90% of us will NEVER escape the rat race

Summary

TLDRThis video explains how to use a custom compound interest calculator to plan for retirement and manage investments. The presenter demonstrates how to input various financial factors such as annual expenses, investment portfolios, inflation rates, and withdrawal rates into an Excel spreadsheet to estimate future financial growth. The video highlights scenarios using traditional stock investments and Bitcoin, emphasizing the potential long-term returns of both, especially Bitcoin, in achieving early retirement. Viewers are encouraged to experiment with the calculator and consider alternative investment strategies for a more secure financial future.

Takeaways

- 🧮 The video introduces a custom compound interest calculator to help users plan their finances for retirement.

- 💡 The calculator allows users to input variables like expenses, annual investments, inflation rate, and expected growth rate to project future portfolio values.

- 📊 It includes a feature to simulate how much users can withdraw from their portfolio while allowing it to grow and sustain their lifestyle.

- 🏦 Users can adjust their cost of living raise, which impacts the amount they invest annually based on salary increases.

- 🔢 The spreadsheet projects future expenses and portfolio growth over time, using customizable assumptions like a 10% annual return and 4% withdrawal rate.

- 📉 The video highlights the potential risk of increased expenses and volatility in the stock market, which could delay retirement for many people.

- 💰 Investing in Bitcoin is suggested as an alternative to stocks, with the presenter claiming Bitcoin has a higher potential return of up to 40-50%, compared to the stock market's average 10%.

- 📈 The video stresses that hyperinflation and currency devaluation could drive the price of Bitcoin much higher, potentially enabling earlier retirement.

- ⏳ The presenter warns that those who rely solely on traditional investments might never be able to retire if inflation outpaces their returns.

- 🔗 The compound interest calculator is provided for viewers to experiment with different financial scenarios and see how various factors could impact their retirement timeline.

Q & A

What is the main purpose of the video?

-The main purpose of the video is to show how to use a compound interest calculator to plan finances for future investments and retirement.

What is the first step the speaker takes in the video?

-The first step the speaker takes is to introduce an Excel spreadsheet, which functions as a compound interest calculator, showing future investment growth, expenses, and withdrawals.

What factors can be customized in the compound interest calculator?

-Users can customize factors such as annual expenses, interest rates, inflation rates, annual deposits, withdrawal rates, and the cost of living adjustment.

What is the Trinity Study, and how is it applied in this calculator?

-The Trinity Study suggests that a 4% withdrawal rate from your portfolio can sustain your retirement for at least 30 years. The calculator uses this principle to calculate how much of your expenses can be covered by withdrawals.

Why does the speaker recommend considering Bitcoin for investments?

-The speaker recommends Bitcoin because of its higher potential returns compared to traditional stock market investments, citing past returns of 50-60% and projecting 20-40% returns in the future.

What potential risks does the speaker mention regarding investments?

-The speaker mentions the risk of portfolio volatility, potential drops in value by as much as 90%, and the impact of inflation on long-term retirement planning.

How does the speaker describe the relationship between portfolio growth and expenses over time?

-Initially, the portfolio may not cover all expenses, but over time, as the portfolio grows faster than the expenses, it will eventually cover and surpass them, creating a surplus.

How does inflation impact retirement planning according to the speaker?

-Inflation can significantly increase living expenses over time, making it harder to retire if investments do not grow fast enough to keep up with the rising cost of living.

What is the significance of a 10% return on investment in the speaker's projections?

-A 10% return is used as a baseline for investment growth in the stock market, allowing the speaker to project when a person might be able to retire, based on consistent contributions and returns.

What does the speaker suggest about the future of the US dollar and Bitcoin?

-The speaker suggests that hyperinflation of the US dollar could lead to a scenario where Bitcoin becomes more valuable, with its price potentially increasing significantly due to limited availability.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

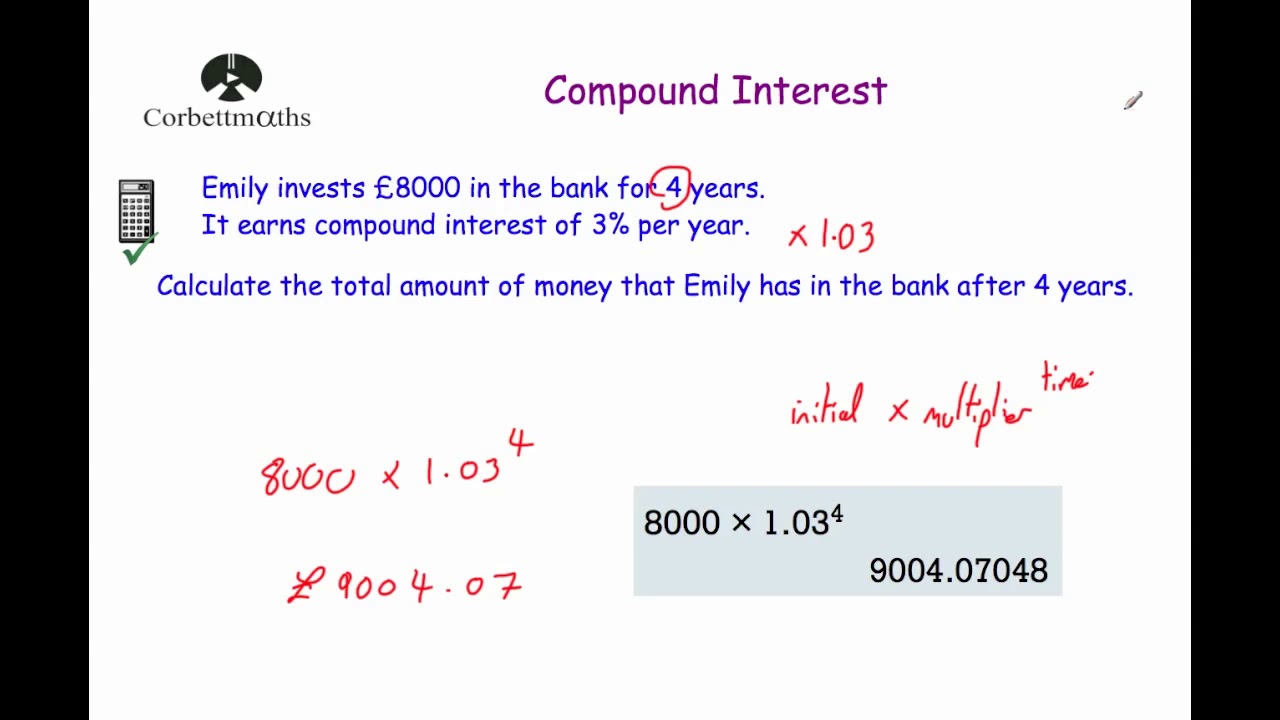

Compound Interest - Corbettmaths

COMPOUND INTEREST (compounded annually) || GRADE 11 GENERAL MATHEMATICS Q2

Compound Interest (Higher & Foundation) | GCSE Maths Revision | GCSE Maths Tutor

The Smart Way To Buy Cars (Bank on Yourself) (Infinite Banking)

the student guide to personal finance 💸 adulting 101

CPP, Explained - Everything You Need To Know About The Canada Pension Plan (CPP vs OAS)

5.0 / 5 (0 votes)