Advanced Market Structure Course (Full Tutorial)

Summary

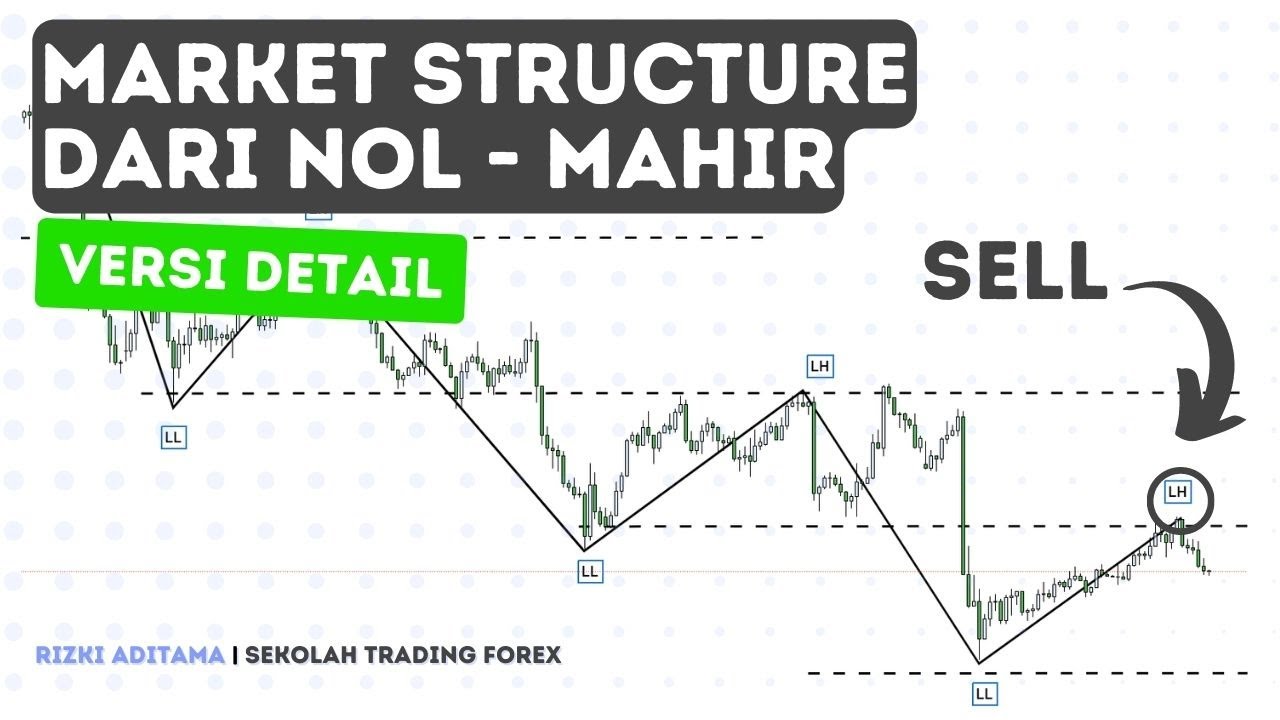

TLDRThis insightful video delves into the critical aspects of market structure for traders, emphasizing the importance of identifying trends and consolidation phases. It outlines the dynamics behind market movements, distinguishing between uptrends, downtrends, and consolidation phases. The video provides a basic introduction to market structures and then explores advanced concepts, focusing on the identification of major highs and lows to detect trend reversals or continuations. It explains the significance of breaks of structure (BOS) and the rules for determining valid breaks, which are crucial for avoiding trading pitfalls. The video also highlights the concept of 'change of character' in market behavior, differentiating between minor and major changes and their implications for trading strategies. By the end, viewers are encouraged to backtest strategies and provided with a platform for doing so. The presenter stresses the need for patience and accurate market structure identification to avoid entering trades on the wrong side of the market.

Takeaways

- 📈 **Market Structure Identification**: Understanding market structure is crucial for traders to succeed, as it helps identify trends and consolidation phases.

- 🔄 **General Market Behavior**: Market movements are influenced by trending (uptrends and downtrends) and consolidation phases, which are essential for price direction.

- 🔺 **Uptrend Dynamics**: In an uptrend, prices form higher highs and lows, and a break of a major low signals the end of the uptrend.

- 🔻 **Downtrend Dynamics**: In a downtrend, prices form lower lows and highs, and a break of a major high signals the end of the downtrend.

- 📊 **Major Highs and Lows**: Identifying valid major highs and lows is key to detecting trend reversals or continuations in the market.

