BELAJAR AKUNTANSI UMKM

Summary

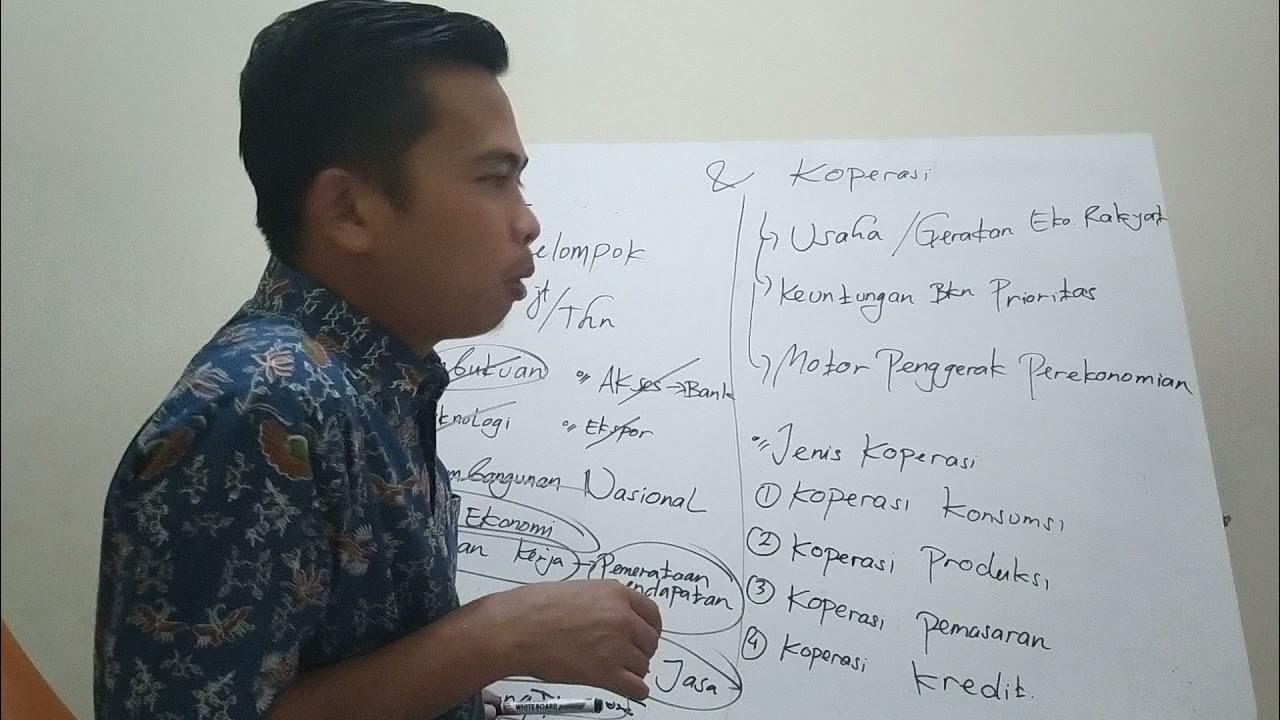

TLDRThis lecture introduces the course on Accounting for Small and Medium Enterprises (UMKM) and Cooperatives, aiming to equip students with the skills to prepare, analyze, and interpret financial reports. The course will cover accounting cycles for both UMKM and various types of cooperatives. The importance of accessible accounting for business decision-making is emphasized, as many UMKM and cooperatives currently do not use accounting. The course is structured with active participation, assignments, competency tests, and a final exam. It will be conducted fully online, using multimedia resources to enhance learning.

Takeaways

- 😀 The course focuses on teaching accounting for SMEs and cooperatives, preparing students to compile and analyze financial statements for these businesses.

- 😀 Students will learn how to interpret financial reports, enabling them to make informed business decisions based on the financial data.

- 😀 For cooperatives, the course will also cover the calculation of patronage refunds (X-HU) and how to distribute profits to cooperative members.

- 😀 The curriculum includes learning accounting cycles for both SMEs and cooperatives, with a focus on service, trading, and manufacturing businesses for SMEs.

- 😀 The course will focus on accounting for specific types of cooperatives: savings and loans, marketing, consumer, producer, and multi-purpose cooperatives.

- 😀 The course addresses the common challenge that many SMEs and cooperatives do not use accounting in their business operations due to perceived complexity.

- 😀 As instructors, the goal is to make accounting easier for SMEs and cooperatives, enabling them to better assess financial performance and make better decisions.

- 😀 Active participation in the learning process is encouraged, with tasks such as asking questions, answering, solving problems, and completing assignments.

- 😀 The course uses multiple textbooks, including 'Accounting for SMEs: Easy to Understand and Implement' and 'Accounting for Cooperatives,' alongside other supportive resources.

- 😀 The course grading structure includes 4 components: participation (10%), assignments (30%), competency tests (30%), and the final exam (30%).

Q & A

What is the main goal of studying accounting for MSMEs and cooperatives?

-The main goal is to prepare students to create financial statements for MSMEs and cooperatives, analyze these reports, interpret the financial data, and make informed decisions based on the financial information presented.

How does the lecturer intend to help students understand MSME and cooperative accounting?

-The lecturer aims to simplify accounting concepts, making them more accessible for MSME and cooperative owners by explaining accounting in a straightforward way, so they can apply it effectively in their businesses.

What topics will be covered during the course of MSME and cooperative accounting?

-The course will cover accounting cycles for MSMEs (in sectors such as trade, services, and manufacturing) and cooperatives (focusing on types like savings and loans, marketing, consumer, producer, and multi-purpose cooperatives).

Why do many MSME and cooperative owners not use accounting in their businesses?

-Many owners believe that accounting is complicated and difficult, which is why they do not implement it. The course aims to address this challenge by simplifying the process and demonstrating its importance.

What benefits are expected for MSMEs and cooperatives if they adopt accounting practices?

-By using accounting, MSMEs and cooperatives can evaluate their financial performance, make better business decisions, and improve their overall management by using accurate financial reports.

What activities will students participate in during the course?

-Students will actively participate in various activities, including asking questions, answering, completing assignments, and working on projects, all contributing to the overall assessment of their performance.

What are the key reference books for this accounting course?

-The course uses several reference books, including 'Accounting for MSMEs Made Easy' by Dr. Sony Warsono Mavis, 'Cooperative Accounting' by Rudianto, and 'Accounting Without Stress' by the lecturer Indramurti Sagoro.

How will students' performance be evaluated in this course?

-The evaluation will be based on four components: participation (10%), assignments and quizzes (30%), competency tests (30%), and the final exam (30%). These will collectively determine the final grade.

What is the expected level of participation in this course?

-Students are expected to actively engage in the course, including asking questions, providing answers, and completing tasks. Participation will be tracked and will contribute to the final assessment.

What are the main challenges for students taking this online course?

-Students must manage their time well, as this is a fully online course. Late submissions are not allowed, so students must adhere to deadlines and stay up-to-date with the materials and assignments.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)