How To Trade Smart Money Concepts | LuxAlgo Full 2025 Updated Guide and Trading Strategy

Summary

TLDRThis tutorial offers a comprehensive approach to technical trading, focusing on advanced strategies for cryptocurrencies and stocks. Key topics include order block mitigation using high-low values, the concept of fair value gaps, and the identification of support and resistance levels. The speaker demonstrates a strategy involving multiple indicators (MACD, Stochastic, RSI) to pinpoint optimal entry and exit points, emphasizing the importance of aligning momentum and market trends. The tutorial also covers using premium/discount zones for support and resistance and tips on leveraging for higher returns in day trading and swing trading.

Takeaways

- 😀 Focus on using the highs and lows of candlesticks for order block mitigation, as wicks hold significant trading relevance over closing prices.

- 😀 Color customization for order blocks is important for clarity, with blue for support levels and red for resistance, though personal preferences can vary.

- 😀 Fair value gaps are not essential for all traders; they can be helpful for scalpers but are less relevant for swing or long-term traders.

- 😀 Recognize the significance of daily, weekly, and monthly high and low levels, as they act as key support and resistance levels for price action analysis.

- 😀 Premium and discount zones provide additional support and resistance insights, especially when deciding whether to buy or sell at high or low levels.

- 😀 Use a combination of indicators like MACD, RSI, and stochastic oscillators to assess market momentum and strength, aligning them across different timeframes for better trade setups.

- 😀 Avoid trading during choppy market conditions where indicators are misaligned. Only trade when multiple indicators show a clear consensus across timeframes.

- 😀 Consistent use of multiple timeframes (weekly, daily, 4-hour) is crucial for understanding the overall market trend and for avoiding false signals.

- 😀 Leverage trading on altcoins can amplify returns due to their higher volatility, but caution is advised when using leverage.

- 😀 A good strategy includes waiting for clear confirmation of breakout signals before entering trades, ensuring alignment across all indicators and timeframes.

Q & A

What is the significance of order block mitigation in trading?

-Order block mitigation is used to determine potential price levels based on previous highs, lows, and closing prices. Traders typically use high-low data, as it reflects key points on the chart, including wicks, which can provide better entry points. However, for new tokens or stocks, testing different settings might be necessary to find the most accurate values.

Why does the speaker prefer using highs and lows rather than closing prices for order block mitigation?

-The speaker believes that wicks, which represent the high and low points of a candle, carry significant importance in trading as they reflect extreme price action. This is why the speaker prefers using high-low data over the closing price, especially for established assets like Bitcoin and blue-chip stocks.

What role do equal highs and lows play in the trading strategy?

-Equal highs and lows are removed to reduce noise and highlight stronger support and resistance levels. By filtering out these equal levels, the trader can focus on more potent price points, improving the clarity of the signal.

How does the 'threshold' setting impact trading decisions?

-The 'threshold' setting helps to filter the most relevant support and resistance levels by adjusting sensitivity. Lower values return fewer, but more pertinent results, while higher values show more levels, some of which may be less significant.

What are fair value gaps, and why does the speaker not recommend relying on them heavily?

-Fair value gaps are areas where the market might return to after a sharp price move. They can indicate potential pullbacks. However, the speaker doesn't use them much, as they are more relevant for scalpers, and they may not be necessary for longer-term traders who focus on other indicators.

How does the speaker suggest using daily, weekly, and monthly high and low levels?

-These levels represent critical support and resistance areas that can help traders identify important price points. They may not seem crucial at first, but once familiar with them, traders can use these levels to make informed decisions, especially when approaching key price zones.

What are premium and discount zones, and how do they relate to support and resistance?

-Premium and discount zones help identify key price levels where an asset is considered overbought (premium) or oversold (discount). These zones give traders another perspective on support and resistance, helping them determine whether it's a good time to buy or sell based on longer-term trends.

How can combining different time frames (weekly, daily, and 4-hour charts) improve trading results?

-By aligning indicators across multiple time frames, traders can ensure that all signals are consistent. For instance, if the weekly chart is bullish and the daily chart aligns with that trend, the trader is more likely to make a successful trade. Using multiple time frames helps in confirming the trend and reducing the risk of false signals.

What is the role of technical indicators like MACD, Stochastic, and RSI in the trading strategy outlined in the video?

