AKUNTANSI KEUANGAN MENENGAH - Bagian 2

Summary

TLDRThis educational video provides an in-depth explanation of accounting for cash in financial reports, focusing on two types of cash accounts: petty cash and bank cash. It outlines how to manage and record transactions for these accounts using two systems: the impress system and the fluctuating system. The video discusses the steps for recording cash transactions, how to maintain accurate balances, and the importance of reconciling bank statements with company records. The final segment touches on how to report cash in financial statements and prepare for the next lesson on marketable securities.

Takeaways

- 😀 Cash is the most liquid asset of a company, used for various transactions such as purchasing equipment, vehicles, or other necessities.

- 😀 There are two types of cash: 'cash on hand' (small cash fund) and 'cash in bank' (larger cash amounts held in the bank).

- 😀 Small cash funds (cash on hand) are typically used for minor expenses, such as buying snacks for meetings or paying repair workers, and are managed by the finance department.

- 😀 Cash in bank is used for larger transactions, often paid via transfers or checks, and is typically kept in the company's bank account.

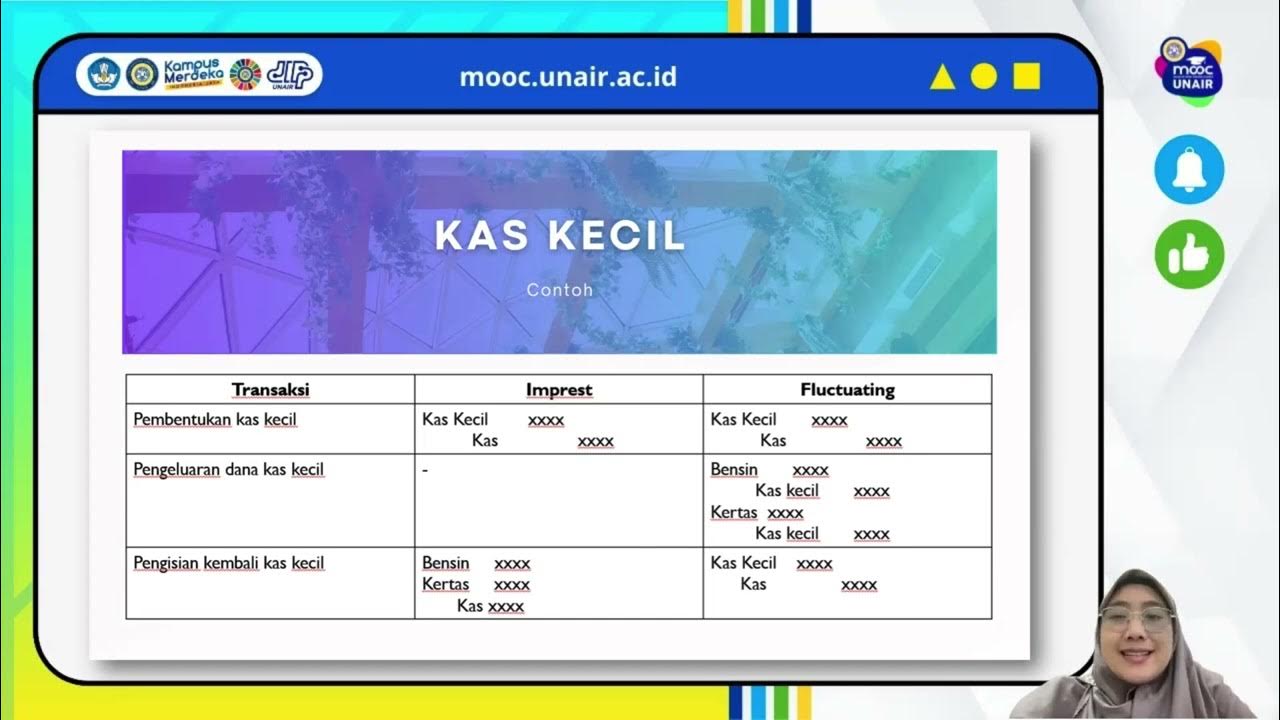

- 😀 Two accounting methods exist for managing small cash funds: the 'impress system' and the 'fluctuating system'.

