MGT101_Topic015

Summary

TLDRThis video script walks through practical examples of recording financial transactions using the accounting equation. The scenario centers on a business, Micrologix, where Henry, the sole proprietor, introduces capital and engages in various transactions, such as purchasing furniture, paying expenses, selling stock, and withdrawing funds. Each transaction is explained in detail, showing how it affects assets, liabilities, and owner's equity. The video emphasizes the impact of income and expenses on equity and reinforces the importance of maintaining a balanced accounting equation through each business transaction.

Takeaways

- 😀 Each transaction brings a change in the accounting equation.

- 😀 Transactions are recorded according to the business entity concept, meaning the business and its owner are treated as separate entities.

- 😀 Cash introduced by the owner increases both assets and owner's equity in the business.

- 😀 When purchasing furniture, cash decreases while assets (furniture) increase, keeping the accounting equation balanced.

- 😀 Transactions that involve both cash payment and promissory notes affect multiple sides of the equation (assets, liabilities).

- 😀 Credit transactions (e.g., buying stock on credit) increase both assets (inventory) and liabilities (accounts payable).

- 😀 Revenue earned through services increases both cash (asset) and owner's equity (through profit).

- 😀 Expenses paid (e.g., wages, rent) decrease cash and reduce owner's equity by decreasing profits.

- 😀 Payments made to creditors reduce both liabilities and cash, ensuring the equation remains balanced.

- 😀 Sales transactions where stock is sold for more than its cost generate profits, reduce stock, and increase receivables (asset).

- 😀 Withdrawals made by the owner from the business decrease both cash (asset) and owner's equity.

Q & A

What is the accounting equation?

-The accounting equation is: Assets = Liabilities + Owner’s Equity. It represents the balance between what the business owns (assets), owes (liabilities), and the owner’s stake (owner's equity).

How does Henry’s capital contribution affect the accounting equation?

-Henry’s capital contribution of 45,000 increases both the business’s assets (cash) and the owner’s equity by 45,000, keeping the equation balanced.

Why is it important to treat the business entity and the owner as separate in accounting?

-Following the business entity concept ensures that the business's financial transactions are distinct from the personal transactions of the owner, allowing for accurate financial reporting.

How does the purchase of furniture affect the accounting equation?

-When furniture worth 20,000 is purchased with cash, the business’s assets change. Cash decreases by 20,000, but furniture (another asset) increases by the same amount, maintaining the balance.

What is the impact of using a promissory note to buy a computer?

-In this case, cash decreases by 8,000, and a computer worth 28,000 is added to assets. Additionally, a liability (bills payable) increases by 20,000, keeping the equation in balance.

How does purchasing inventory on credit impact the accounting equation?

-Purchasing inventory on credit increases both assets (inventory) and liabilities (accounts payable), ensuring that the accounting equation remains balanced.

How does earning income through service affect the accounting equation?

-Earning income increases both cash (asset) and owner’s equity, as the income adds to the business's profits. This change reflects in an increase in cash and a corresponding increase in equity.

How do expenses affect the accounting equation?

-Expenses decrease cash (assets) and reduce owner’s equity because expenses lower profits. This decrease is shown in the equation as a reduction in both assets and equity.

What happens when creditors are paid in cash?

-When creditors are paid, cash (an asset) decreases and liabilities (accounts payable) decrease, as the payment reduces the amount owed, keeping the accounting equation balanced.

How does selling stock on credit affect the accounting equation?

-Selling stock on credit increases both assets (accounts receivable) and owner’s equity (through the profit of 400). The stock decreases by its cost (800), but the receivable increases by the sale price (1,200).

