🔴 MENGHITUNG RETRIBUSI PBG OTOMATIS TANPA RIBET | PAKAI INI❗

Summary

TLDRIn this tutorial, the presenter explains how to calculate the retribution fees for a building permit (PBG) application in DKI Jakarta using an Excel calculator. The video guides viewers through filling out the necessary fields, including building type, ownership, complexity, and additional structures like fences and parking areas. By inputting these details, the calculator automatically calculates the retribution fees based on local regulations (Perda Provinsi DKI Jakarta No. 1/2024). The tutorial provides a practical example for a small business (UMKM) building, demonstrating the process from data entry to final billing.

Takeaways

- 😀 The tutorial explains how to calculate building permit fees (retribusi) for buildings in Jakarta using an Excel-based calculator.

- 😀 Users need to input the building’s type, purpose (e.g., UMKM), and size (e.g., 373.92 m²) to begin the retribusi calculation.

- 😀 The retribusi calculation takes into account factors such as building complexity, ownership type, and location index.

- 😀 The Excel file used in the tutorial includes three main sheets: Retribution Calculation Note, SKRD Billing, and Index Data.

- 😀 The locality index for Jakarta is 0.5% of the standard building cost, and users can select whether the building is new or renovated.

- 😀 The ownership factor is set to 1 for private or business ownership, and 0 for state-owned buildings.

- 😀 The building’s permanence (e.g., permanent structure) and complexity (e.g., simple or complex) influence the final retribusi amount.

- 😀 The final retribusi includes both the main building’s fees and additional infrastructure like fences and parking areas.

- 😀 The Excel calculator automatically calculates and fills in the retribusi values based on the selected inputs and parameters.

- 😀 The total estimated retribusi for the example given in the tutorial is IDR 698,530, which is displayed in the SKRD billing sheet.

Q & A

What is the main focus of the tutorial in the script?

-The main focus of the tutorial is to explain how to calculate the retribution fee for building permits (PBG) for UMKM (small businesses) in Jakarta, using an Excel-based calculator and referring to local regulations (Perda DKI Jakarta No. 1/2024).

What is the importance of the Excel-based calculator mentioned in the script?

-The Excel-based calculator helps users estimate the retribution fee they will need to pay for a building permit. It automates calculations based on inputs like building type, area, complexity, and other relevant parameters, streamlining the process.

What does the term 'retribusi' refer to in the context of the tutorial?

-'Retribusi' refers to the fee or tax that is paid for obtaining a building permit (PBG) for a building project, which is calculated based on various parameters such as the building’s area, type, and function.

Why is the retribution value left blank in the PBG application form initially?

-The retribution value is left blank because it is filled out by the relevant technical agency handling the building permit process. The tutorial provides an estimation method, but the official value is determined by the local authority.

How does the user input data into the calculator for retribution calculation?

-The user manually inputs data such as the building’s function, area, and other characteristics into specific fields in the Excel calculator. The tool then automatically computes the retribution fee based on these inputs.

What factors affect the retribution fee calculation according to the script?

-Factors such as the building's function (e.g., UMKM), its area, complexity (simple or not), ownership status, permanence, the number of floors, and additional building elements like walls or parking all affect the retribution fee calculation.

What is the role of the 'indeks lokalitas' (locality index) in the calculation process?

-The 'indeks lokalitas' (locality index) reflects the standard local tax rate for building retribution in Jakarta. It is applied based on the area of the building, influencing the total retribution fee calculation.

What does the term 'SKRD' refer to, and why is it important in this process?

-SKRD stands for 'Surat Ketetapan Retribusi Daerah' (Regional Retribution Tax Assessment Letter). It is the official document issued by the local government that shows the exact retribution fee to be paid for the building permit, based on the calculations performed using the Excel tool.

What happens if a user selects 'renovation' instead of 'new building' in the calculator?

