💀 Who Is Under The Resource Curse? | 2 Causes of Curse

Summary

TLDRThe resource curse, or paradox of plenty, refers to the phenomenon where countries rich in natural resources experience slower economic development. This underperformance is linked to political and institutional issues such as corruption, rent-seeking, and poor resource management. The Dutch disease, where a booming resource sector harms other sectors, further exacerbates this problem. Notable examples include 17th century Spain and countries like Venezuela and Malaysia. Effective solutions involve political, social, and economic reforms, including maintaining budget surpluses and competitive exchange rates, to overcome the resource curse and diversify economies.

Takeaways

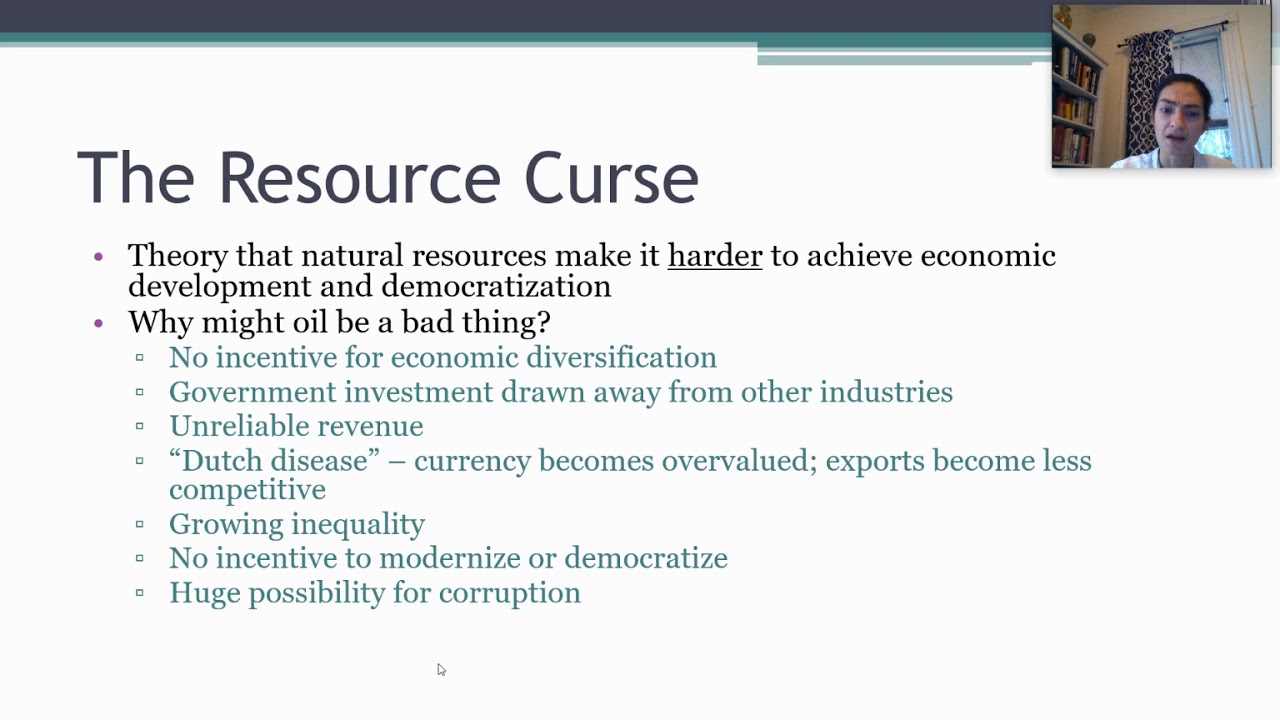

- 😀 The resource curse, also known as the paradox of plenty, refers to the phenomenon where countries rich in natural resources often experience poor economic performance compared to resource-poor countries.

- 😀 Richard M. Auty coined the term 'resource curse,' highlighting the negative effects of having easy access to natural resources, leading to underdevelopment.