-The MACD, Stochastic, and RSI indicators help to measure momentum and trends in the market. These indicators are used together to identify buy and sell signals, with the MACD showing momentum shifts, Stochastic indicating overbought or oversold conditions, and RSI providing additional confirmation of price movements.

How does the concept of 'scaling out' benefit traders in volatile markets?

-Scaling out allows traders to secure partial profits while still keeping a portion of their position open. This approach helps manage risk during volatile market conditions, ensuring that the trader locks in some gains while still having exposure to further price movements. This is especially useful when the market is experiencing strong trends or breakouts.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

HOW TO TRADE THE 5 AND 13 EMA IN CRYPTO CURRENCY?

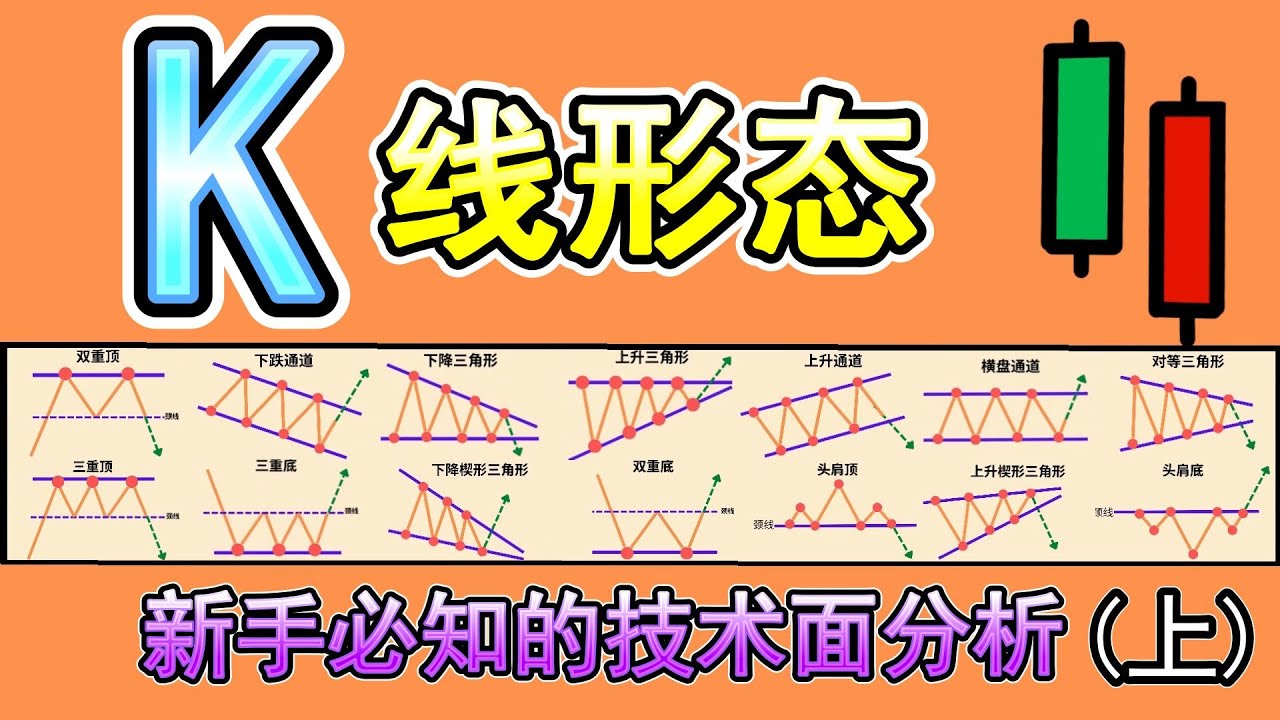

【K线形态 技术面分析】(上)你必知的18种K线形态完整教学|K线形态交易策略大公开|技术分析新手入门教学|专业交易员必备的K线形态技术分析|Chart Pattern Analysis

How to Trade Crypto | How to Trade on Pocket Option | Trading Tutorial

Technical Analysis is Hard (until you see this)

Btcusdt sell ở vùng thanh khoản key volume | Trading | Angel

MAKE CONSISTENT MONEY BY USING THIS INDICATOR. MUST WATCH WITH SCREENER. #ADX, #INDICATOR, #SCREENER

5.0 / 5 (0 votes)