Tại Sao Na Uy Xóa Bỏ Được Lời Nguyền Tài Nguyên ?

Summary

TLDRThis video discusses the 'resource curse,' a paradox where nations rich in natural resources often experience slower economic growth compared to those with fewer resources. It explores how many countries focused solely on exploiting resources like oil or gas, leading to corruption and inequality. Norway is highlighted as an exception, having successfully managed its oil wealth through innovative policies and social welfare programs. The video explains how Norway built a massive sovereign wealth fund, benefiting future generations while maintaining one of the highest living standards and a minimal wealth gap worldwide.

Takeaways

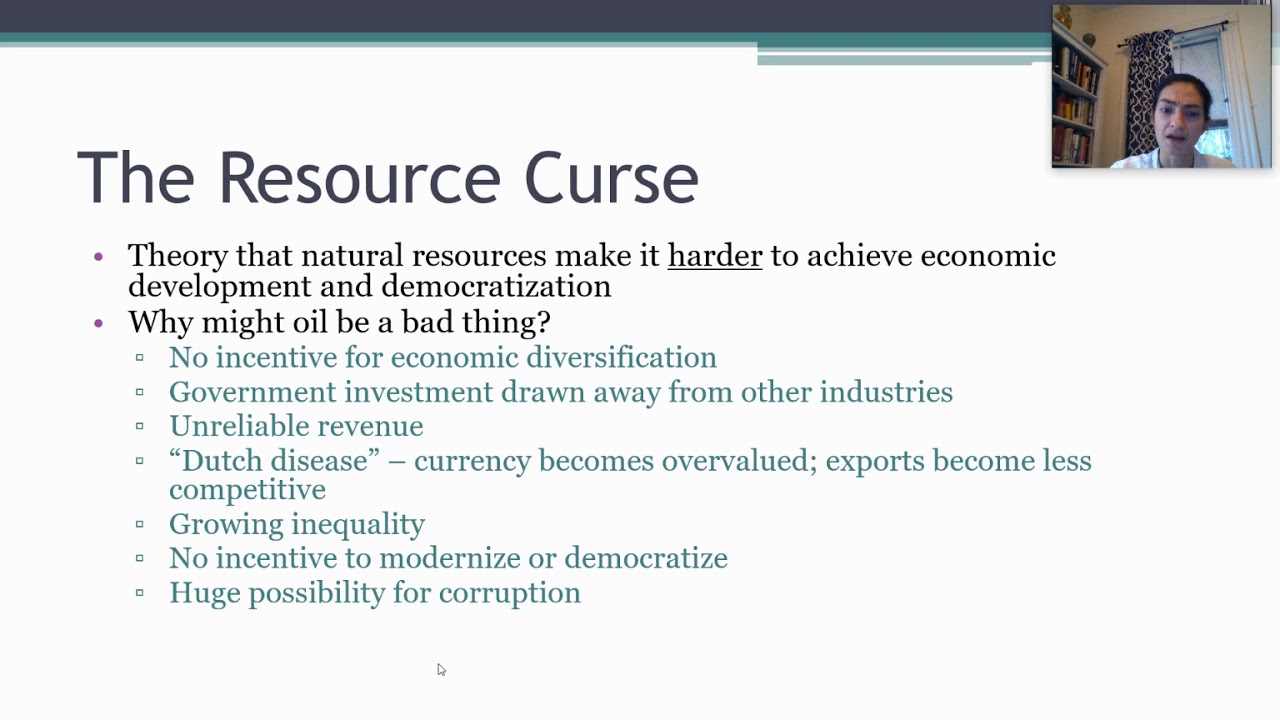

- 🌍 The paradox of resource-rich nations is that they often experience slower economic development than resource-poor countries.

- 💡 In 1993, British economist Richard Auty coined the term 'resource curse' to describe the phenomenon where countries rich in natural resources often suffer from economic stagnation.

- ⛏️ Countries heavily reliant on natural resources like oil and gas often fail to develop other industries, leading to unequal wealth distribution and economic instability.

- 🇳🇴 Norway is an exception to the resource curse, having successfully managed its oil wealth to foster economic growth and maintain a high standard of living.

- 🏦 Norway established a sovereign wealth fund, which now exceeds €1 trillion, ensuring future generations benefit from today's oil revenues.

- 📉 Despite initial struggles with inflation and currency overvaluation, Norway reformed its oil industry to reduce dependency on oil revenues and diversified its economy.