- 😀 Terry L. Carl introduced the term 'paradox of plenty,' which describes how resource abundance can hinder development rather than promote it.

- 😀 The resource curse can be attributed to two main factors: political/social issues (corruption, rent-seeking, political instability) and institutional weaknesses (poor management and inefficient resource allocation).

- 😀 Countries rich in resources may prioritize controlling these resources over long-term development, leading to poor investments in new technology, infrastructure, and innovation.

- 😀 An example of the resource curse is 17th-century Spain, which exploited resources from colonies but saw economic decline due to the focus on importing goods with gold rather than producing domestically.

- 😀 The Dutch disease occurs when a booming resource sector, like oil or natural gas, harms other sectors such as agriculture and manufacturing by absorbing capital and labor, making the economy dependent on one industry.

- 😀 Instability in resource prices can lead to governmental fiscal instability, causing problems such as erratic spending, political volatility, and reduced foreign investment.

- 😀 Countries that manage their resource wealth poorly often face an overreliance on the resource sector, which can be destabilizing when market conditions change.

- 😀 Some countries successfully avoid the resource curse by saving money during prosperous times, investing wisely, and maintaining stable economic policies such as controlling inflation and ensuring competitive exchange rates.

- 😀 While political and institutional reforms are challenging, creating the right environment for business and governance is crucial to overcoming the resource curse and achieving long-term growth.

Q & A

What is the resource curse, and who coined the term?

-The resource curse, or paradox of plenty, is the phenomenon where countries rich in natural resources experience economic underperformance compared to countries with fewer resources. The term was coined by Richard M. Auty.

What does the term 'paradox of plenty' mean in the context of the resource curse?

-The term 'paradox of plenty' refers to the idea that having abundant natural resources doesn't always lead to economic prosperity. In fact, it can lead to negative outcomes such as corruption, poor governance, and over-reliance on a single resource sector.

What are the primary causes of the resource curse?

-The causes of the resource curse are divided into two main categories: political and social factors (e.g., corruption, rent-seeking, and instability) and institutional factors (e.g., poor quality of public institutions and mismanagement of resources).

How can political factors contribute to the resource curse?

-Political factors can contribute to the resource curse by creating a system where political leaders prioritize resource extraction over investment in other sectors, leading to corruption, rent-seeking, and unstable government spending.

What is the Dutch Disease, and how does it relate to the resource curse?

-Dutch Disease is an economic phenomenon in which a booming resource sector leads to the neglect of other sectors, such as agriculture or manufacturing. It results from the overvaluation of the country's currency, making other industries less competitive on the global market.

How does the resource curse impact government stability and economic development?

-The resource curse can make governments overly dependent on resource exports, leading to unstable revenues when prices fluctuate. This can cause government income and spending instability, hindering long-term economic growth and making the country more vulnerable to economic shocks.

Can a country with abundant natural resources still overcome the resource curse?

-Yes, countries can overcome the resource curse if they adopt sound economic policies, avoid excessive debt, save during prosperous times, and invest resource wealth in sustainable development. Strong public institutions and good governance are also critical.

What examples of countries suffering from the resource curse are mentioned in the script?

-Examples of countries affected by the resource curse include 17th-century Spain, which relied heavily on gold from its colonies, and modern oil-exporting countries such as Venezuela and Iraq, where mismanagement of wealth has led to economic instability.

What is the role of institutions in mitigating the effects of the resource curse?

-Institutions play a crucial role in mitigating the resource curse by ensuring proper management of resource wealth, creating a favorable environment for business, and preventing corruption. Strong institutions can help diversify the economy and avoid the negative impacts of resource dependence.

What solutions are proposed for countries suffering from the resource curse?

-Solutions include implementing macroeconomic policies that focus on controlling inflation, maintaining a competitive exchange rate, avoiding large debts, and saving during times of prosperity. Political and social reforms are also essential for long-term stability and economic growth.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)