Prinsip-prinsip Dasar Bank Syariah • Perbankan Syariah #4

Summary

TLDRThis video explains the core principles of Islamic banking and the key aspects of Sharia-compliant products. It highlights the importance of fairness, partnership, transparency, and security in the operations of Islamic banks. The video covers essential banking principles like profit-sharing, sales contracts, and leasing, along with how Islamic banks manage deposits and investments in line with Islamic law. The goal is to showcase the ethical foundation of Islamic finance and its commitment to justice, equity, and universal access, distinguishing it from conventional banking practices.

Takeaways

- 😀 Islamic banks operate under the principles of Sharia law, avoiding practices like riba (interest), gharar (uncertainty), and maysir (gambling).

- 😀 The relationship between customers and the bank is based on partnership, not debtor-creditor dynamics.

- 😀 Key principles of Islamic banking include justice, transparency, partnership, security, and universality.

- 😀 Justice is maintained through profit-sharing and avoiding exploitative financial practices.

- 😀 Partnership means both the bank and customers share profits and risks fairly, with no one party being at a disadvantage.

- 😀 Transparency is ensured by providing clear and continuous financial reports, allowing customers to track their investments.

- 😀 Islamic banking is universal and does not discriminate based on race, religion, or social status.

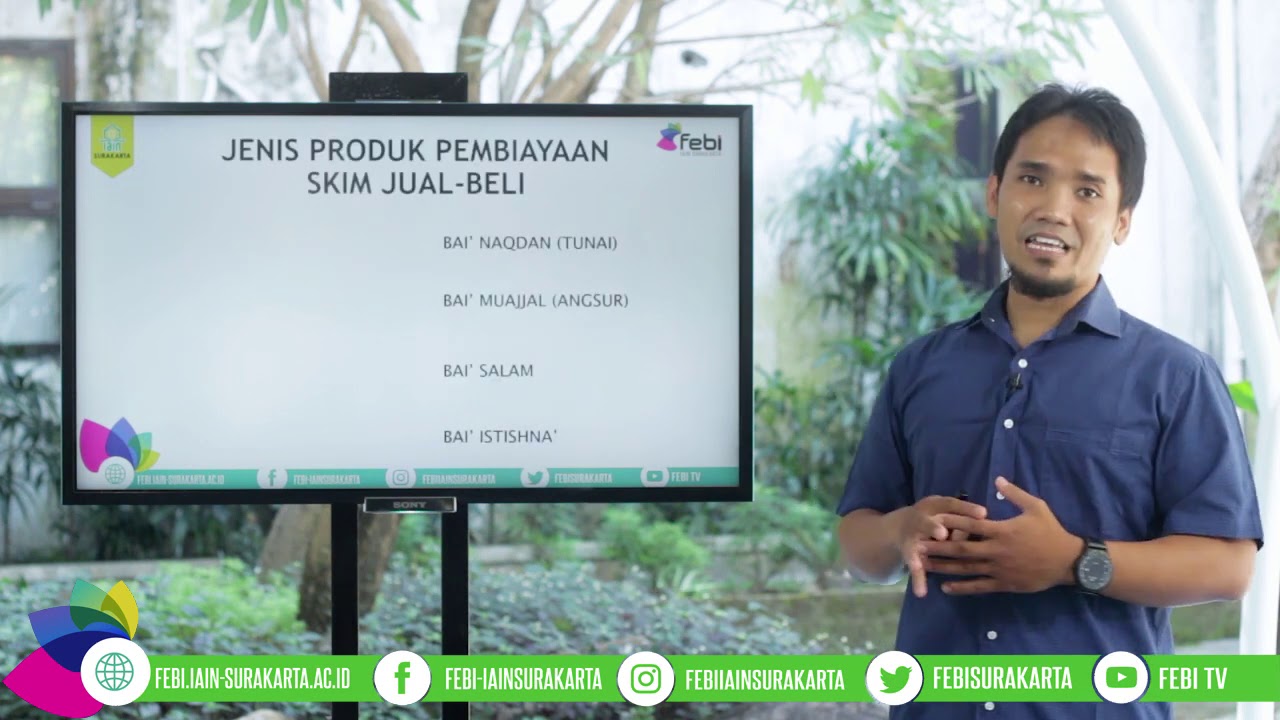

- 😀 Islamic banks offer products based on trust (wadiah), profit-sharing (mudarabah and musyarakah), and sale (murabaha, istishna, salam).

