Akuntansi Dasar | Pengantar Akuntansi | Tutor Aja

Summary

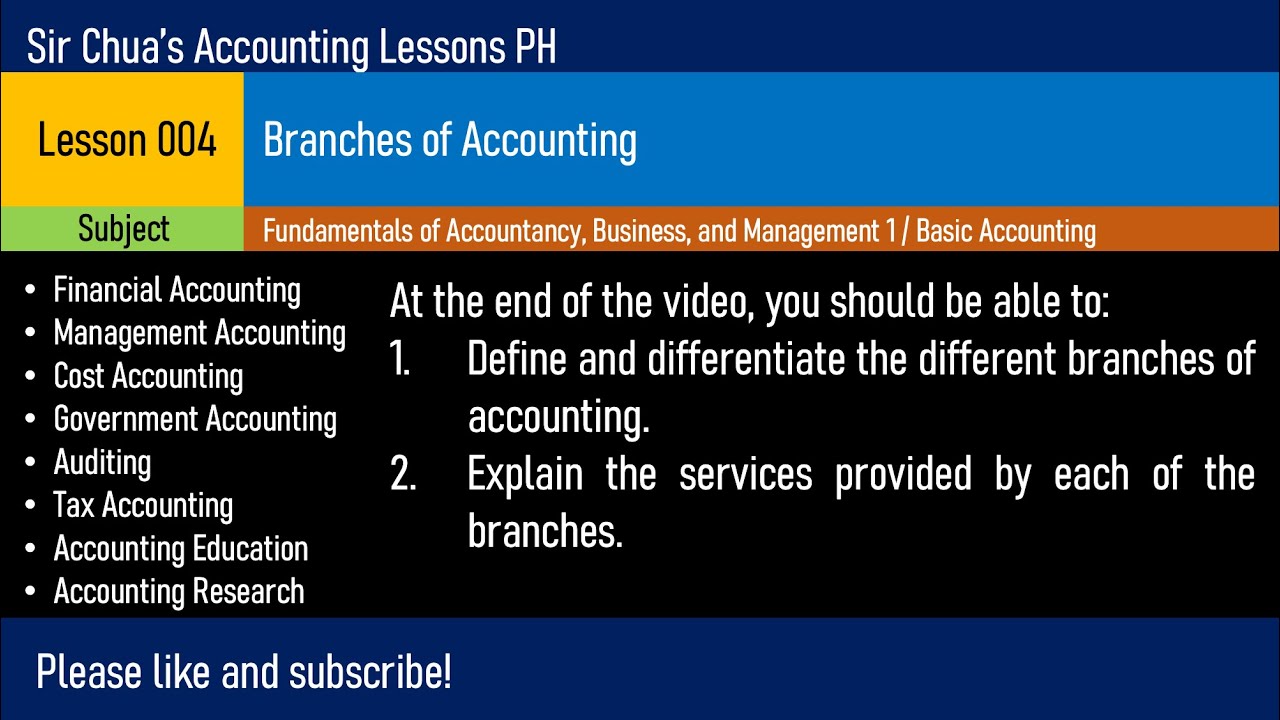

TLDRThis video script offers an insightful introduction to financial accounting, focusing on basic accounting concepts. It explains the importance of identifying, recording, and communicating financial transactions effectively. The script uses a barbershop as an example to illustrate assets, liabilities, equity, revenue, and expenses, emphasizing the role of accounting in decision-making for both internal and external stakeholders. It also discusses the accounting equation, A = L + E, and its impact on business operations and growth.

Takeaways

- 📚 The video is an educational tutorial on financial accounting, aimed at beginners who want to delve into the field of accounting for business or academic purposes.

- 🏦 Accounting is often misunderstood as just dealing with money, but it's much more than that—it's about identifying, recording, and communicating financial transactions in a business context.

- 🧐 The basic accounting equation is Assets = Liabilities + Equity, which is fundamental to understanding how accounting works and the impact of various transactions on a company's financial health.

- 💼 Accounting serves as the 'language of business', crucial for internal decision-making by managers, marketing, and finance departments, as well as for external stakeholders like investors and creditors.

- 📈 The importance of accounting is evident in its widespread use for making informed decisions, both internally within a company and externally by those interacting with the company.

- 🛠️ Assets are anything of value owned by a company, including cash, inventory, supplies, equipment, and other resources used in operations.

- 📊 Liabilities are obligations or debts that a company owes to others, and they can include various types such as accounts payable, bonds payable, and bank loans.

- 💡 Equity represents the ownership interest in a company, including the initial capital invested and retained earnings from operations.

- 💸 Revenue is the income generated from the company's normal business activities, such as providing services or selling goods.

- 💳 Expenses are the costs incurred in the process of generating revenue, and they can include costs of goods sold, operating expenses, and interest.

- 📊 The accounting cycle involves the recording of transactions that affect assets, liabilities, equity, revenue, and expenses, reflecting the financial activities of a business over a period of time.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is basic accounting, particularly financial accounting, and its application in business.

Why is accounting considered the language of business?

-Accounting is considered the language of business because it communicates financial information to various stakeholders, both internal and external, allowing them to make informed decisions.

What are the three main components of the accounting equation?

-The three main components of the accounting equation are assets, liabilities, and equity.

What is an example of an asset mentioned in the script?

-An example of an asset mentioned in the script is equipment, such as chairs used in a barbershop for customers to sit and get haircuts.

What is the term for expenses that are paid in advance but have not yet been used?

-The term for expenses that are paid in advance but have not yet been used is prepaid expenses.

What is the term used for money owed to a company for services rendered but not yet paid by the customer?

-The term used for money owed to a company for services rendered but not yet paid by the customer is accounts receivable or simply receivables.

What is the term used for obligations that a company has to fulfill, such as paying back borrowed money?

-The term used for obligations that a company has to fulfill is liabilities.

What is the difference between revenue and expenses in the context of the accounting cycle?

-Revenue is the income generated from the company's normal business operations, while expenses are the costs incurred in the process of generating that revenue.

What is equity in the context of accounting?

-Equity in the context of accounting represents the ownership interest in the company, which can be influenced by factors such as revenue, expenses, and dividends.

How does the accounting cycle relate to the growth and management of a business?

-The accounting cycle relates to the growth and management of a business by tracking the financial transactions that affect assets, liabilities, equity, revenue, and expenses, allowing for informed decision-making and strategic planning.

What is the importance of understanding the accounting equation A = L + E in managing a business?

-Understanding the accounting equation A = L + E is crucial in managing a business as it helps in maintaining the balance between assets, liabilities, and equity, ensuring the financial stability and growth of the company.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)