Akad dalam Kajian Fikh Mu'amalah

Summary

TLDRThe video discusses the concept of akad (contracts) in Islamic economics, emphasizing their importance in distinguishing Islamic finance from conventional finance. It explains the difference between akad and a simple promise, outlining the legal implications of an akad, which binds both parties. The video covers the two types of akad—tijari (business-related) and tabaru (based on charity)—and outlines the necessary elements for a valid akad, including the parties involved, the object of the contract, and the ijab (offer) and kabul (acceptance). It also highlights the importance of fulfilling akad, citing relevant Quranic teachings and legal requirements.

Takeaways

- 😀 'Akad' is a fundamental concept in Islamic economics, distinguishing it from conventional economics. It turns general property into something specifically owned through a binding agreement.

- 😀 The term 'akad' refers to an agreement or a binding contract, which is different from a mere promise. A promise does not carry legal consequences unless fulfilled, whereas an 'akad' involves legal obligations.

- 😀 An 'akad' can involve two or more parties and requires 'Ijab' (offer) and 'Qabul' (acceptance) to be valid. These elements form the basis of the contractual agreement.

- 😀 There are two main categories of 'akad': 'Akad Tijari' (commercial contracts) and 'Akad Tabaru' (charitable acts). 'Akad Tijari' involves profit-driven transactions, while 'Akad Tabaru' is based on altruism without expecting a return.

- 😀 In Islamic finance, 'Akad Tijari' includes contracts like buying and selling, joint ventures, and lending with profit sharing. These are profit-based transactions.

- 😀 'Akad Tabaru' includes acts of charity, such as giving zakat, charity, or performing acts of kindness. These contracts are motivated by goodwill, not for profit.

- 😀 The fulfillment of an 'akad' is crucial and has legal consequences, both in this life and the hereafter. It is prohibited in Islam to take 'akad' lightly or as a joke.

- 😀 Islamic law (Shari'ah) requires specific conditions for the validity of an 'akad,' such as the capability of the parties involved, a clear object of the contract, and a lawful purpose.

- 😀 There are conditions for both the offeror (Akid) and the object of the contract (Maqud alai). The parties must be competent, and the object must be tangible and lawful.

- 😀 'Akad' can be executed through words, actions, or written agreements, including modern technological methods like virtual meetings. However, it must meet Shari'ah standards for being legally binding.

Q & A

What is the main concept of 'akad' in Islamic economics?

-The concept of 'akad' (contract) in Islamic economics is a binding agreement that distinguishes Islamic economics from conventional economics. It turns something from public ownership into private ownership and gives it legal significance.

How does an 'akad' differ from a simple promise in Islamic practice?

-An 'akad' involves a formal commitment between parties, and failing to uphold it can lead to legal consequences, unlike a simple promise, which has no legal binding unless explicitly stated.

What is the importance of 'akad' in Islamic finance and transactions?

-'Akad' is crucial in Islamic finance as it ensures that all parties are committed to their obligations, making transactions lawful and binding. Without an 'akad', a transaction may be deemed invalid or illegal.

What are the key differences between 'akad tijari' and 'akad tabaru'?

-'Akad tijari' refers to contracts made for commercial purposes where profit or gain is expected, such as in trade. On the other hand, 'akad tabaru' involves voluntary acts like charity or gifts, where no profit is anticipated.

What does the term 'ijab' and 'qabul' mean in the context of an 'akad'?

-'Ijab' refers to an offer, and 'qabul' refers to an acceptance. These two are essential components of an 'akad' as they form the basis of mutual agreement in a transaction.

What are the consequences if an 'akad' is not executed properly in Islamic law?

-If an 'akad' is not executed correctly, it may be considered invalid, and the involved parties could face legal consequences, including possible financial penalties or other forms of accountability depending on the nature of the contract.

What are the basic requirements for an 'akad' to be considered valid in Islamic law?

-For an 'akad' to be valid, it must meet specific conditions: there must be two competent parties (Akid), a clear subject matter (Maqud Alaih), and proper declarations (Ijab and Qabul). Additionally, the subject matter must be legal and capable of being transferred.

What is the difference between 'akad nafiz' and 'akad maukuf'?

-'Akad nafiz' is a contract that is immediately binding once the rukun (requirements) are fulfilled. In contrast, 'akad maukuf' refers to a contract that is contingent or postponed, where one party’s action or decision may delay its execution.

