ICT Charter Price Action Model 6 - Algorithmic Theory

Summary

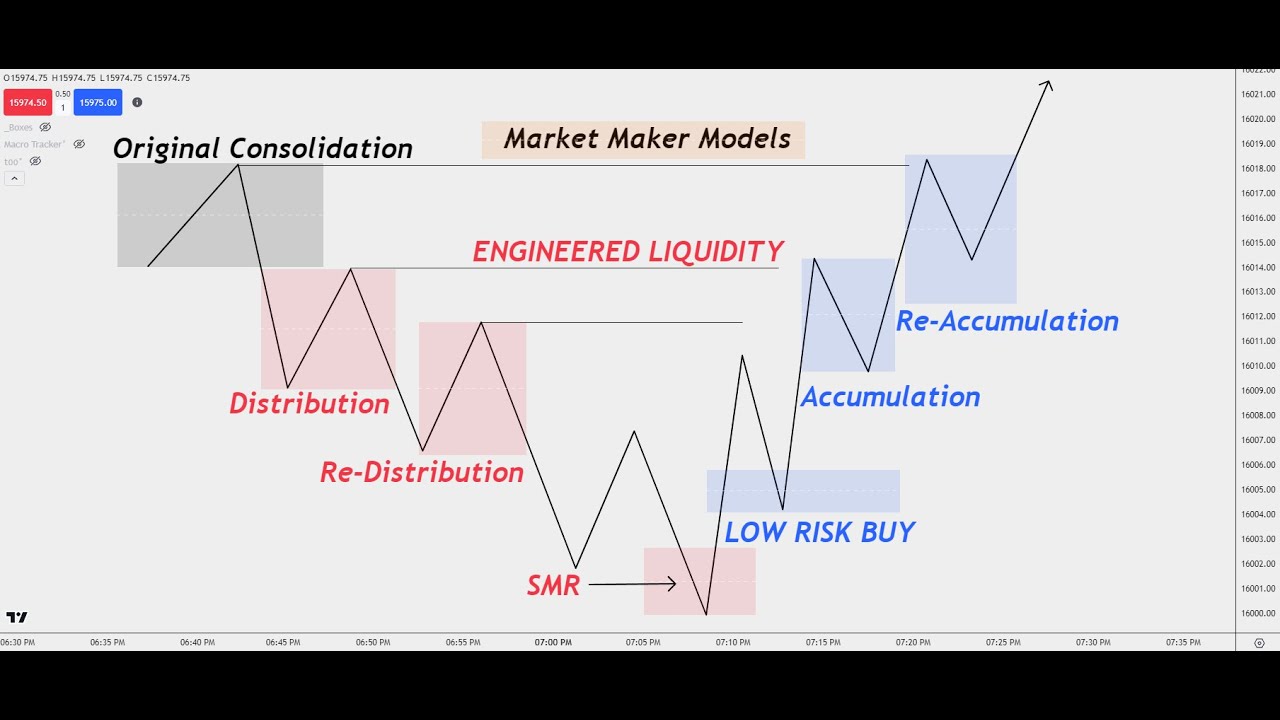

TLDRThis video delves into advanced trading concepts, focusing on market maker buy/sell models, liquidity runs, and fractals. It highlights the importance of identifying accumulation and reaccumulation phases in the market, understanding price movements across timeframes, and utilizing confluences like fair value gaps for entry strategies. Emphasizing discipline, backtesting, and journaling, the video teaches traders to anticipate price moves by reading market structures and targeting specific levels. The goal is to build a flexible, experience-driven framework that enables traders to navigate various timeframes and market conditions with precision and confidence.

Takeaways

- 😀 Understand market maker buy and sell models are fractal and can appear on any timeframe, but the narrative behind price movement is crucial for accuracy.

- 😀 Accumulation and reaccumulation phases are essential for identifying price runs to key levels, particularly during bullish setups.

- 😀 Use multiple timeframes (highest to lowest) to look for a consistent narrative to justify price movements to key levels or premium arrays.

