54th GST council Meeting New Decisions and major GST changes

Summary

TLDRThe 54th GST Council Meeting introduced significant changes, including new provisions for GST invoicing, reverse charges, and rate adjustments across various sectors. Key highlights include the expansion of e-invoicing to businesses with a turnover above ₹5 crore, the shift to reverse charge for specific goods and services, and tax rate revisions for sectors like textiles, solar panels, and luxury goods. These updates aim to simplify compliance, enhance transparency, and stimulate sectoral growth. The meeting's outcomes underscore the government's ongoing efforts to streamline tax processes and support economic recovery.

Takeaways

- 😀 GST Council approved a simplification in the taxation of services, including a reduction in GST rates for several categories, benefiting the hospitality and tourism sectors.

- 😀 Changes in GST rates on restaurant services will lead to better clarity on tax calculations, and GST will now apply uniformly to services provided by outdoor caterers.

- 😀 The decision to implement an E-invoicing system for businesses above a certain threshold will streamline operations and improve transparency in GST compliance.

- 😀 Exporters will benefit from a new GST mechanism that eliminates the tax burden on export goods, helping to boost international trade.

- 😀 The GST Council introduced an automated system for refund claims related to the export of goods, minimizing delays and enhancing efficiency in the process.

- 😀 A new initiative to ease GST compliance for small businesses, including relaxing the threshold for e-commerce operators and introducing simpler tax filing processes.

- 😀 Clarifications were made on the taxation of various services, including the need to specify certain services under GST, preventing confusion among taxpayers.

- 😀 GST rate adjustments were made to several services, including healthcare and education, to align with current market trends and provide relief to these sectors.

- 😀 Increased focus on making tax processes more transparent and easier for both taxpayers and government authorities through technological advancements.

- 😀 A reduction in GST rates on goods like footwear and textiles aims to make essential products more affordable for the common consumer.

Q & A

What major changes were introduced regarding e-invoicing during the 54th GST Council meeting?

-The 54th GST Council meeting introduced mandatory e-invoicing for B2C transactions. Initially, it will be voluntary for businesses but will be gradually implemented across different sectors and states, aiming to simplify the invoicing process and improve compliance.

How will the new Invoice Management System (IMS) impact businesses?

-The new Invoice Management System (IMS) will help businesses match invoices against supplier data, facilitating a more streamlined and efficient invoicing process. It aims to reduce tax evasion and discrepancies in invoice reporting.

What key clarifications were issued regarding Input Tax Credit (ITC)?

-The GST Council clarified the eligibility of ITC on various items, including demo vehicles, and provided clearer guidelines on how businesses should handle ITC claims for previous years (2017-2021).

What is the purpose of the announced amnesty scheme for taxpayers?

-The amnesty scheme is designed to waive penalties and interest for taxpayers who clear their outstanding GST dues by March 31, 2025. This initiative aims to promote compliance and reduce the burden on businesses with pending dues.

What changes were made to the Reverse Charge Mechanism (RCM) for commercial property rentals?

-A new Reverse Charge Mechanism (RCM) was introduced for rental transactions involving unregistered persons renting commercial properties to registered businesses. This ensures that GST on such rentals is paid by the recipient instead of the property owner.

How did the GST Council address the issue of GST on services provided by educational boards and universities?

-The GST Council issued clarifications regarding the GST applicability on services provided by educational boards, such as CBSE, and on affiliation services offered by universities. These clarifications aim to ensure consistent GST treatment in the education sector.

What is the revised GST rate for passenger transport by helicopters?

-Passenger transport by helicopters will be taxed at a 5% GST rate, while chartered helicopter services will continue to attract an 18% GST rate. This differentiation reflects the nature of the service being provided.

Why was the reduction of GST on medical insurance deferred?

-Discussions around reducing the GST rate on medical insurance premiums were deferred to the next GST Council meeting, which is scheduled for November 2024. The delay is likely due to further analysis and discussions on the proposal.

What clarifications were given regarding GST on flying training courses?

