12. Single Column Cash Book - Problem No: 1

Summary

TLDRThis video script discusses the structure and types of cash books in accounting, emphasizing the importance of maintaining accurate financial records. It covers the distinction between single-column and double-column cash books, the recording of transactions, and the classification of payments and receipts. The script also touches on the concepts of credit and debit sides, and explains various processes in financial management, including salary payments, purchases, and reimbursements. Through examples and explanations, the script aims to provide a clear understanding of how to manage cash transactions effectively in accounting.

Takeaways

- 😀 **Cash Book Basics**: A Cash Book is used to record cash-related transactions, including both cash receipts and payments.

- 😀 **Types of Cash Books**: There are several types of Cash Books, such as Single-Column, Double-Column, and Triple-Column formats, each recording different types of transactions.

- 😀 **Single-Column Cash Book**: Records only cash transactions, either receipts or payments, in a single column.

- 😀 **Double-Column Cash Book**: Includes two columns—one for cash transactions and another for bank transactions.

- 😀 **Triple-Column Cash Book**: Adds a third column specifically for discount entries, providing more detailed tracking of financial movements.

- 😀 **Debit Entries**: Debit entries in a Cash Book record all cash receipts, meaning money coming into the business.

- 😀 **Credit Entries**: Credit entries capture all cash payments, such as expenses or purchases, going out of the business.

- 😀 **Transaction Documentation**: Each Cash Book entry should include the date, the nature of the transaction, and the amount on either the debit or credit side.

- 😀 **Recording Purchases and Sales**: Cash Book entries should document purchases made for cash and cash received from sales, ensuring clear tracking of financial exchanges.

- 😀 **Balance Maintenance**: It is important to regularly calculate the balance in the Cash Book, ensuring that receipts and payments are accurately tracked.

- 😀 **Practical Application**: Regularly balancing the Cash Book helps prevent errors, especially when dealing with multiple types of transactions across different columns.

Q & A

What is a cash book?

-A cash book is a financial record that records all cash transactions, including receipts and payments. It typically includes details of cash inflows and outflows and is used to track cash balances.

What are the types of cash books mentioned in the script?

-The script mentions three types of cash books: Single Column Cash Book, Double Column Cash Book, and a third type involving 'International Schools', which may be referring to different formats of cash book entries.

What is the difference between single column and double column cash books?

-A Single Column Cash Book records only cash transactions in one column. In contrast, a Double Column Cash Book includes both cash and bank transactions in separate columns, providing a more detailed view of the financial transactions.

What is the significance of the debit and credit sides in a cash book?

-In a cash book, the debit side records cash inflows (e.g., receipts), while the credit side records cash outflows (e.g., payments). Properly categorizing transactions helps ensure accurate financial tracking.

How are transactions like salary payments recorded in a cash book?

-Salary payments are recorded on the credit side of the cash book, as they represent cash outflows from the business to employees.

What types of transactions are typically recorded in a cash book?

-Typical transactions recorded in a cash book include purchases, sales, payments (e.g., salary), receipts, bank deposits, withdrawals, and other cash-related activities.

What is the importance of identifying cash transactions?

-Identifying cash transactions is essential for maintaining accurate financial records, ensuring that all cash movements are accounted for, and providing clear insights into a company’s cash position.

What does the script suggest about the process of recording a purchase from Rajoo?

-When purchasing goods from Rajoo, the transaction is recorded in the cash book as a cash purchase, where the amount spent is noted. The script stresses that purchases should not be treated as credit transactions in such cases.

What does the script say about the significance of 'balance' in a cash book?

-The balance in a cash book is important as it indicates the available cash or bank balance after accounting for all the receipts and payments. It helps track the liquidity of the business.

What is the process for handling payments made for advertisements, according to the script?

-Payments made for advertisements are recorded as cash payments, with the credit side reflecting the amount paid for the advertisements, ensuring that the cash book accurately reflects this outflow.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

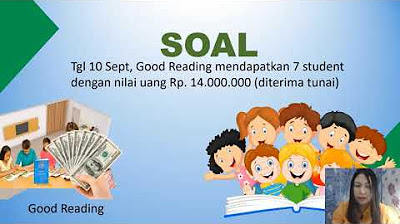

Mengelola Dokumen Transaksi#Akuntansi#Part1#SMKTarakanita

AKUNTANSI KEUANGAN MENENGAH - Bagian 2

[Podcast BAKSO MALANG UMKM Eps 4] Saatnya Menjurnal, Siklus Akuntasi dimulai!

How To Read And Understand Financial Statements As A Small Business

Introduction To Accounting | Meaning, Definition And Objectives Of Accounting | Class 11 Accounts |

PENGANTAR AKUNTANSI 1 - JURNAL

5.0 / 5 (0 votes)