1 Candle Tells You Everything

Summary

TLDRThis video delves into advanced price action trading strategies, focusing on candle formations like 'disrespect' and 'respect' candles to identify market direction. It explores how traders can utilize fair value gaps, previous candle highs and lows, and lower timeframe entries to improve trade execution. Emphasizing the fractal nature of markets, the video shows how higher timeframe analysis can enhance lower timeframe trades, targeting premium and discount zones for higher profitability. By combining these concepts with price delivery zones (PD rays), traders can develop more effective and precise strategies for market entry and exit.

Takeaways

- 😀 **Candle Types**: Disrespect candles have a large body and small wicks, indicating continuation of price in one direction, while respect candles, with a long wick, suggest a potential reversal at key levels.

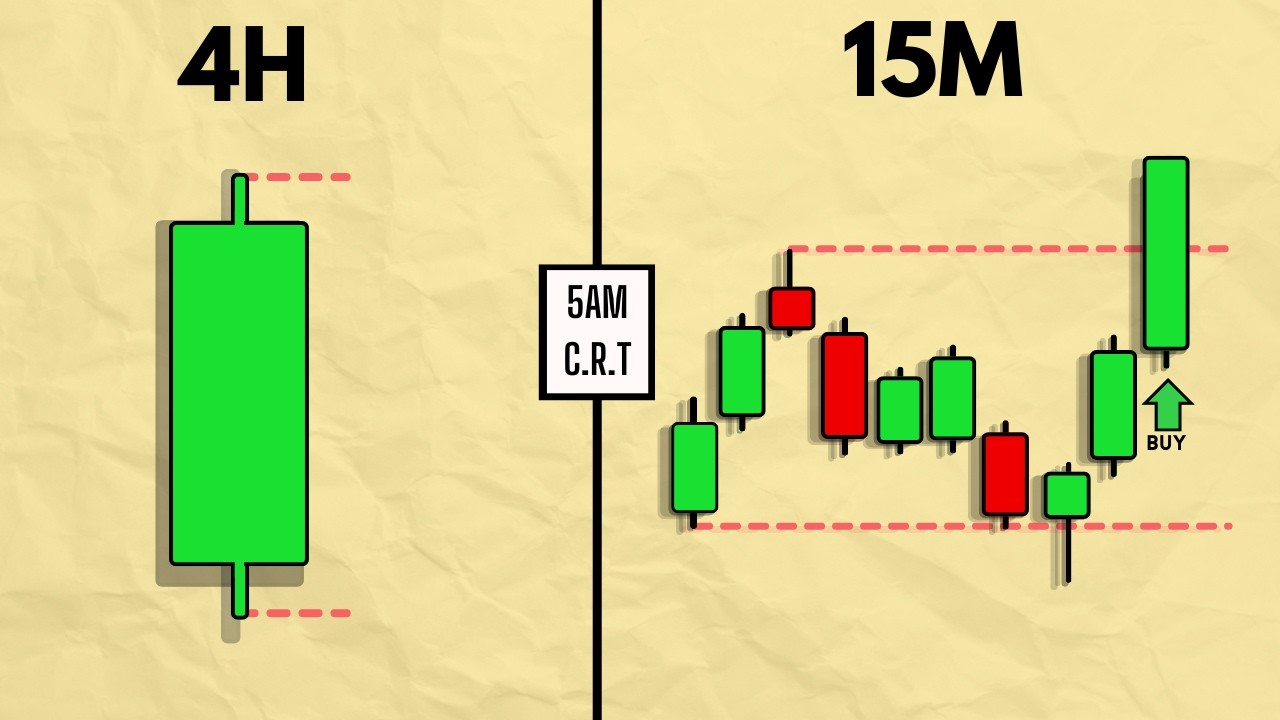

- 😀 **Time Frame Considerations**: Higher time frames (like 1-hour and 4-hour) define the overall market trend, while smaller time frames (like 15-minute or 1-minute) help identify entry points.

- 😀 **Fair Value Gaps**: These gaps, created by price moving too quickly, represent areas of imbalance where price is likely to return to fill the gap, offering trade opportunities.

- 😀 **Premium and Discount Areas (PD arrays)**: Price behaves differently in premium (overvalued) and discount (undervalued) areas. Traders look to buy in discount zones and sell in premium zones for optimal trades.

