SESI 14 MANAJEMEN PIUTANG DAN PERSEDIAAN

Summary

TLDRIn this session, the speaker discusses the management of accounts receivable and inventory, emphasizing their interconnected yet inverse relationship. Accounts receivable policies, such as credit periods, discounts, credit standards, and collection strategies, are explored to minimize default risks while maintaining sales. The speaker also highlights inventory management, explaining how timing and quantity impact storage and ordering costs. Key concepts like Economic Order Quantity (EOQ) and Reorder Point (ROP) are introduced to ensure efficient inventory control. The session emphasizes the importance of balancing these factors to optimize company performance and profitability.

Takeaways

- 😀 Accounts receivable and inventory management are closely related, but inversely proportional. When inventory decreases, sales increase, which can cause accounts receivable to rise if sales are on credit.

- 😀 A longer credit period can boost sales as customers are more likely to buy on credit, but it also increases the risk of default. Conversely, a shorter credit period reduces the risk of default but may lower sales.

- 😀 Offering discounts for early payments can reduce the risk of default by encouraging quicker payments, though it may reduce overall profit margins.

- 😀 Credit standards, such as the length of the credit period, discounts, customer income, and their history with other companies, help determine if a consumer is likely to default. Finding a balance in credit standards is key to managing risk and sales.

- 😀 Collection policies need to balance firmness and flexibility. A firm collection policy may reduce sales but ensure quicker payments, while a loose policy may increase the risk of defaults but maintain higher sales.

- 😀 High accounts receivable can strain a company's capital and increase risks, so managing it effectively is essential to avoid cash flow problems.

- 😀 Inventory management is crucial for balancing storage and ordering costs. Too much inventory incurs storage costs, while too little can lead to missed sales and ordering costs.

- 😀 The Economic Order Quantity (EOQ) determines the most cost-effective amount of inventory to order, balancing storage and ordering costs.

- 😀 The Reorder Point (ROP) is essential for determining the right time to restock, ensuring inventory arrives just in time to meet demand without excess.

- 😀 Managing inventory carefully, through policies like EOQ and ROP, ensures that products are available when needed without incurring unnecessary costs or risking stockouts.

Q & A

What is the relationship between accounts receivable and inventory?

-Accounts receivable and inventory are inversely proportional. When inventory decreases, sales typically increase, leading to a rise in accounts receivable, especially if the company sells on credit. Conversely, when inventory increases, sales stagnate, which leads to a decrease in accounts receivable.

Why is managing accounts receivable crucial for a company?

-Managing accounts receivable is essential because if they are too high, it means a significant amount of capital is tied up in unpaid invoices. This can lead to a lack of liquidity for the company, affecting its ability to operate efficiently.

What are the four key credit policies for managing accounts receivable?

-The four key credit policies are: 1) Credit period, 2) Discount for early payment, 3) Credit standards, and 4) Collection policy. Each of these policies impacts sales, default risk, and liquidity.

How does the credit period affect sales and default risk?

-A longer credit period can increase sales as customers are more inclined to purchase on credit, but it also raises the risk of defaults. A shorter credit period reduces the risk of defaults but may decrease sales because customers may be less willing to purchase with a shorter repayment window.

What role does offering a discount for early payment play in managing accounts receivable?

-Offering a discount for early payment encourages customers to pay sooner, reducing the risk of defaults. However, the downside is that the company may earn less profit per sale, as the discount lowers the total sale price.

What is the significance of credit standards in managing accounts receivable?

-Credit standards set the regulations for granting credit to customers, including factors like credit period, income, and past payment behavior. Tight credit standards reduce the risk of default but may lower sales, while relaxed standards may increase sales but expose the company to higher default risks.

How do collection policies affect the company’s accounts receivable?

-Collection policies can be firm, loose, or moderate. A firm policy reduces default risk but may harm sales, while a loose policy increases the chance of defaults. A moderate policy aims to balance both sales and risk.

What happens when inventory arrives too fast or too late?

-If inventory arrives too fast, the company incurs higher storage costs. If it arrives too late, the company risks losing sales due to stockouts and may need to incur extra ordering costs. Both scenarios affect profitability and operational efficiency.