- 😀 The wadiah contract ensures the safety of customer funds, with options for non-usage (Yad Amanah) or usage (Yad Dhamanah) by the bank.

- 😀 Mudarabah and musyarakah are profit-sharing contracts where the bank and customers share both the profits and risks from investments.

- 😀 Sale contracts like murabaha (cost-plus financing), istishna (manufacturing orders), and salam (prepaid orders) are common in Islamic banks.

- 😀 Islamic lease contracts include ijarah (rental) and ijarah muntahia bittamlik (rent-to-own), offering flexibility for asset usage and acquisition.

Q & A

What is the main purpose of a Shariah-compliant bank?

-A Shariah-compliant bank functions as an intermediary, connecting individuals with surplus funds to those in need of capital, while ensuring all operations and financial products adhere to Islamic principles, avoiding elements like gharar (uncertainty), riba (interest), and maysir (gambling).

What are the key principles that guide a Shariah-compliant bank?

-The key principles include fairness (keadilan), partnership (kemitraan), tranquility (ketentraman), transparency (keterbukaan), and universality (universalitas), which distinguish Islamic banks from conventional ones.

How does the principle of fairness (keadilan) manifest in Shariah banking?

-Fairness is demonstrated through profit-sharing agreements such as mudarabah (profit-sharing) and mutually agreed-upon margins, ensuring both the bank and the client share profits and risks equitably.

What does the principle of partnership (kemitraan) in Shariah banking mean?

-Partnership means that the relationship between the bank and its clients is based on a business partnership, not on a debtor-creditor relationship. Both parties share profits, risks, and responsibilities equally.

How is the principle of tranquility (ketentraman) ensured in Islamic banking?

-Tranquility is achieved by ensuring that all financial products and transactions comply with Islamic law, especially avoiding interest (riba) and ensuring the transactions are ethically sound and free of exploitative practices.

Why is transparency (keterbukaan) important in Shariah banking?

-Transparency ensures that financial transactions, including the bank's financial reporting, are clear and accessible to clients. This builds trust and allows customers to assess the safety of their deposits and the quality of the bank’s management.

What does universality (universalitas) mean in the context of Shariah banking?

-Universality means that Shariah-compliant banks operate without discrimination based on ethnicity, race, religion, or social class, following the Islamic principle of rahmatan lil’alamin (mercy for all of creation).

What are the main types of contracts used in Shariah banking?

-The main types of contracts include wadiah (safekeeping), mudharabah (profit-sharing), musyarakah (joint venture), murabahah (cost-plus sale), istishna (manufacturing contract), salam (advance payment sale), and ijarah (leasing), among others.

What is the difference between wadiah Yad Amanah and wadiah Yad Dhamanah?

-Wadiah Yad Amanah refers to safekeeping where the bank cannot use the deposit for its own benefit, while wadiah Yad Dhamanah allows the bank to utilize the deposit, such as in savings accounts or giro accounts.

How does profit-sharing work in mudarabah and musyarakah contracts?

-In a mudarabah contract, the bank manages the funds of the investor (the client) and shares the profits according to a pre-agreed ratio, while in musyarakah, both the bank and the client contribute capital and share the profits and risks of the venture equally.

What is the role of a Shariah Supervisory Board in a Shariah-compliant bank?

-A Shariah Supervisory Board ensures that all products, services, and transactions offered by the bank comply with Islamic law. They review contracts, transactions, and financial products to make sure they align with Shariah principles.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Tabungan dalam Bank Syariah • Produk dan Jasa Bank Syariah #1

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

Ini Dia Isu Paling Hot Terkait Bank Syariah

Benarkah Bank syariah hanya kedok? - Ustadz Dr Erwandi Tarmizi LC, MA

Bab 4 Asuransi, Bank, dan Koperasi Syariah | Bagian Pertama Asuransi Syari'ah | Kurikulum Merdeka

Tugas Perbankan Syariah

5.0 / 5 (0 votes)