Breakout के पहले Sector Rotation कैसे identify करे | Understanding The Sector Rotation | RRG Chart

Summary

TLDRIn this tutorial, the speaker explains how to use the Relative Rotation Graph (RRG) tool on StockCharts for stock market analysis. They guide users through the setup process, selecting different time frames for swing, positional, and long-term trading. The RRG chart is explained as a way to track sector performance across four quadrants: Leading, Improving, Weakening, and Lagging. By analyzing momentum and relative strength, traders can make informed decisions about which sectors and stocks to invest in, focusing on those with improving momentum. The video also highlights how to track daily changes and shift strategies accordingly.

Takeaways

- 😀 Sign up for a free trial on StockCharts to access a variety of paid tools for technical analysis.

- 😀 The RRG chart is a key tool for analyzing stock momentum and relative performance over different time frames (e.g., 1 month, 6 months, 1 year).

- 😀 In the RRG chart, sectors are categorized into four quadrants: Leading, Improving, Weakening, and Lagging, based on their momentum and performance.

- 😀 Momentum on the Y-axis and relative strength on the X-axis are key factors in understanding sector movement in RRG charts.

- 😀 Outperformance is determined by comparing the returns of an index against a benchmark (e.g., Nifty), and sectors can shift from outperforming to underperforming.

- 😀 The life cycle of stocks and indices is dynamic, moving through cycles from leading to lagging, based on economic and market factors.

- 😀 A sector's movement from weakening to lagging indicates fading momentum and performance, while movement from lagging to improving signals potential growth.

- 😀 RRG charts help identify promising stocks or sectors, especially those improving and likely to shift into leading quadrants.

- 😀 Leading sectors are those with strong momentum and outperformance, which are ideal for investment, while lagging sectors should generally be avoided.

- 😀 Regular updates on RRG charts (e.g., daily posts) can aid traders in making informed decisions, especially for swing or positional trading strategies.

Q & A

What is the main tool discussed in the video for technical analysis?

-The main tool discussed is the Relative Rotation Graph (RRG) available on the StockCharts website, which is used for tracking the momentum and relative strength of different stock indexes or sectors.

How does a user begin using the RRG chart on StockCharts?

-A user needs to first sign up on stockcharts.com and opt for a free trial. After logging in, they can navigate to 'Charts and Tools' and select the RRG chart option.

What are the four quadrants in the RRG chart and what do they signify?

-The four quadrants are 'Improving,' 'Leading,' 'Weakening,' and 'Lagging.' These quadrants indicate the momentum and relative strength of a stock or index, with 'Leading' showing strong performance and 'Lagging' showing weak performance.

How does the RRG chart help in analyzing stock performance?

-The RRG chart helps by tracking the momentum (Y-axis) and relative strength (X-axis) of various sectors or indexes over time, which helps identify which sectors are outperforming or underperforming the market.

What does it mean when an index moves from the 'Weakening' quadrant to the 'Lagging' quadrant?

-This means the index is experiencing a decline in momentum and has started to underperform relative to other benchmarks or sectors.

How can time frames affect the use of the RRG chart for different types of trading?

-For swing trading, a time frame of one month is suitable, while for positional trading, a time frame of six months is ideal. For long-term analysis, a one-year time frame is often preferred.

What role do momentum and relative strength play in the movement of stocks on the RRG chart?

-Momentum is represented on the Y-axis, showing whether a stock's momentum is increasing or decreasing. Relative strength is on the X-axis, indicating whether a stock is outperforming or underperforming relative to the benchmark.

How do economic, fundamental, and technical factors impact the RRG chart's interpretation?

-These factors influence the momentum and performance of stocks or sectors, which are reflected on the RRG chart. News, economic events, and market conditions can cause shifts in momentum, affecting the sector's position on the chart.

What is the significance of an index moving from 'Lagging' to 'Leading' in the RRG chart?

-This indicates that the index's relative strength has improved and its momentum is on the rise, signaling a potential opportunity for outperformance in the near future.

Why is the RRG considered a lagging indicator, and how does this affect trading decisions?

-The RRG is a lagging indicator because it shows the momentum and relative strength based on historical data, not predicting future movements. Traders use it to identify trends but must be cautious as future performance may differ.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

cara pake graph editor.

What is Fibonacci Retracement? How to use Fibonacci Retracement in Trading? Explained By CA Rachana

The LAST graph editor tutorial you'll ever need. \\ After Effects Tutorial

RSI Powerful Strategies for Intraday and Swing Trading || RSI Advance Strategy - कही नहीं मिलेगा ये

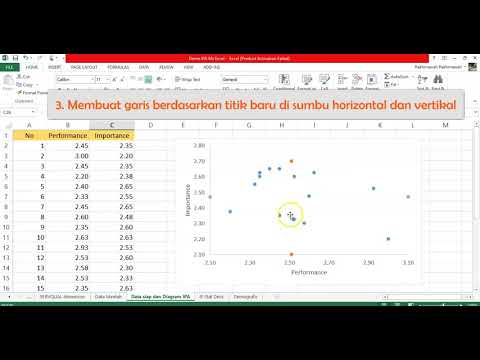

7 Diagram IPA Ms Excel (2) | Importance Performance Analysis Ms Excel

Rotasi Hal 34-36 Bab 1 TRANSFORMASI FUNGSI Kelas 12 SMA SMK Kurikulum Merdeka

5.0 / 5 (0 votes)