Risk Management & Position Sizing Strategy for Trading

Summary

TLDRIn this crucial video, the channel emphasizes the importance of risk management for day traders, especially for those aiming for profitability. The speaker shares a personal experience with a bad trade on PDD, highlighting the necessity of a risk management strategy to prevent significant losses. The video outlines a three-step approach to risk management, focusing on understanding risk-reward ratios, setting proper stop-loss and take-profit levels based on daily support and resistance, and recognizing personal strengths and weaknesses to establish trading rules. The speaker encourages traders to practice discipline, track trades in a journal, and follow a set of personal rules to maintain profits, offering a free risk management crash course for further insights.

Takeaways

- 😀 Risk management is crucial for becoming a profitable trader, as it helps to preserve profits.

- 📉 The speaker emphasizes the importance of having a risk management strategy, using a personal trade on PDD stock as an example.

- 💰 The key to risk management is understanding and applying the power of risk-reward ratio, which should be considered in relation to account size.

- 🔢 For a $10,000 account, the speaker suggests risking about 1% per trade, which equates to $100 per trade.

- 🚫 Risking the same amount as you are making can lead to a break-even scenario or losses, especially with a 50% win rate.

- 📈 A better approach is to aim for a risk-reward ratio of at least 1:2, meaning you risk $100 to make $200.

- 🏆 For substantial growth, especially with a small account, aim for a risk-reward ratio of 1:3 or higher.

- 📊 Use daily support and resistance levels to set stop-loss and take-profit levels, ensuring a favorable risk-reward setup.

- 📝 It's essential to know your strengths and weaknesses as a trader and set rules for yourself to maintain discipline.

- 📉 The speaker shares personal rules like stopping trading after a certain time or after giving back a certain percentage of profits to avoid emotional trading.

- 📚 Keeping a trading journal and tracking all trades can help traders understand their actual risk-reward ratio and improve their strategy.

Q & A

What is the main focus of the video?

-The main focus of the video is on risk management strategies for day trading, emphasizing its importance for becoming a profitable trader.

Why is risk management considered crucial in day trading?

-Risk management is crucial in day trading because it helps traders control their losses, which is essential for maintaining profitability, especially with a small account.

What was the trader's experience with the stock PDD?

-The trader had a bad trade with PDD, which quickly dropped to daily support and resulted in a significant loss. However, the trader managed the risk and stopped out for a loss, which was about 1% of their account size.

What is the recommended maximum percentage of account size to risk per trade?

-The recommended maximum percentage to risk per trade is about 1% of the account size.

How does the trader suggest managing risk if you have a more conservative approach?

-For a more conservative approach, the trader suggests risking a fixed amount per day, such as $100, and adjusting the risk per trade based on the number of trades planned for the day.

What is the significance of the risk-reward ratio in trading?

-The risk-reward ratio is significant because it helps traders manage their potential losses and gains. A proper risk-reward ratio ensures that the potential profit is greater than the potential loss, which is key to long-term profitability.

What is the minimum risk-reward ratio a new trader should aim for?

-A new trader should aim for a minimum risk-reward ratio of 1:2, meaning they should risk $1 to make $2.

How does the trader calculate the risk for a trade?

-The trader calculates the risk for a trade by determining the entry point and the stop-loss level, and then assessing the potential profit target based on the risk-reward ratio.

What is the importance of having a trading journal?

-A trading journal is important for tracking trades, analyzing risk-reward ratios, and understanding a trader's strengths and weaknesses. It helps in maintaining discipline and improving trading strategies.

What are some personal rules the trader suggests setting for oneself?

-The trader suggests setting personal rules based on one's strengths and weaknesses, such as stopping trading after a certain time of day or after giving back a certain percentage of profits, to maintain discipline and prevent overtrading.

How can traders improve their win rate and profitability?

-Traders can improve their win rate and profitability by working on their risk-reward ratio, aiming for at least 1:2, and ideally 1:3 or more. Additionally, they should focus on managing their risk effectively and maintaining discipline in their trading.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How I manage position size, money, and risk management (Class 15)

The Market is Changing, Don’t Get Left Behind

8 Rules That Changed my Trading Forever

How To Start DAY TRADING - Becoming A Trader IN 30 DAYS

ICT Mentorship Core Content - Month 02 - No Fear Of Losing

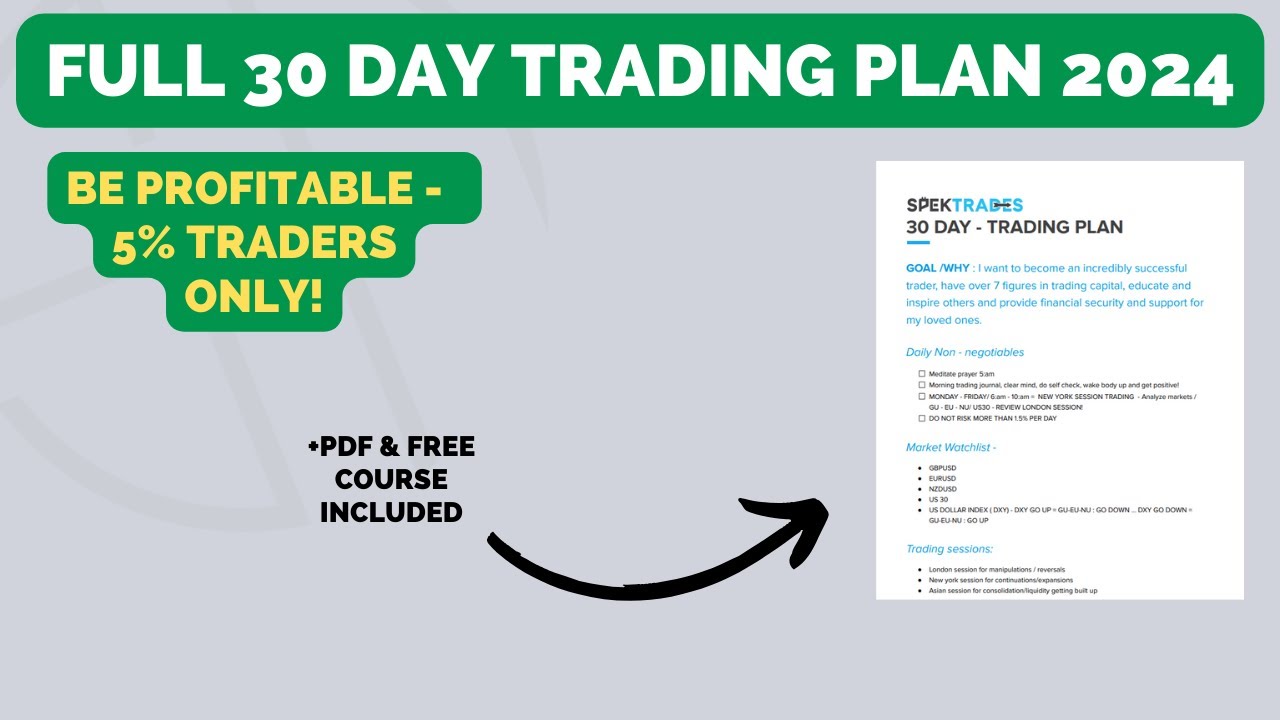

Full 30 Day Trading Plan: Become Profitable In 2024 (5% Traders only!)

5.0 / 5 (0 votes)