- 🔧 The government ensured that foreign companies extracting oil in Norway adhered to strict environmental and economic regulations, encouraging sustainable practices.

- 💰 Norway uses oil profits to fund social welfare programs, invest in public services, and enhance quality of life for its citizens.

- 📊 The country consistently ranks high in human development indicators and has one of the world's lowest income inequality gaps.

- 🌐 Norway's sovereign wealth fund invests globally, contributing to the country's economic stability while limiting domestic spending to 4% of the fund's earnings.

Q & A

What is the 'Resource Curse' or 'Paradox of Plenty' described in the video?

-The 'Resource Curse,' also known as the 'Paradox of Plenty,' refers to the phenomenon where countries with abundant natural resources, like oil or minerals, tend to have slower economic growth compared to countries with fewer resources. These nations often become overly dependent on resource extraction, neglecting other sectors, which can lead to corruption and economic instability.

Why do countries with abundant natural resources often struggle with economic development?

-Countries with abundant natural resources often focus solely on resource extraction for income. This over-reliance can stifle the development of other industries, lead to corruption, benefit only a small elite, and increase income inequality. Additionally, fluctuating global commodity prices can destabilize their economies.

Which country is cited as an exception to the Resource Curse, and how did it avoid it?

-Norway is cited as an exception to the Resource Curse. It avoided the curse by establishing a sovereign wealth fund, ensuring that oil revenues were saved and invested for future generations. The government also implemented transparent governance, focused on equitable wealth distribution, and diversified its economy.

What role does the Norwegian Sovereign Wealth Fund play in the country's economy?

-The Norwegian Sovereign Wealth Fund, managed by the Central Bank but owned by the Ministry of Finance, stores all the profits from Norway’s oil and gas sales. It is used to invest globally in various assets like stocks and real estate, ensuring financial security for future generations and maintaining a high standard of living.

How did Norway initially respond to the discovery of oil in the late 1960s?

-Norway discovered a large oil reserve in the North Sea in 1969. Initially, the discovery raised concerns about how to manage the oil wealth without damaging the broader economy. The government implemented policies to prevent 'Dutch disease' and avoid over-reliance on oil revenues, investing in other sectors to ensure economic stability.

What is 'Dutch Disease,' and how did Norway address it?

-'Dutch Disease' refers to the negative economic effects caused by a booming resource sector, which leads to currency appreciation, making exports less competitive and harming other industries. Norway addressed it by controlling inflation, carefully managing oil revenues, and encouraging investment in non-oil sectors.

What strategies did Norway adopt to prevent corruption and ensure transparent management of oil revenues?

-Norway created a transparent and efficient system for managing oil revenues. It established a clear separation of powers, where the Norwegian Petroleum Directorate regulates the oil sector independently from the state-owned company Statoil (now Equinor). This structure prevents conflicts of interest and ensures accountability.

What impact has the Norwegian Sovereign Wealth Fund had on its citizens' quality of life?

-The fund has contributed to high living standards in Norway, providing resources for public services like free education, healthcare, and infrastructure. It also ensures that future generations benefit from today's oil revenues, making Norway one of the countries with the smallest wealth gaps and highest Human Development Index (HDI).

How did Norway manage foreign oil companies operating in its territory?

-Norway allowed foreign oil companies to operate in its territory but imposed strict regulations, including environmental safeguards. These companies had to adhere to the rules set by Norway's independent regulatory body, the Norwegian Petroleum Directorate, which ensured that both the government and foreign companies shared risks and benefits.

How has Norway’s management of its oil industry differed from oil-exporting countries in the Middle East?

-Unlike many Middle Eastern countries that nationalized their oil industries, Norway maintained a balanced approach, allowing private companies to extract oil under strict government oversight. This approach promoted competition, prevented monopolies, and ensured that oil profits were used to benefit the entire population, not just the elite.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

💀 Who Is Under The Resource Curse? | 2 Causes of Curse

Why Resource Rich Countries Grow Slowly?

Kekayaan Alam Berlimpah, Kok Bisa Jadi Negara Miskin?

AP Comp Gov - The Resource Curse

What Is The Relationship Between Corruption And GDP? - Learn About Economics

How China became so Rich and Powerful in just 3 decades? Economic History of China by Adarsh Gupta

5.0 / 5 (0 votes)