[MEET 9] AKUNTANSI EKUITAS & PELAPORAN KEUANGAN - PERUBAHAN AKUNTANSI & ANALISIS KESALAHAN

Summary

TLDRThis lecture delves into accounting changes, estimates, and error analysis. It covers changes in accounting policies, such as inventory valuation methods, and how to apply these changes retrospectively or prospectively. The retrospective approach ensures consistency across periods, while prospective application is used for estimation changes, such as depreciation. The script also addresses error correction in financial reports, highlighting the need to restate previous financial statements. Finally, the importance of disclosure for accounting changes, estimates, and errors is emphasized, ensuring transparency for stakeholders and providing accurate financial insights.

Takeaways

- 😀 Accounting changes can be categorized into policy changes, accounting estimate changes, and error corrections.

- 😀 Policy changes occur when a company shifts from one accepted accounting policy to another, like changing the inventory valuation method.

- 😀 There are three approaches to reporting accounting policy changes: Carly (current period adjustment), Retrospective (adjusting prior periods), and Prospective (applying the new policy moving forward).

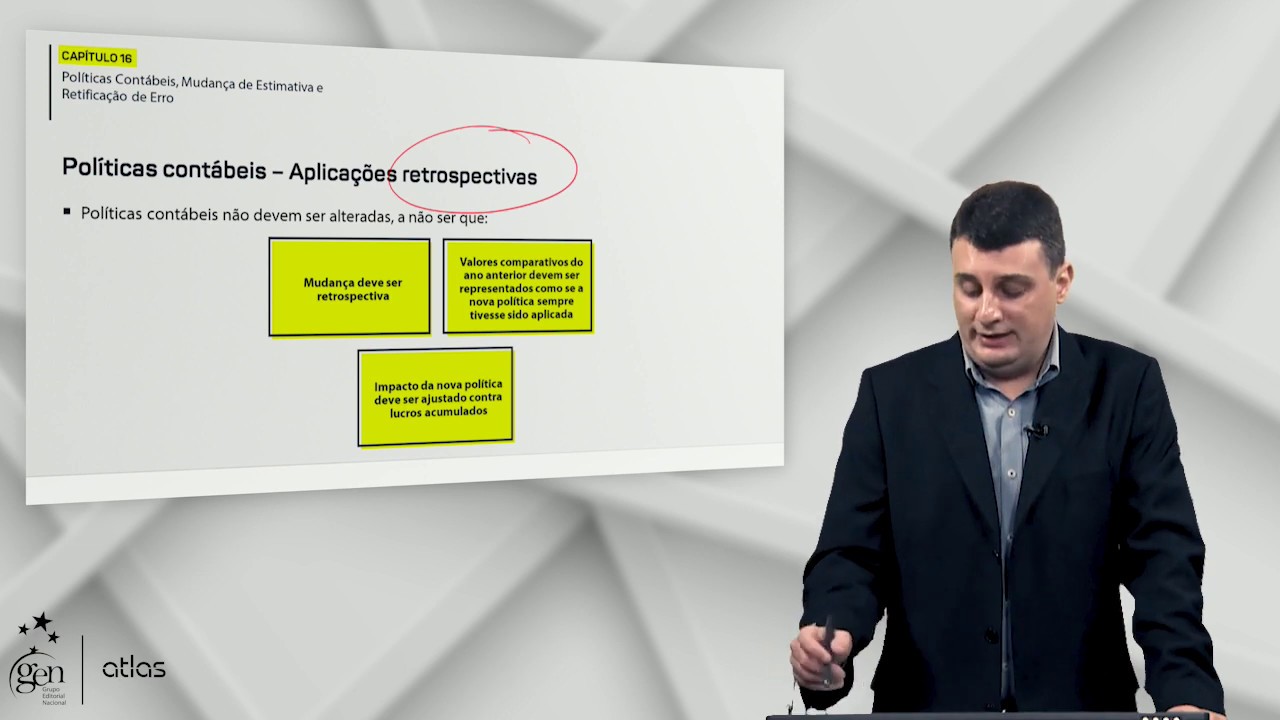

- 😀 The retrospective approach is preferred by accounting standards (ISB) because it ensures consistency across periods and provides more useful information to stakeholders.

- 😀 When a company changes an accounting policy retrospectively, it must adjust prior financial statements and disclose the cumulative effect on retained earnings.

- 😀 Accounting estimate changes happen due to new information or experiences, such as revising the expected useful life of assets or adjusting bad debt estimates.

- 😀 Changes in accounting estimates are reported prospectively, meaning only future periods are impacted, not prior financial statements.

- 😀 Error corrections arise from mistakes like mathematical errors or misapplication of accounting policies and must be adjusted in the relevant prior period's financial statements.

- 😀 Companies must disclose the nature, reason, and financial impact of any accounting policy changes, as well as the effect on both the current period and prior periods.

- 😀 Retrospective application of changes is not always practical if the effects on prior periods can't be reliably estimated, in which case the prospective approach should be used.

- 😀 When applying retrospective changes, companies should adjust the opening balance of retained earnings for the earliest period presented to reflect the cumulative effect of the change.

Q & A

What are the two types of accounting changes mentioned in the lecture?

-The two types of accounting changes discussed are changes in accounting policies and changes in accounting estimates.

What is the difference between a change in accounting policy and a change in accounting estimate?

-A change in accounting policy involves adopting a different method of accounting (e.g., switching inventory valuation methods), while a change in accounting estimate refers to adjusting estimates based on new information or experiences (e.g., revising the useful life of an asset).

What are the three approaches to reporting changes in accounting policies?

-The three approaches are: (1) Current year effect (Carly), where the change is reported in the income statement of the current year only, (2) Retrospective, where prior periods are restated to reflect the new policy, and (3) Prospective, where the new policy is applied only from the change date onward without adjusting past periods.

Which approach to reporting accounting changes is preferred by most accountants?

-The retrospective approach is preferred because it allows for consistency in financial reporting, making it easier for users to compare financial data across periods.

What disclosures are required when a company changes its accounting policy?

-The company must disclose the nature of the change, the reason for adopting the new policy, and the periods affected by the change, along with the cumulative effect of the change on retained earnings or other relevant accounts.

What is the key difference between retrospective and prospective application of accounting changes?

-Retrospective application adjusts prior periods to reflect the new accounting policy, while prospective application applies the new policy from the date of the change without adjusting past financial statements.

What are examples of accounting estimates that might change over time?

-Examples include changes in bad debt allowances, inventory obsolescence, depreciation estimates, warranty provisions, tax liabilities, and the estimated recoverable amounts of mineral reserves.

How are changes in accounting estimates reported?

-Changes in accounting estimates are reported prospectively, meaning the effects of the change are recognized in the period of change and in future periods, without adjusting past periods.

What is an example of how a change in accounting estimate is applied, as given in the lecture?

-An example given in the lecture is a company revising the useful life of its equipment. If the company originally estimated a 10-year life but later determines it should be 15 years, the depreciation expense for future periods is recalculated based on the new estimate.

What should companies do if they make an error in their financial statements?

-If a company makes an error, such as a mathematical mistake or misapplication of accounting policies, the error should be corrected by adjusting the opening balance of retained earnings in the period the error is discovered, unless it is impractical to do so.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Políticas Contábeis, Mudança de Estimativa e Retificação de Erro | Contabilidade Avançada | 2ª ed.

Dynamic Positioning for Dummies - Kalman Filter & Error Computation (4)

4.2 Audit Procedures

Operating System Services

Introduction to Accounting Theory

[MEET 7] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI UNTUK BELANJA & BEBAN

5.0 / 5 (0 votes)