The ONLY Market Structure Lesson You'll EVER Need (Step by Step)

Summary

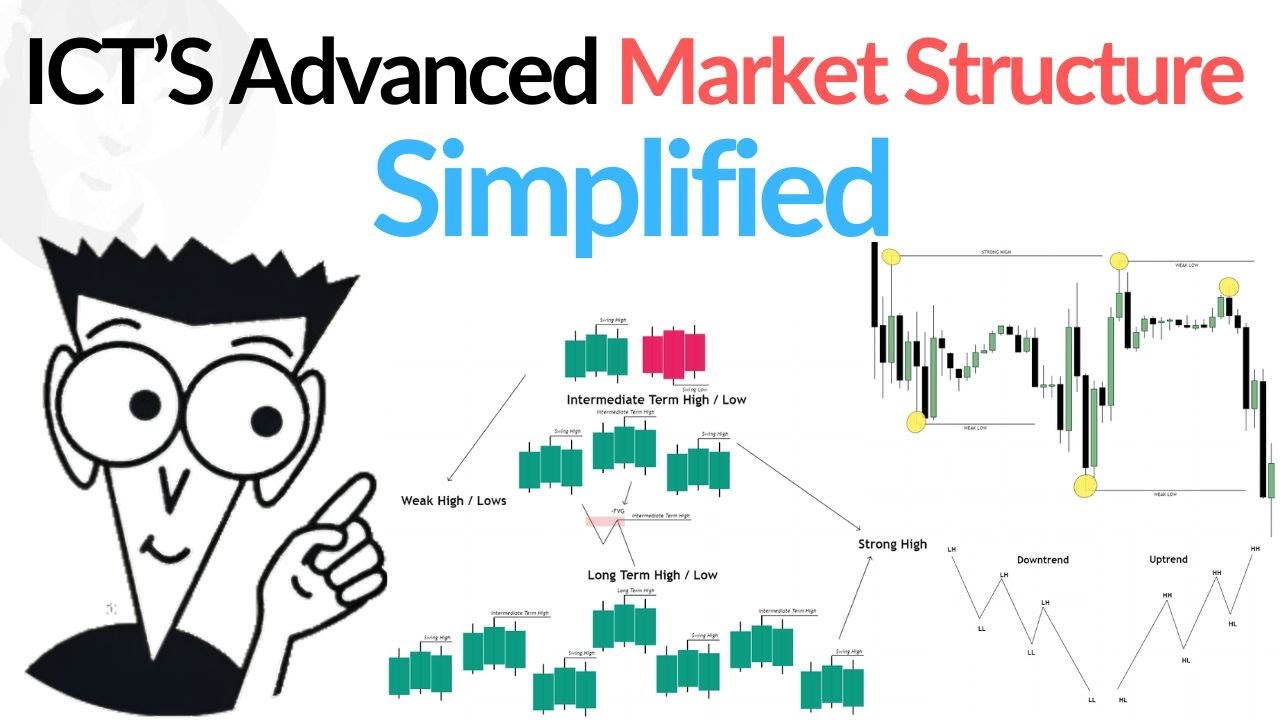

TLDRThis video explains the fundamentals of market structure in trading, breaking down the key phases: uptrends, consolidation, and downtrends. It emphasizes the importance of reading highs and lows accurately by viewing structure as waves, rather than focusing on every small move. The concept of substructure (smaller trends within the larger trend) is introduced, allowing traders to capitalize on valid counter-trend opportunities. The video also highlights the fractal nature of markets, where patterns repeat across timeframes, and provides tips on taking profits in substructure trades while staying aligned with the larger trend. Practical examples are given to demonstrate the method.

Takeaways

- 😀 Market structure refers to how the market moves: uptrends, downtrends, and consolidations.

- 😀 The three main phases of market structure are uptrends, consolidations, and downtrends, and it's crucial to buy during uptrends, sell during downtrends, and stay out during consolidation.

- 😀 Impulses are strong directional moves, and corrections are pullbacks within a trend. Understanding these phases is key to trading.

- 😀 The market functions like an auction. In an uptrend, buyers may hesitate to pay the current price, causing temporary price pullbacks until a better price is met.

- 😀 Avoid getting caught up in small fluctuations. Focus on the bigger picture by viewing market structure in waves rather than obsessing over every tiny move.

- 😀 Swing structure represents the larger trend (impulses and corrections), while substructure represents smaller trends within the larger trend.

- 😀 You can trade smaller substructure moves within a larger trend by analyzing lower time frames and spotting valid trends inside the larger move.

- 😀 When trading substructure, use proper risk management strategies such as break-even points or trailing stops, as smaller trends can reverse once the larger trend resumes.

- 😀 In a bullish market, when taking counter-trend trades (such as selling during a correction), exit before reaching the demand zone of the swing structure to avoid getting caught in the reversal.

- 😀 To identify the right substructure trade, focus on lower time frames (e.g., 15-minute charts) while respecting the overall higher time frame trend.

- 😀 Always backtest and refine your strategy by building your own data set and analyzing personal market perception to improve your trading performance.

Q & A

What are the three main phases of market structure in trading?

-The three main phases of market structure are uptrends, downtrends, and consolidation.

How should traders approach trading during these different market phases?

-Traders should buy during uptrends, sell during downtrends, and stay out during consolidation phases.

What are impulse moves and corrections in the context of market structure?

-Impulse moves are trend moves that push the market in the direction of the trend, while corrections are pullback moves that temporarily counter the trend before the impulse resumes.

Why do impulse and correction phases occur in the market?

-These phases occur because the market functions like an auction. In an uptrend, for example, buying slows when buyers aren't willing to pay current prices, leading to a correction until a price level is reached that encourages buying again.

What is the common mistake people make when analyzing market structure?

-A common mistake is reading highs and lows incorrectly, often getting caught up in small, short-term movements rather than focusing on the larger trend direction.

What is the difference between swing structure and substructure in market analysis?

-Swing structure refers to the larger, more significant market trends (impulses and corrections), while substructure refers to smaller trends that occur within the larger trend, like smaller counter-trend moves.

How can traders identify the difference between swing structure and substructure?

-Traders can differentiate them by viewing market movements as waves. Swing structure is observed through bigger waves (impulse and correction), while substructure involves smaller waves within those larger movements.

Can smaller substructure trends be traded independently?

-Yes, smaller substructure trends can be traded independently, but they should be understood within the context of the larger swing structure. Traders can take advantage of smaller counter-trend moves using lower timeframes.

How does the fractal nature of the market benefit traders?

-The fractal nature of the market means that the same patterns appear across different timeframes, allowing traders to identify valid trends on both higher and lower timeframes, thus enabling more precise entries.

What risk management strategies should be employed when trading against the higher timeframe trend?

-When trading against the higher timeframe trend, it’s important to use strategies like break-even stops, trailing stops, and locking in profits to protect from potential reversals.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Advanced Market Structure Course (Full Tutorial)

Trading Transformation Day 6: Highs, Lows, and Trends

Market Structure Explained – Stop Trading Blind

Master SMC/ ICT Market Structure The Correct Way (very easy)

ICT Advanced Market Structure | The ONLY Video You Will ever Need

Master MARKET STRUCTURE Strategy Now to MAKE MILLIONS

5.0 / 5 (0 votes)