- 🛠️ **Break of Structure (BOS)**: A valid BOS occurs when the price breaks and closes above (in an uptrend) or below (in a downtrend) the most recent higher high or lower low.

- 🚫 **Invalid BOS Scenarios**: A break with a long shadow or wick that closes within the high's range does not constitute a valid BOS.

- 🔄 **Internal vs. External Structures**: Internal structures are price actions within the range of external structures and do not affect the market's primary direction unless a major low or high is broken.

- ⏳ **Patience for Market Shifts**: Traders should wait for a major change of character, confirmed by the price breaking and closing beyond the last major low or high, before considering a market structure shift.

- ⚠️ **Risk of Falling into Traps**: Not properly identifying pivotal points can lead to trading on the wrong side of the market and falling into traps.

- 📚 **Backtesting Importance**: Before using a strategy in a live account, it should be backtested at least 100 times to ensure its validity and effectiveness.

- 📉 **Bearish Market Structure**: The principles of market structure, BOS, and change of character apply similarly to bearish scenarios, with attention to breaking major highs and lows.

Q & A

What is the initial key step that every trader must take on their trading journey?

-The initial key step for every trader is to accurately identify and understand the market structure along with its crucial elements.

What are the two key factors that consistently influence price direction in the market?

-The two key factors that consistently influence price direction are trending, which includes uptrend and downtrend, and the consolidation phase, like a choppy or ranging market.

What is the significance of identifying valid major highs and lows in the market structure?

-Identifying valid major highs and lows is critical as it enables traders to detect signals for a trend reversal or continuation in the market. Without proper identification, there is a risk of falling into traps and trading on the wrong side of the market.

What is an ideal uptrend market structure characterized by?

-An ideal uptrend market structure is characterized by prices consistently forming higher highs and higher lows, where the price typically breaks the previous highs while holding the lows.

What is a break of structure (BOS) and how is it identified in a valid manner?

-A break of structure (BOS) is a situation where the price breaks a high to the upside or a low to the downside, indicating a potential trend reversal or continuation. A valid BOS occurs when the price breaks and closes above (in an uptrend) or below (in a downtrend) the most recent higher high or lower low with the body of a candle.

What is considered when determining a valid change of character in the market structure?

-To determine a valid change of character, one must first determine the general market direction, highlight the valid break of structures on the price chart, and then look for the price to break and close below the last major low (in a bullish scenario) or above the recent major high (in a bearish scenario) with the body of a candle.

Why is it important to wait for a major change of character before entering a short position in a bullish market?

-It is important to wait for a major change of character because a minor change of character alone cannot be regarded as a sign of a shift in the market structure. Entering a short position prematurely may result in a stop loss being triggered as the market continues its primary direction.

What is the recommended practice before using a strategy or setup in a real trading account?

-The recommended practice is to backtest the strategy or setup at least 100 times to ensure its effectiveness and reliability in real market conditions.

What tool is mentioned in the script for backtesting trading strategies and setups?

-The Trader Edge platform is mentioned as a tool for backtesting trading strategies and setups.

What is the implication of the price breaking the recent higher high with a long shadow or wick in a bullish scenario?

-If the price breaks the recent higher high with a long shadow or wick and the body of the candle promptly closes below the range of the high, with the subsequent candle's wick not surpassing the first candle's wick, it is not considered a valid break of structure. The low in this case is regarded as an internal structure within the trading range.

How does the consolidation phase in the market contribute to the accumulation of liquidity and institutional orders?

-The consolidation phase is a period where price typically does not move in a clear uptrend or downtrend, creating a range or choppy market conditions. During this phase, liquidity accumulates as traders and investors wait for clearer direction, and institutional orders may also be placed in anticipation of the next major market move.

What is the role of internal structures in defining the current area of interest and trading range in the market?

-Internal structures are the price movements that occur between the major external structures (major highs and lows). They define the current area of interest and trading range as long as the price remains within the bounds of the most recent major low (in a bullish state) or major high (in a bearish state), indicating the ongoing market trend.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Trading Cepat dan Mudah dengan Market Structure (Detail)

ICT MMXM Trading Strategy That Works Every Time! (Highly Profitable)

Identifying Channels | Technical Analysis Explained | NinjaTrader

The ONLY Market Structure Lesson You'll EVER Need (Step by Step)

ICT Charter Price Action Model 6 - Algorithmic Theory

Advanced Market Structure Course (step by step) SMC

5.0 / 5 (0 votes)