Aula 3 - Direito Empresarial II

Summary

TLDRThis lecture explores the distinction between 'sociedade simples' (simple society) and 'sociedade limitada' (limited company) in Brazil, focusing on professionals such as lawyers, doctors, and dentists. The speaker explains how liberal professionals can form a sociedade simples for service provision without being considered business owners, emphasizing registration with relevant professional bodies and tax authorities (CNPJ). Key differences, including legal registration, tax implications, and liability limitations, are addressed. The speaker also highlights the possibility of transitioning from a sociedade simples to a sociedade limitada, should the professional decide to expand into business operations.

Takeaways

- 😀 Professionals, such as lawyers, dentists, and other liberal professionals, can form a 'sociedade simples' (simple partnership) but are not considered business entities.

- 😀 A 'sociedade simples' does not require registration with the commercial registry, unlike a 'sociedade limitada' (limited company).

- 😀 Professionals can form a 'sociedade simples' for offering services collectively, but it doesn't make them entrepreneurs or business owners.

- 😀 The key distinction between 'sociedade simples' and 'sociedade limitada' is that a simple society doesn't require registration in the commercial registry and operates with a different tax framework.

- 😀 The tax treatment for professional service providers in a 'sociedade simples' is generally lighter than for business entities, especially in terms of taxation passed on to the consumer.

- 😀 Professionals forming a 'sociedade simples' are still required to register with their professional body (e.g., OAB for lawyers, CRM for doctors) depending on their profession.

- 😀 In a 'sociedade simples,' partners are liable for the business' debts only in proportion to their individual contribution to the society, not personally liable beyond their share.

- 😀 A 'sociedade simples' allows professionals to pool their services, like an advocacy firm or medical practice, while maintaining their individual professional identities.

- 😀 It is possible for a 'sociedade simples' to transition into a 'sociedade limitada' if the professionals involved wish to adopt a business model and register with the commercial registry.

- 😀 Professionals in a 'sociedade simples' must be cautious with tax filing to ensure that they comply with the regulations and avoid paying incorrect tax amounts or penalties.

Q & A

What is the main difference between a sociedade simples and a sociedade limitada?

-The main difference is that a sociedade simples (simple society) is designed for professionals such as lawyers and doctors who are not classified as entrepreneurs. They do not need to register with the commercial business registry. In contrast, a sociedade limitada (limited liability company) is for entrepreneurial activities and requires registration with the commercial registry.

Can liberal professionals such as lawyers and dentists form a sociedade simples?

-Yes, liberal professionals like lawyers, dentists, and other service providers can form a sociedade simples, but they must ensure to comply with the relevant professional bodies' regulations and may need to register with those bodies, such as the OAB for lawyers or CRM for doctors.

What is required for the registration of a sociedade simples?

-The sociedade simples does not require registration with the commercial business registry, but it must be registered with the appropriate professional body for the liberal profession, such as a lawyer's office being registered with the OAB.

What happens if a liberal professional decides to become an entrepreneur and wants to change their sociedade simples to a sociedade limitada?

-If a professional wants to shift from a sociedade simples to a sociedade limitada, they must follow the necessary legal procedures, including registering with the commercial business registry and ensuring proper tax structure, as the legal and tax obligations differ significantly between the two.

What is the role of professional bodies like OAB or CRM in the registration of a sociedade simples?

-Professional bodies such as OAB for lawyers or CRM for doctors play a crucial role in the registration of sociedade simples. They ensure that professionals comply with the regulations of their respective fields and oversee the formation of societies among professionals.

Are the tax obligations of a sociedade simples different from those of a sociedade limitada?

-Yes, the tax obligations of a sociedade simples are generally lighter than those of a sociedade limitada. However, professionals still need to ensure they comply with tax laws specific to their type of society and avoid overpaying or making errors in tax filing.

What is the main legal framework governing the formation and regulation of a sociedade simples?

-The main legal framework for the formation and regulation of a sociedade simples is provided by the Brazilian Civil Code, which covers aspects like formation, administration, dissolution, and the duties of the partners within a sociedade simples.

Can a sociedade simples be transformed into a sociedade limitada? If so, how?