- 😀 The market structure shift, combined with a fair value gap, is often used to validate trades as prices move toward expected targets.

- 😀 To successfully pyramid trades, there must be enough ‘unrealized range’ left in the market, ensuring potential for further price movement before targeting the premium.

- 😀 Avoid rushing to trade like experienced traders. Build your understanding gradually through journaling, backtesting, and reviewing market setups over time.

- 😀 The framework of Universal Trading Model emphasizes patience and understanding the logic of price action before jumping into live trades.

- 😀 Having a clear understanding of price structure and market logic is critical. Use confluences, such as fair value gaps, to increase trade success and confidence.

- 😀 Successful trading requires a combination of technical knowledge, like identifying fair value gaps and order blocks, alongside the right mindset and discipline.

- 😀 Consistency in market setups, combined with long-term mentorship and experience, will allow you to trade effectively across multiple timeframes without limitations.

Q & A

What is the main focus of Model Number 6 in algorithmic trading?

-Model Number 6 focuses on the 'universal trading' framework, specifically examining Market Maker Buy and Sell Models, low resistance liquidity runs, and fractals across different timeframes.

What are the two key stages of accumulation in a Market Maker Sell Model?

-The two key stages of accumulation are Stage 1 (initial accumulation where liquidity is gathered) and Stage 2 (reaccumulation where price builds momentum for a price move).

How does fractality affect market structure analysis?

-Fractality means that Market Maker models and price action patterns, such as accumulation and distribution, appear across multiple timeframes. Understanding these fractal patterns allows traders to apply the same principles to any chart, from 15-second to monthly timeframes.

What is pyramiding in trading, and when is it appropriate to use?

-Pyramiding involves adding to an existing position as the market moves in your favor. It's appropriate when there’s still 'unrealized range' in the market, meaning the price has not yet reached its expected target or premium array.

What is the significance of a Fair Value Gap in trading?

-A Fair Value Gap is an area where price moves quickly, leaving a gap in market structure. Traders often look for price to retrace into this gap, and if the gap aligns with an old area of distribution, it can provide a high-probability entry point.

How does the concept of accumulation and reaccumulation apply to price action?

-Accumulation and reaccumulation refer to phases where price consolidates before moving in the expected direction. Accumulation happens at lower levels, while reaccumulation typically follows a retracement and signals the start of a larger price move.

Why is understanding the narrative of price movement crucial in algorithmic trading?

-Understanding the narrative behind price movements helps traders interpret why the market is moving toward certain levels (like premium arrays or liquidity zones). This narrative-based approach helps in making informed, logically-driven trades rather than relying on arbitrary indicators.

How does one determine whether a market is likely to go higher or lower based on a Market Maker Buy Model?

-In a Market Maker Buy Model, if the market has already accumulated sell-side liquidity, and a price level is cleared (e.g., relative equal highs or old resistance), it is likely that the price will move higher. Reaccumulation at key levels confirms this bullish move.

What role does backtesting and journaling play in the development of a trader’s skills?

-Backtesting allows traders to test their strategies on historical data, while journaling helps in tracking trades, reflecting on mistakes, and understanding market behavior. Both practices build a deeper understanding of price action, helping traders avoid mistakes and develop consistency.

Why should traders avoid rushing to trade with live funds when starting out?

-Rushing to trade with live funds before mastering the concepts can lead to significant losses. It’s important to gain experience through backtesting, paper trading, and understanding the underlying principles of price action before committing real money to trades.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT Charter Price Action Model 6 - Universal Trading Model

ICT Concepts: Understanding How To Trade ICT Market Maker Models!

ICT Charter Price Action Model 6 - Amplified Lesson

ICT Market Maker Models simplified in 9 Minutes

EXPOSED - ICT’s Favorite Trading Strategy (Hear it From ICT Himself)

ICT's Favorite Trade Setup - Explained In-depth

5.0 / 5 (0 votes)