What is Economic Order Quantity (EOQ), and why is it important for inventory management?

-Economic Order Quantity (EOQ) is the optimal amount of inventory a company should order to minimize the combined costs of ordering and storing inventory. It ensures the company orders in the most cost-efficient manner.

What is the Reorder Point (ROP) and how does it help in inventory management?

-The Reorder Point (ROP) is the inventory level at which a company needs to reorder stock to avoid stockouts. It helps ensure that inventory is replenished in time, maintaining a smooth operation and preventing lost sales.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

LENDING RATIONALE II DEMO VERSION

Menghitung Perputaran Piutang, Perputaran Persediaan dan TATO (Rasio Aktivitas)

‼️ASET LANCAR ‼️PENGERTIAN & CONTOH ‼️

[MEET 6] AKUNTANSI SEKTOR PUBLIK - TRANSAKSI PENDAPATAN LRA DAN LO

AKM 1: 3-2 Pengakuan Piutang Dagang

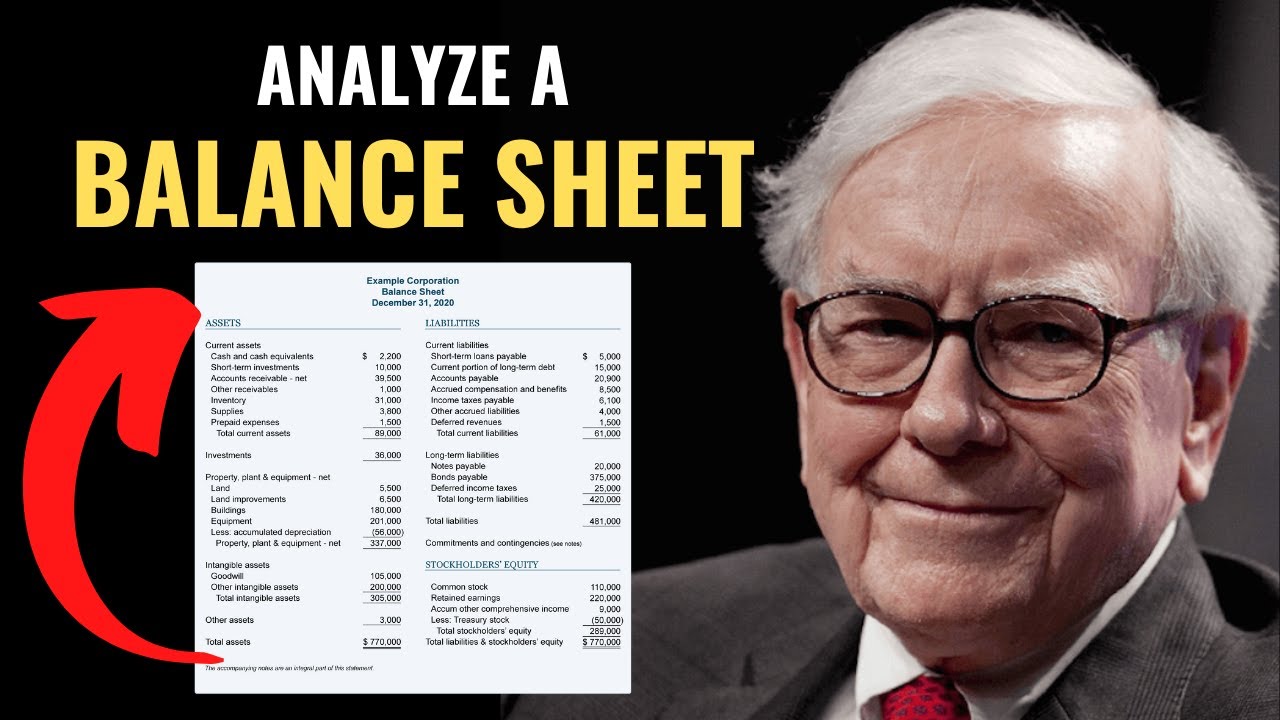

How to Analyze a Balance Sheet Like a Hedge Fund Analyst

5.0 / 5 (0 votes)