-Yes, a sociedade simples can be transformed into a sociedade limitada if the professionals decide to engage in entrepreneurial activities. This process involves filing the appropriate legal paperwork, including the registration of the society with the commercial registry and adjusting the company's tax structure.

How does the administration of a sociedade simples compare to that of a sociedade limitada?

-The administration of a sociedade simples follows similar principles to a sociedade limitada, with provisions for decision-making, management, and dissolution. However, the specific rules governing each type of society may differ based on the legal framework and the activities conducted.

What should professionals be cautious about when changing from a sociedade simples to a sociedade limitada?

-Professionals must carefully manage the transition to ensure proper tax compliance, file the correct legal paperwork, and properly register with the commercial registry. They should also be aware of any legal or financial implications, such as adjusting the organizational structure and handling taxes.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

É possível retirar um sócio da administração da sociedade?

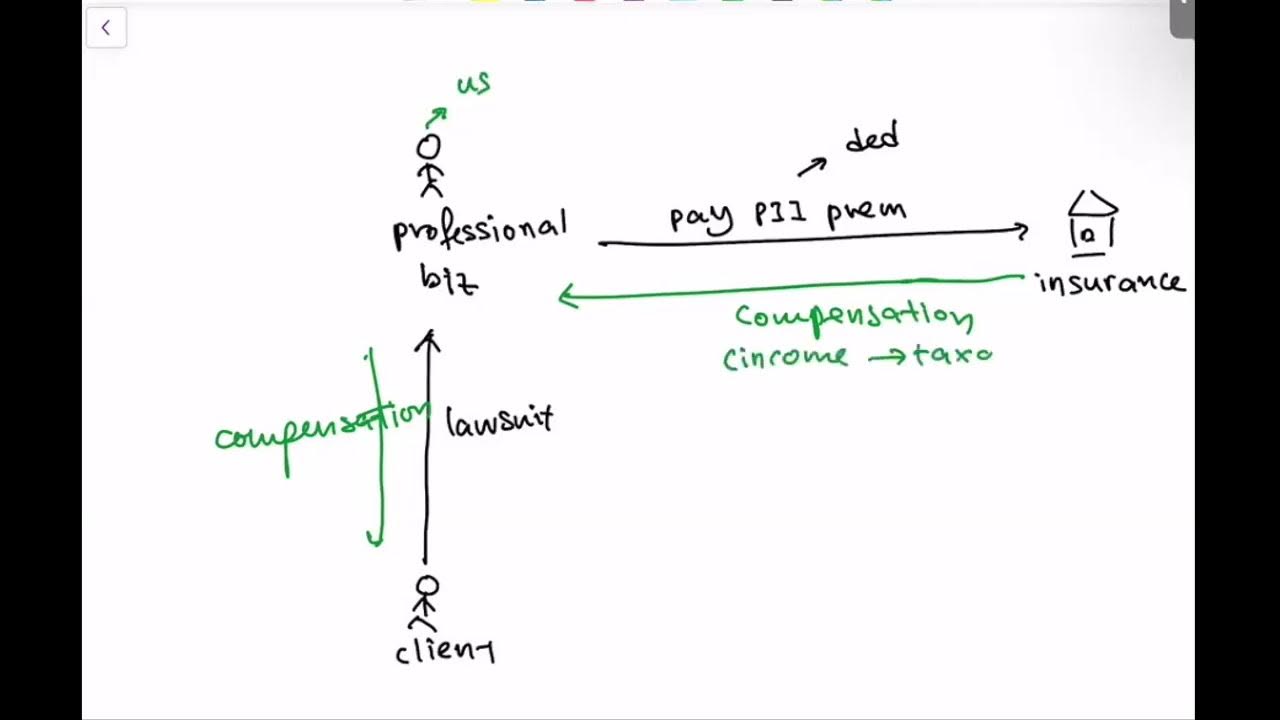

PII Professional Indemnity Insurance

#06 Os caminhos da Educação Física Adaptada no Brasil e seu cenario atual

Você sabe a diferença entre tipo societário e porte de empresa?

Florestan Fernandes | Sociologia Brasileira - Brasil Escola

Direito Empresarial - Aula #62- Sociedade Anônima (I) - Conceito, nome e estrutura.

5.0 / 5 (0 votes)