Persamaan Dasar Akuntansi | Ekonomi Kelas 12 - EDURAYA MENGAJAR

Summary

TLDRThis educational video explains the basic accounting equation: Assets = Liabilities + Equity, using a real-life example of a business owner starting a new company. The video details various transactions, such as initial capital investment, asset purchases, loan repayments, rent payments, and service revenues, demonstrating how each affects the company's financial records. Through these examples, viewers learn how to classify transactions into assets, liabilities, and equity, and how the accounting equation remains balanced throughout. The lesson concludes with a check to ensure the accuracy of the accounting entries, reinforcing the fundamental principle of double-entry bookkeeping.

Takeaways

- 😀 The basic accounting equation is: Assets = Liabilities + Owner’s Equity, which is fundamental to recording financial transactions.

- 😀 Assets represent the resources or properties owned by a company, such as cash, equipment, or buildings.

- 😀 Liabilities are the company's obligations or debts to external parties, such as loans or unpaid bills.

- 😀 Owner’s Equity refers to the owner’s claim over the company's assets after subtracting liabilities, also known as capital.

- 😀 In the example of Muskilat, the owner invested 300 million IDR in cash and 150 million IDR in a vehicle into the business.

- 😀 Equipment and other assets are categorized under 'Assets' (Aktiva), while liabilities like loans are under 'Liabilities' (Pasiva).

- 😀 Transactions must be recorded in a way that ensures both sides of the accounting equation balance.

- 😀 For example, when the owner deposited capital into the company, both cash (assets) and equity (owner’s capital) increased.

- 😀 Payments for expenses, like rent, reduce both cash (assets) and equity, since it’s an expenditure.

- 😀 The company’s performance is monitored by ensuring that total assets equal total liabilities plus equity at the end of each period.

Q & A

What is the basic accounting equation, and why is it important?

-The basic accounting equation is: Assets = Liabilities + Equity. This equation is crucial because it ensures that every financial transaction is recorded accurately, and it helps maintain balance in the company’s financial statements.

What are the key elements of the basic accounting equation?

-The key elements of the basic accounting equation are Assets (Aset), Liabilities (Utang), and Equity (Modal). Assets are what the company owns, Liabilities are what the company owes, and Equity represents the owner's investment in the business.

How do assets and liabilities relate to each other in the accounting equation?

-In the accounting equation, assets are financed by either liabilities or equity. Liabilities represent the debts the company owes, while equity represents the owner’s stake. Therefore, assets are always balanced by liabilities and equity.

What type of transaction occurred when the entrepreneur invested personal funds into the business?

-When the entrepreneur invested 4.8 million IDR, it was a capital contribution, which increased both the assets (cash) and the equity (owner’s capital) of the business by the same amount.

How is the purchase of office equipment recorded in the accounting equation?

-The purchase of office equipment is recorded as an increase in assets (peralatan) and a decrease in cash (if paid partially in cash). Any remaining balance to be paid later is recorded as a liability (utang).

What is the effect of paying off a debt on the accounting equation?

-Paying off a debt reduces both liabilities (utang) and assets (cash), maintaining the balance in the accounting equation by decreasing both sides equally.

How is rent payment for office space recorded in the accounting equation?

-Rent payment is recorded as a decrease in cash (asset) and a decrease in equity (owner’s capital) since it is considered an expense that reduces the owner's stake in the business.

What happens when the business receives income from services provided?

-When the business receives income, cash (asset) increases, and equity (owner’s capital) also increases since the income boosts the owner's investment in the business.

Why is it necessary to verify the total of assets and liabilities + equity?

-It is necessary to verify that the total of assets matches the total of liabilities + equity because the accounting equation must always remain balanced. This ensures that the financial records are accurate and complete.

What was the final result of the accounting equation after all transactions were recorded?

-After recording all transactions, the total assets and total liabilities + equity both amounted to 6,000,136 IDR, confirming that the accounting equation remained balanced.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Basic Accounting Equation

NGERTI AKUNTANSI TANPA MENGHAPAL [PART 1]: Hal Paling Dasar yang Harus Dipahami Mengenai Akuntansi.

Basic Financial Accounting – Recording Transactions – The Double Entry System – Video #6

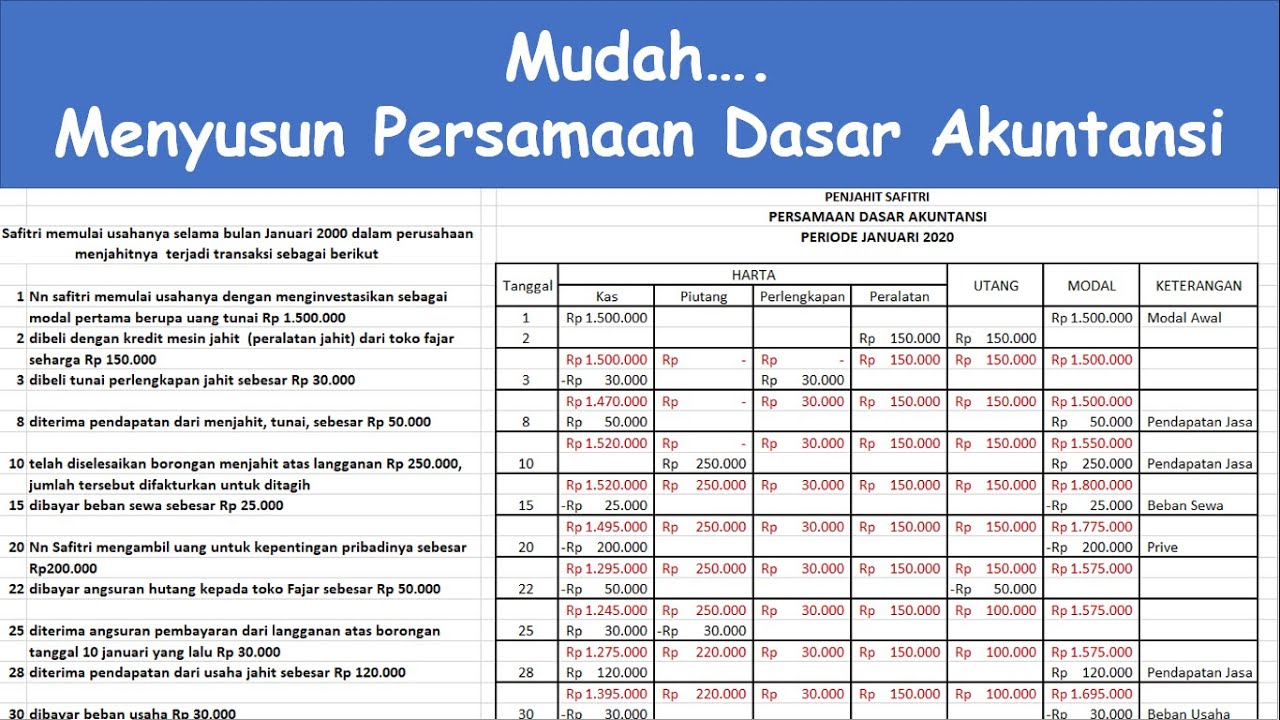

PERSAMAAN DASAR AKUNTANSI -Studi kasus Penjahit Safitri

Ekonomi Kelas XII Bab 2: Analisis Transaksi Persamaan Dasar Akuntansi (Part 2)

AKUNTANSI DASAR || PERSAMAAN DASAR AKUNTANSI || MATERI KELAS 10SMK

5.0 / 5 (0 votes)