-The GST Council clarified that flying training courses, particularly those conducted by the Directorate General of Civil Aviation (DGCA), are subject to GST. This includes specific rules and guidelines for how these services should be taxed.

What is the significance of the amendments to sections 16(5) and 16(6) in the GST Act?

-The amendments to sections 16(5) and 16(6) of the GST Act aim to refine the conditions for claiming ITC. These changes affect the eligibility criteria for Input Tax Credit and will influence GST filings for past years, ensuring a more accurate reporting of taxes.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

GST on Rent of Property - RCM, FCM or Exempt? GST on Renting commercial property, 18% GST on Rent

54th GST Council Meeting highlights: What's getting cheaper and what’s getting pricier

New condition for credit note deduction in GST

55th GST council meeting Important Changes | New GST Rates | New GST changes

Analyses of RCM Liability on Renting of Any Property by unregistered person to registered person

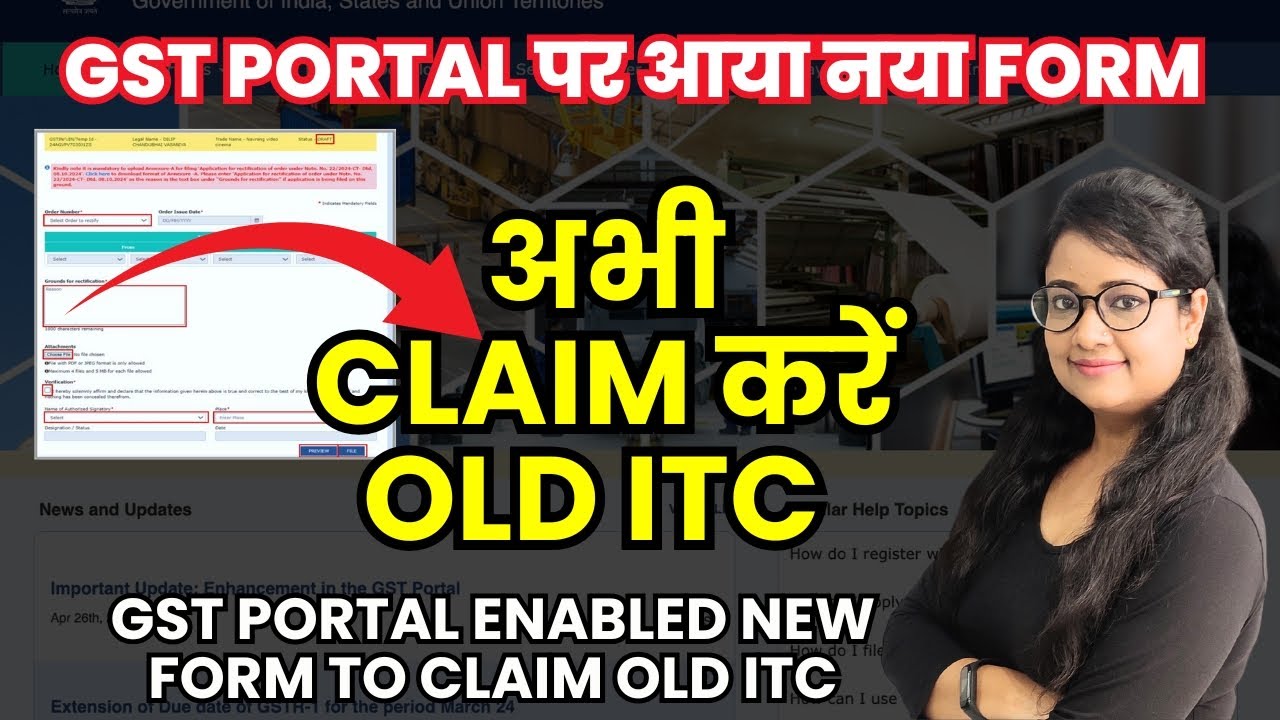

GST ITC big update - Claim your Old ITC | File Application to claim Old Input Tax Credit under GST

5.0 / 5 (0 votes)