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

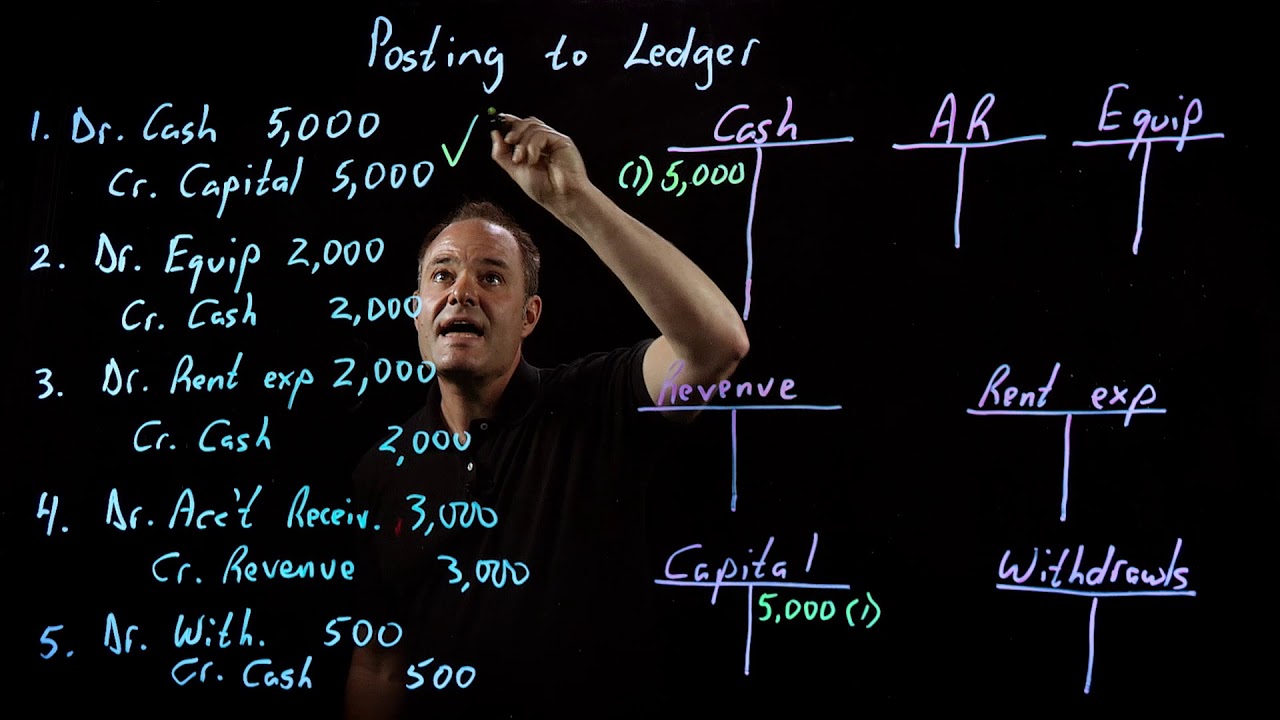

Accounting Fundamentals | Posting to the Ledger

Akuntansi Dasar | Pengantar Akuntansi | Tutor Aja

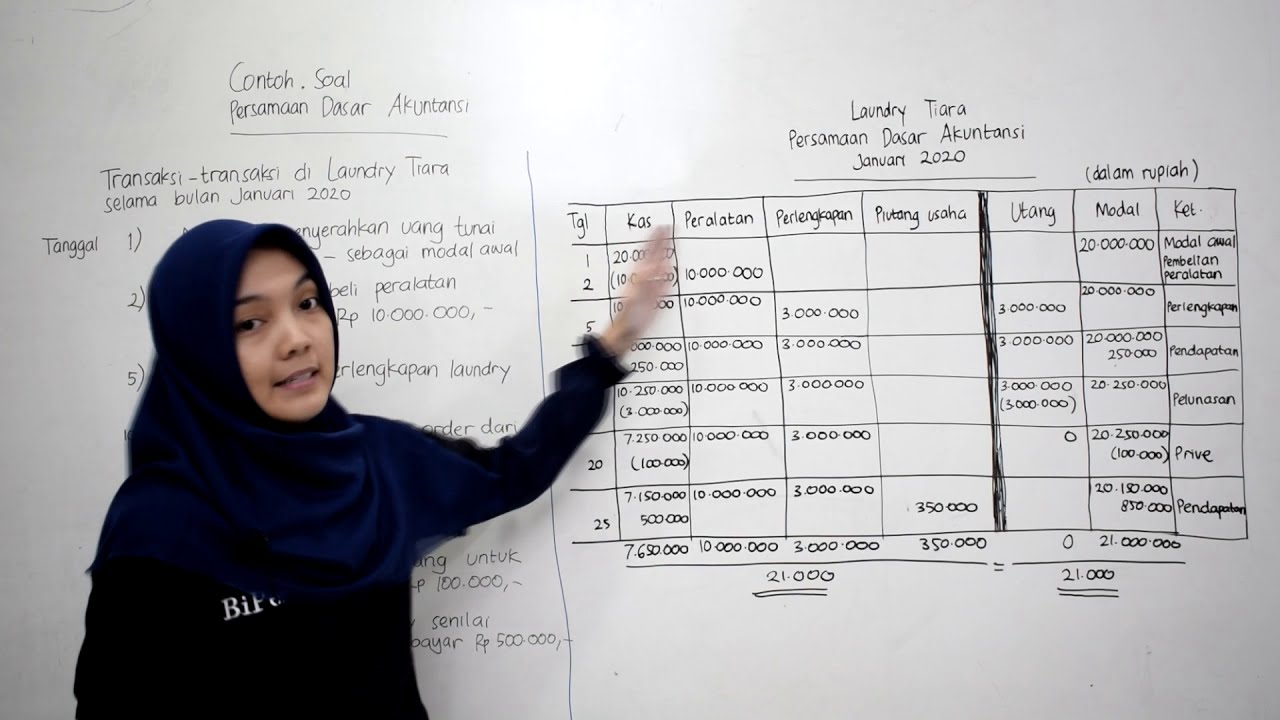

Persamaan Dasar Akuntansi | Ekonomi Kelas 12 - EDURAYA MENGAJAR

AKUNTANSI SEBAGAI SISTEM INFORMASI DAN PERSAMAAN DASAR AKUNTANSI - EKONOMI AKUNTANSI - KELAS 12

Modul 01 - Laboratorium Pengantar Akuntansi

Persamaan Dasar Akuntansi Perusahaan Jasa bag-2 #belajardirumah #ekonomi kelas 12

5.0 / 5 (0 votes)