-If 'renovation' is selected instead of 'new building,' the calculator will adjust the relevant indices to reflect the lower retribution fee typically associated with renovation projects, as opposed to new construction.

What additional building components are considered in the retribution calculation apart from the main building?

-Apart from the main building, the retribution calculation also takes into account additional building components such as fences (pagar) and parking areas, with their respective areas and retribution rates factored into the final fee.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Install Wireshark dan Cara menggunakan wireshark pertama kali

Cara Membuat Kalkulator Sederhana Java Netbeans | jSwing Calculator

Belajar Ilmu Falak | Pengoperasionalan Kalkulator Scientific

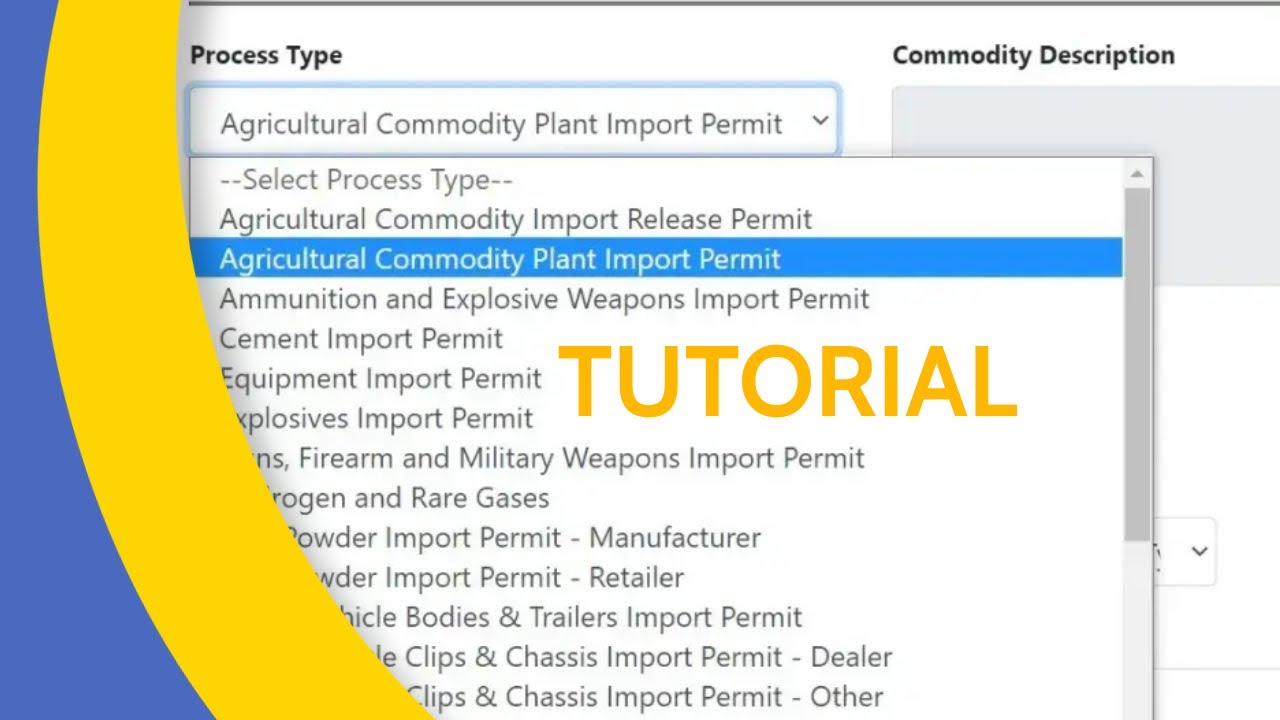

Agricultural Commodity Plant Import Permit (Plant Quarantine and JACRA Processing)

APLIKASI KALKULATOR - UJI KOMPETENSI KEAHLIAN (UKK) RPL TAHUN 2024

90% of us will NEVER escape the rat race

5.0 / 5 (0 votes)