- 😀 **Target Levels**: Targets for trades are usually previous candle highs or lows. Price often revisits these levels before continuing in the direction of the larger trend.

- 😀 **Entry Strategies**: Traders can enter trades on lower time frames by identifying fair value gaps that form after a significant price movement. These gaps act as entries in the direction of the larger trend.

- 😀 **Multiple Time Frame Analysis**: A higher time frame provides a directional bias (bullish or bearish), while lower time frames offer more precision for entry points and trade management.

- 😀 **Sharp Turn Entries**: Sharp turns, where price reverses quickly after reaching a specific level, often indicate the best entry points for trades based on the formation of fair value gaps.

- 😀 **Risk-Reward Ratio (RR)**: Traders should ensure their entry offers a favorable risk-reward ratio, with the first target being easily achievable before considering further price movements.

- 😀 **Patience in Trade Execution**: Successful traders wait for price to reach key levels (previous highs/lows or fair value gaps) before entering trades, ensuring higher probability setups and avoiding impulsive decisions.

Q & A

What is the significance of 'respect' and 'disrespect' candles in price action trading?

-'Respect' candles have long wicks and indicate potential reversals, while 'disrespect' candles have large bodies with short wicks, suggesting a continuation of the prevailing trend. Understanding these candles helps traders anticipate price direction and potential entry points.

How can 'respect' and 'disrespect' candles be applied across different time frames?

-The principles of 'respect' and 'disrespect' candles apply universally across all time frames. Traders begin with higher time frames (like weekly or daily) for broader market context and then drill down to lower time frames (e.g., 1-hour or 15-minute) to refine entry points and actions.

What is a Fair Value Gap (FVG), and why is it important in price action trading?

-A Fair Value Gap (FVG) is an area of price imbalance where the market is likely to revisit. These gaps are important because they help traders identify areas where price might retrace to, providing high-probability entry points on lower time frames.

How can traders identify high-probability entry points using fair value gaps?

-Traders can identify high-probability entry points by looking for FVGs on lower time frames (like 15-minute or 1-minute charts). When price revisits an FVG, it may offer an opportunity to enter the market with a favorable risk-reward ratio, targeting key price levels such as previous highs or lows.

What is the process for identifying and acting on a 'sharp turn' in the market?

-A 'sharp turn' occurs when price quickly reverses after filling a Fair Value Gap. Traders can identify this by looking for strong, swift movement in the opposite direction, signaling a potential entry point to capitalize on the reversal.

How does a trader use multiple time frames to refine their trading strategy?

-By analyzing price action on higher time frames (e.g., daily, 4-hour), traders can identify the broader trend and key price levels. Then, they switch to smaller time frames (e.g., 15-minute, 1-minute) to pinpoint entry opportunities with greater precision and better risk-reward setups.

Why is the concept of fractals important in this type of price action trading?

-The fractal nature of markets means that patterns and behaviors seen on larger time frames (e.g., weekly, monthly) can be observed and applied on smaller time frames. This enables traders to understand and react to the same market dynamics, regardless of the time frame they are trading.

What role does the previous candle high/low play in this strategy?

-The previous candle's high or low serves as a key reference point. Price often targets these levels, and traders use them as potential entry or exit points. If price reaches the previous candle high/low, it may continue in the same direction or reverse, offering clear targets for trades.

What is meant by 'candle science' in the context of this trading strategy?

-'Candle science' refers to the study and application of candle patterns and price action behavior to predict market movements. By understanding how candles form and how they interact with previous price levels (like FVGs and previous candle highs/lows), traders can refine their entries and exits.

What is the benefit of entering on the creation of a fair value gap rather than waiting for confirmation?

-Entering on the creation of a fair value gap allows traders to take advantage of price movement earlier, potentially securing better risk-reward ratios. This method is particularly useful for those willing to act on a setup as soon as it forms, rather than waiting for full confirmation through subsequent candles.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How To Predict The Next Candle (Candlestick Logic)

Best Bank Nifty Scalping Strategy || Golden 10% Q&A

Wick Size Matters: The Key to Understanding Reversal and Expansion Candles

ICT Didn’t Work for You - Try This Instead

This 1 Candle Reveals Price's Next Move

Trading one candle is easy, actually | Determine Market Direction and Daily bias

5.0 / 5 (0 votes)