Studi Kasus SUKUK MURABAHAH

Summary

TLDRThis video explores the structure and mechanism of sukuk issuance in Saudi Arabia, focusing on a case involving the Kingdom’s financial strategies and special-purpose vehicles (SPVs). The video explains the use of hybrid contracts like Mudharabah and Murabahah for financing various infrastructure projects. It covers the roles of investors, the process of collecting funds, and the implementation of these funds in key sectors like port development and real estate. Additionally, it highlights the guarantees and partnerships between banks and companies involved in securing investment returns.

Takeaways

- 😀 The main case in the script involves an investment structure in Saudi Arabia, utilizing sukuk (Islamic bonds) to fund various projects.

- 😀 The sukuk issued follows a hybrid contract model, combining two Islamic finance principles: mudhorobah (profit-sharing) and murabaha (cost-plus financing).

- 😀 51% of the funds raised are allocated using mudhorobah, which involves profit-sharing from productive entities, while the remaining 40% is used under a murabaha contract for the purchase of goods.

- 😀 The funding raised is used for infrastructure development projects in Saudi Arabia, such as ports, with a focus on generating returns over time.

- 😀 Investors in this scheme are promised returns through a profit-sharing mechanism, where profits from the projects are shared periodically.

- 😀 The sukuk structure involves an SPV (Special Purpose Vehicle) acting as the intermediary between the investors and the projects in Saudi Arabia.

- 😀 The investor's returns are based on the performance of the infrastructure projects, such as ports, which generate income through usage fees or leasing.

- 😀 A key feature of the investment scheme is the involvement of multiple parties, including banks like Citibank and JNE, for the collection of funds and risk sharing.

- 😀 The second case in the script discusses an alternative sukuk structure, which uses a hybrid contract combining wakalah (agency) and tijarah (trading) principles for investment in real estate and other projects.

- 😀 The investment funds raised through the second sukuk structure are also used for different projects, with one focus on real estate development and the other on trading and leasing assets.

- 😀 In both cases, the investment structures are designed with a built-in guarantee from associated companies to ensure returns or compensate for shortfalls in expected revenues.

Q & A

What is the main topic of the case discussed in the transcript?

-The main topic revolves around the issuance of sukuk by Saudi Arabia through a Special Purpose Vehicle (SPV), utilizing hybrid contracts like Mudhorobah and Murabaha to raise funds for various projects.

What are the two types of contracts mentioned in the case study?

-The two types of contracts mentioned are Mudhorobah (profit-sharing) and Murabaha (sale-based financing).

How is the 51% of the funds raised under Mudhorobah utilized?

-The 51% of the funds raised under Mudhorobah are used for investment projects, with profits to be shared based on the project's success.

What is the purpose of the remaining 49% of the funds raised using Murabaha?

-The remaining 49% of the funds are used under a Murabaha contract to buy goods, which are then sold to the Saudi government with a margin added.

What role does the Special Purpose Vehicle (SPV) play in the sukuk issuance?

-The SPV acts as the entity responsible for issuing sukuk, managing funds, and ensuring that the profits are distributed to investors as agreed in the contracts.

How are the sukuk payments structured?

-The sukuk payments are structured as periodic returns, with investors receiving their share of the profits according to the terms of the Mudhorobah and Murabaha agreements.

What is the second case study about in the transcript?

-The second case study involves another sukuk issuance, where a hybrid Wakalah (agency) structure is used. The funds are raised for real estate and infrastructure investments, with guarantees provided by the company's group.

What are the main investment sectors in the second case study?

-The main investment sectors in the second case study are real estate and infrastructure projects, specifically involving lease contracts (Ijarah) and trade-based contracts (Tijarah).

How does the company ensure repayment of funds in the second case study?

-The company guarantees the repayment of funds by providing a backup through its group companies, ensuring investors are compensated even in case of shortfalls.

What is the significance of using SPVs in these financial models?

-SPVs are significant because they isolate risks, manage specific projects, and provide a transparent and secure structure for raising and managing funds through sukuk issuance.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Mengenal SUKUK Murabahah

كمين بن سلمان || الدعم السعودي العسكري لباكستان في مواجهة المصالح العسكرية للامارات و الهند

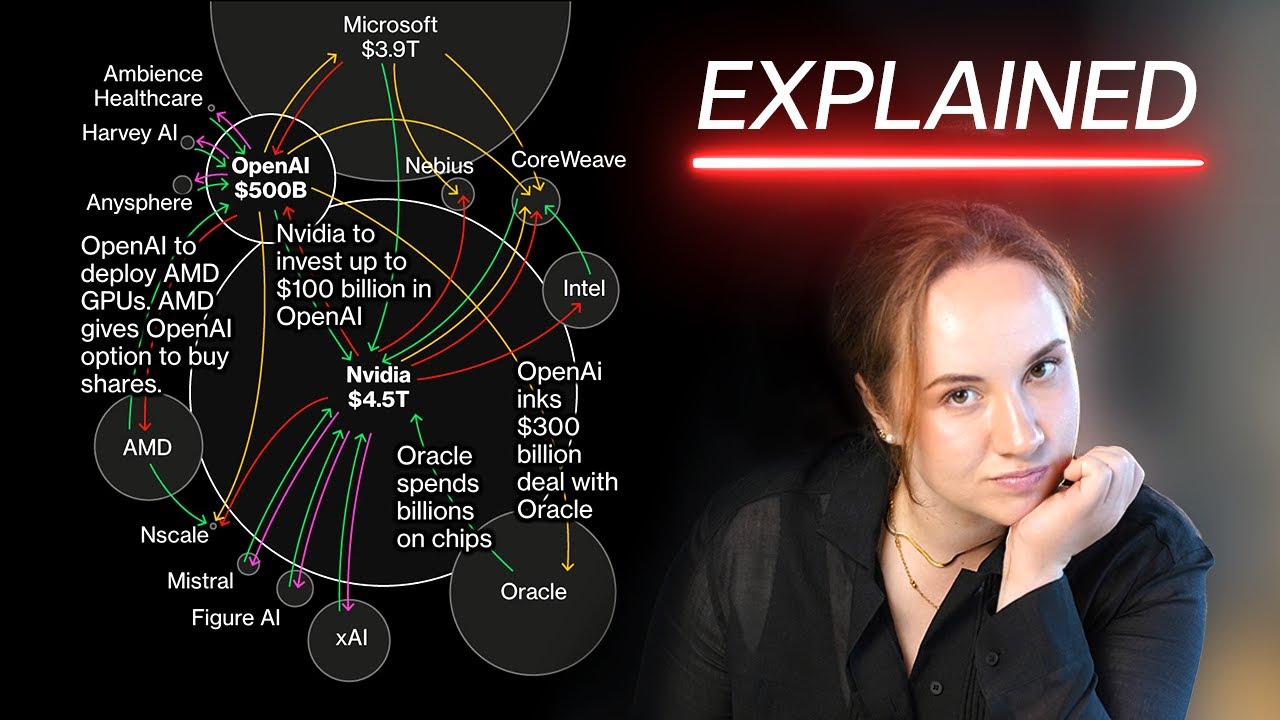

Inside AI’s Circular Economy: Geopolitical Loopholes, Hidden Debt, and Financial Engineering

Sejarah Panjang Berdirinya Negara dan Kesultanan Arab Saudi

China's USD Bond

The Qatar Strike by Israel and Its Geopolitical Consequences

5.0 / 5 (0 votes)