refer to a shift in market direction caused by institutional players, often indicating a reversal point at a critical level. These are significant because they can signal that large players are entering or exiting positions, influencing price movements.

How do 're-accumulation' and 'redistribution' levels affect market behavior?

-Re-accumulation and redistribution levels represent phases where market participants are either buying (re-accumulation) or selling (redistribution) at certain price levels. These levels are key to understanding whether the market is preparing for a reversal or continuation.

Why is having a higher time frame premise important when trading?

-A higher time frame premise helps establish the broader market direction and context, providing a clearer understanding of whether the trend is bullish or bearish. Without this overarching context, decisions based solely on smaller time frames might lead to false signals or incorrect assumptions.

What does 'buy side liquidity' and 'sell side liquidity' refer to in this context?

-Buy side liquidity refers to the accumulation of orders placed by traders looking to buy, often near support levels. Sell side liquidity refers to orders placed by traders looking to sell, often near resistance levels. These liquidity pools are crucial for understanding potential price moves and reversals.

How does correlation between markets (like SP) impact decision making?

-Correlation between markets can provide additional insight into the strength or weakness of a trend. For example, if one market (e.g., SP) is bearish, it might suggest that another correlated market could follow suit. Monitoring these correlations allows traders to better anticipate moves in related markets.

What does 'SPO' refer to in the context of this script?

-SPO stands for 'Sell Point of Origin', which is a level where the price is expected to reverse due to an imbalance of orders. Traders monitor SPOs to identify potential turning points in the market.

What is the importance of looking at volume imbalances in market analysis?

-Volume imbalances highlight areas where large trades or orders are occurring, often signaling a potential reversal or continuation. These imbalances can indicate that institutions are entering or exiting positions, providing key clues about the market's direction.

What is meant by 'turtle soup' in trading terminology?

-'Turtle soup' refers to a strategy where the price tests a key level that has previously been breached, only to reverse sharply afterward. This strategy aims to trap traders who believe the trend will continue, but instead, the market reverses.

What is the role of 'internal liquidity' in understanding market behavior?

-Internal liquidity refers to liquidity within the same market or time frame. It's crucial for identifying key entry or exit points. If there’s no internal liquidity in a given level, it may signal that the price level is not as significant and could lead to false breakouts.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Standard Deviations + MMXM | ICT Concepts | DexterLab

Core Standard Deviations + PO3 | ICT Concepts | DexterLab

ICT Market Maker Models - A Simple Guide

ICT Forex - Accumulation - Manipulation - Distribution

4HR PO3 | MMXM | Standard Deviations | ICT Concepts

Episode 9: Using Standard Deviations Day Trading - ICT Concepts

5.0 / 5 (0 votes)