Why is fulfilling the 'akad' important in Islamic law?

-Fulfilling an 'akad' is crucial in Islamic law as it ensures that agreements are honored, maintaining justice and accountability between the parties involved. Failure to fulfill it can have both legal and spiritual consequences.

Can modern practices like online marriage contracts via platforms such as Zoom be considered valid under Islamic law?

-Yes, as long as the essential components of the 'akad' are met, such as clear 'Ijab' (offer) and 'Qabul' (acceptance), online contracts can be valid. The method of communication does not invalidate the 'akad' as long as it is done with clear mutual consent.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Akad-akad dalam Bank Syariah • Perbankan Syariah #5

Pengertian Leasing Syariah

#2 Types of Islamic Finance - ACCA / CPA / SFM -By Saheb Academy

Prinsip-prinsip Dasar Bank Syariah • Perbankan Syariah #4

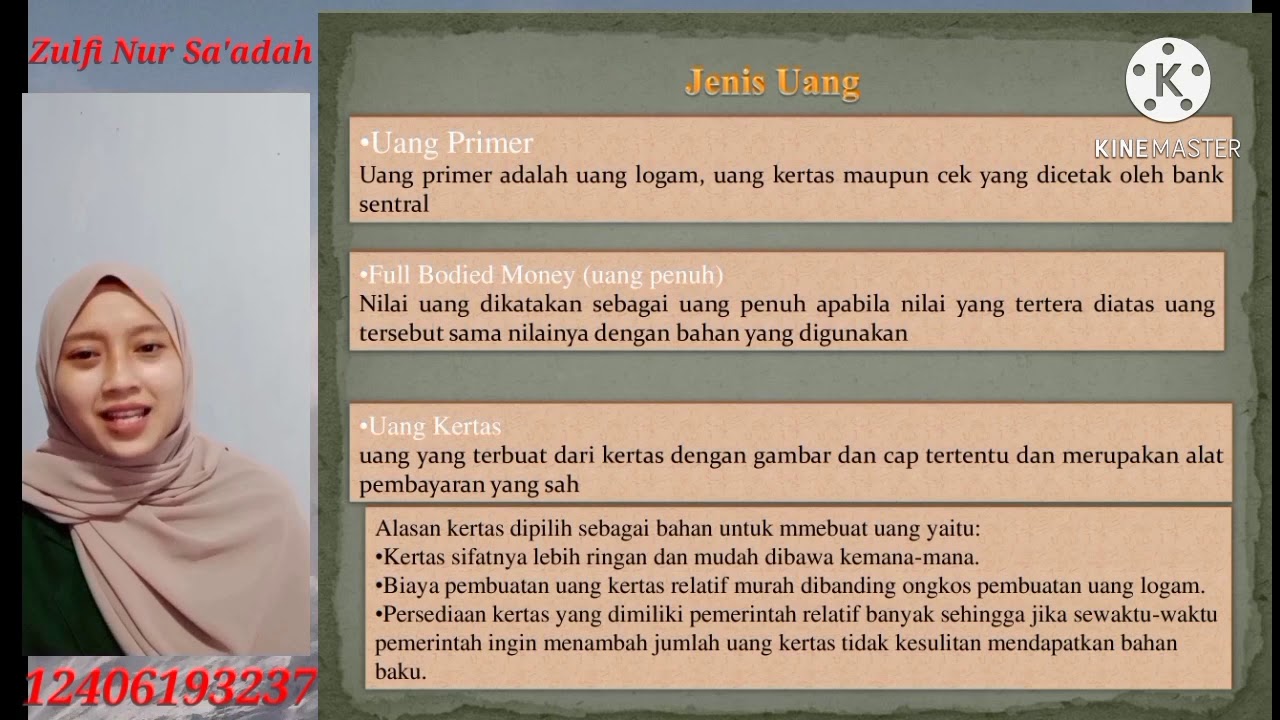

KONSEP UANG DALAM PERSPEKTIF ISLAM || TUGAS UTS || MANAJEMEN KEUANGAN SYARIAH 3F || IAIN TULUNGAGUNG

PERBANDINGAN SISTEM EKONOMI ISLAM, KAPITALIS, DAN SOSIALIS

5.0 / 5 (0 votes)