MGT101_Topic004

Summary

TLDRThis video introduces the core functions of financial accounting, emphasizing five key tasks: classifying, recording, summarizing, reporting, and analyzing financial information. It explains how accountants classify financial data into five main categories and the importance of accurate classification. The process follows the accounting cycle, starting with source documents and progressing through journals, trial balances, and financial statements, before concluding with the analysis of financial health. The module highlights the significance of these functions and the historical nature of financial data in accounting.

Takeaways

- 😀 Financial accounting is a core module of the course, focusing on the duties of a financial accountant.

- 😀 There are five main functions in financial accounting: classification, recording, summarizing, reporting, and analyzing financial information.

- 😀 Classifying financial information into five main categories is crucial; errors in classification can lead to incorrect financial outcomes.

- 😀 Recording financial information in the books of accounts is essential for the accurate tracking of financial data.

- 😀 Summarizing the recorded financial information helps in generating balances, which are essential for the next steps in accounting.

- 😀 Financial information is reported in a structured format, and accountants analyze it to assess the health of an organization.

- 😀 The five functions of financial accounting form the foundation of the accounting cycle, which starts with the source document and ends with the analysis of financial information.

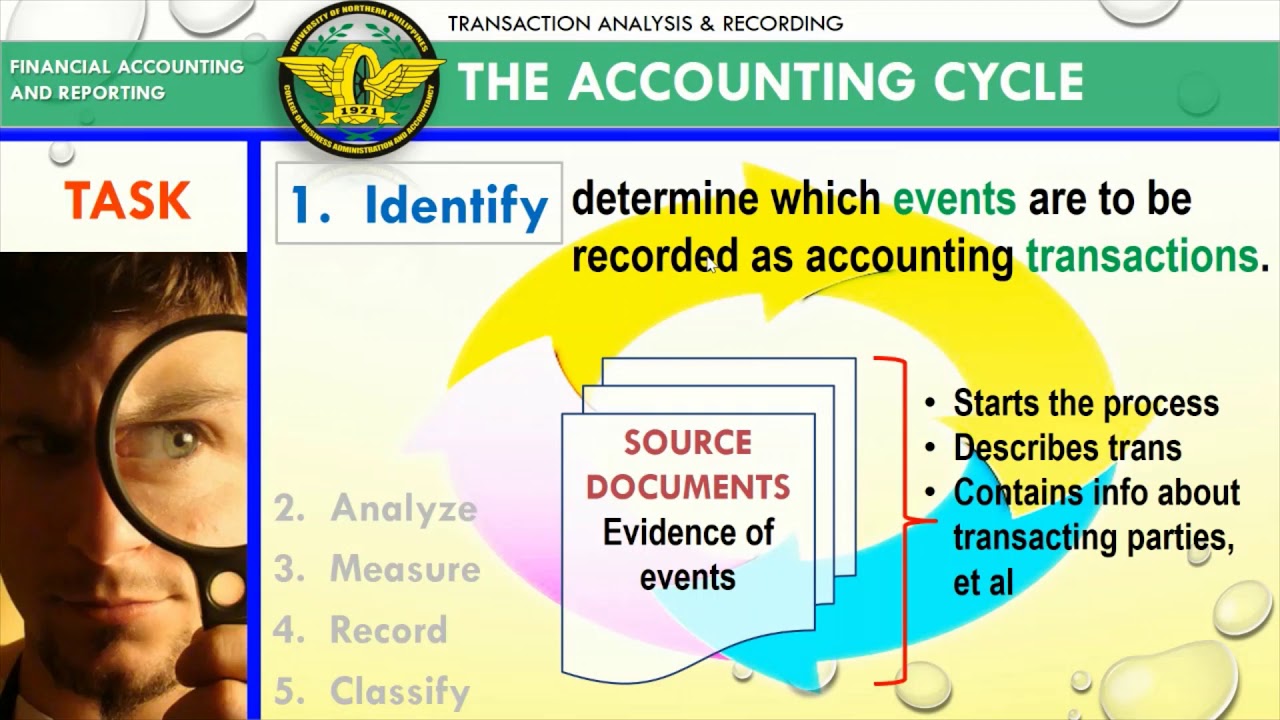

- 😀 The accounting cycle begins with the source document, which contains supporting papers evidencing transactions, events, or conditions.

- 😀 Vouchers are prepared from source documents and recorded in journals, which are then summarized to provide balances.

- 😀 The trial balance is created from the journal summaries, and these balances are used to prepare financial statements.

- 😀 Financial accounting primarily deals with past financial information, and its analysis helps understand the financial health of an organization.

Q & A

What are the five functions of financial accounting?

-The five functions of financial accounting are: 1) Classifying financial information, 2) Recording financial information, 3) Summarizing financial information, 4) Reporting financial information, and 5) Analyzing financial information.

Why is the correct classification of financial information so important?

-The correct classification of financial information is crucial because mistakes in classification can lead to incorrect financial outcomes, affecting the entire structure of the financial data and reports.

How is financial information recorded in accounting?

-Financial information is recorded in the books of accounts through the preparation of vouchers, which are based on source documents and supporting papers. These vouchers are then entered into journals.

What is the accounting cycle?

-The accounting cycle is the process that begins with the source document, proceeds through various stages including recording in journals, summarizing, preparing trial balances, and finally reporting and analyzing the financial information.

What is the significance of the source document in the accounting cycle?

-The source document is the base of the accounting cycle. It contains evidence of a transaction or event and is used to prepare supporting papers and vouchers that lead to the recording of financial information.

What happens after the financial information is classified?

-After the financial information is classified, it is recorded in the books of accounts. From there, summaries are prepared for each accounting head, which leads to the creation of balances that are used for financial reporting.

What role does summarizing financial information play in accounting?

-Summarizing financial information helps in organizing and condensing data for each accounting head. These summaries are crucial for producing accurate balances, which are later used in financial reporting.

How does the reporting function work in financial accounting?

-In financial accounting, reporting involves preparing financial statements that reflect the organization's financial performance. These reports are analyzed to assess the health of the organization.

What is the purpose of analyzing financial information in accounting?

-Analyzing financial information helps accountants communicate the financial health of the organization to the users of the financial reports. It provides insights into the business's financial condition.

What does it mean that financial information in accounting belongs to the past?

-In financial accounting, the information pertains to past transactions, events, or conditions that have already occurred. This past data is used to assess the historical financial performance of an organization.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Akuntansi Sebagai Sistem Informasi | Ekonomi Kelas 12 - EDURAYA MENGAJAR

Meaning and Definitions & Attributes of Accounting | Class 11 Accountancy Chapter 1 | CBSE 2024

ONLINE CLASSES| INTER 1ST YEAR MEC AND CEC\(ACCOUNTING) UNIT-1 BOOK KEEPING & ACCOUNTING IMPORTANT

Transaction & Analysis Recording, Part I

86.Overviu PMK 212/2019 tentang Jurnal Akuntansi Pemerintah Pusat

Lesson 008 - Accounting Concepts and Principles

5.0 / 5 (0 votes)