- 😀 In the fluctuating system, the balance of the small cash fund changes as expenses are paid, and transactions are recorded each time money is used.

- 😀 In the impress system, expenses are not recorded immediately; instead, only the replenishment of the small cash fund is recorded when it is refilled to its original amount.

- 😀 For both methods, the initial transfer of funds into the small cash account is recorded as a debit to 'small cash' and a credit to 'cash in bank'.

- 😀 Replenishment of the small cash fund under the fluctuating system involves debiting the small cash account and crediting the bank, whereas in the impress system, the replenishment is recorded with related expense accounts rather than the small cash account.

- 😀 Cash reconciliation is crucial when preparing financial reports, as the balance in the company's records may differ from the bank's records due to factors like administrative fees, interest income, or outstanding checks.

- 😀 Bank reconciliation ensures that both the company's and the bank's records align, and adjustments are made for discrepancies such as bank fees, interest, or deposits in transit.

Q & A

What is the main focus of the script?

-The script primarily focuses on explaining the different accounting systems for managing cash, specifically 'cash on hand' and 'cash bank,' and their respective documentation methods such as the impress system and fluctuating system.

What is the difference between 'cash on hand' and 'cash bank'?

-'Cash on hand' refers to small amounts of money kept on-site for minor transactions, whereas 'cash bank' refers to larger amounts of money held in a bank account and typically used for significant transactions, often processed through transfers or checks.

What is the 'impress system' in cash management?

-The impress system is a cash management method where a set amount of cash is allocated for small transactions. However, transactions made from this fund are not immediately recorded in the financial system. Only when the fund is replenished is the spending recorded, maintaining a constant balance.

How does the 'fluctuating system' work for managing cash?

-In the fluctuating system, cash transactions are recorded immediately. When cash is used for a transaction, the balance is reduced and recorded, and when the cash fund is replenished, the new deposit is also recorded, causing the balance to fluctuate.

What is the advantage of using the fluctuating system over the impress system?

-The fluctuating system ensures that all transactions are immediately recorded, keeping the cash balance accurate and up-to-date. This eliminates the need for adjustments later on, as opposed to the impress system, where adjustments are needed when cash is replenished.

What are the steps involved in recording small cash transactions using the fluctuating system?

-1. When creating the small cash fund, debit 'cash on hand' and credit 'cash bank.' 2. When using the cash for purchases or expenses, record the transaction by debiting the relevant expense account and crediting 'cash on hand.' 3. When replenishing the fund, debit 'cash on hand' and credit 'cash bank' again.

What is the primary function of cash reconciliation with the bank?

-Cash reconciliation ensures that the company's cash records match the bank's records. Discrepancies can arise due to transactions like bank fees, interest earned, unrecorded deposits, or checks that haven't cleared. The reconciliation process adjusts the company's records to reflect the true available balance.

What is meant by an 'outstanding check'?

-An outstanding check is a check written by the company that has not yet been processed or cleared by the bank. The company may have recorded the transaction, but the bank has not yet deducted the funds, causing discrepancies in cash reporting.

How should a company handle discrepancies in cash records due to a 'bank error'?

-If a bank error is identified (e.g., incorrect deposit amounts or unrecorded transactions), the company must adjust its cash records to reflect the correct balance. If the bank records are incorrect, the company should ensure the bank makes the necessary corrections.

What should a company do if a check is returned due to insufficient funds (a 'bounced check')?

-If a check bounces, the company must reverse the transaction by debiting the cash account and crediting the accounts receivable or relevant account, since the cash was not actually received due to the insufficient funds in the bank.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

AKM 1 - Bab 7. Kas & Rekonsiliasi Bank

Kas & Setara Kas | MOOC | Materi Akuntansi Perpajakan Seri 2

SISTEM AKUNTANSI PENGELUARAN KAS || DAFS OFFICIAL

Rekonsiliasi Bank | Adhelia Desi Prawestri, S.Pd., M.Akun.

ALUR PENGELOLAAN KAS KECIL PADA PERUSAHAAN

Akuntansi Keuangan - Dana Kas Kecil Definisi, fungsi dan tujuan

5.0 / 5 (0 votes)