Perhitungan Biaya Produk Sampingan (By Product) | Akuntansi Biaya

Summary

TLDRThis video lecture delves into cost accounting for by-products, focusing on the methods used to allocate joint production costs. The lecture covers the distinction between main products and by-products, with examples such as kerosene, fabric remnants, and wood planks. It outlines two primary cost allocation methods: the 'without cost' method, which treats by-products as separate entities, and the 'with cost' method, which allocates joint costs to by-products. Real-world examples are provided to demonstrate the application of these methods in financial reporting, making the concepts easier to understand for students studying cost accounting.

Takeaways

- 😀 By-products are secondary products produced alongside the main product, usually in smaller quantities and of lower value.

- 😀 Examples of by-products include kerosene from gasoline production and fabric scraps in garment manufacturing.

- 😀 There are three types of by-products: ready for sale, requiring further processing, or requiring processing to increase their value.

- 😀 The two main methods for allocating costs to by-products are 'without cost allocation' and 'with cost allocation'.

- 😀 The 'without cost allocation' method treats by-products separately, recognizing their revenue as either other income, a reduction in sales, or a reduction in production costs.

- 😀 In the 'without cost allocation' method, by-product revenue can be classified as income outside of operations, added to sales, or subtracted from production costs.

- 😀 The 'with cost allocation' method allocates joint costs to by-products, either through a replacement cost method or a reversal method.

- 😀 The 'replacement cost' method is used when by-products are consumed internally, while the 'reversal method' allocates costs before the by-product is separated from the main product.

- 😀 Practice problems are provided to help students understand how to calculate the cost of products and by-products, and how to prepare financial statements.

- 😀 Students are encouraged to practice accounting for by-products, focusing on understanding the impact of cost allocation on the income statement and final profit.

Q & A

What is a by-product in cost accounting?

-A by-product is a secondary product produced during the manufacturing process alongside the main product. By-products are typically of lower value or quantity compared to the main product.

Can you give examples of by-products mentioned in the script?

-Examples include kerosene produced during gasoline manufacturing, fabric scraps in garment production, and planks or logs in timber production.

What are the three classifications of by-products discussed in the transcript?

-The three classifications are: (1) By-products that are ready for sale after separation, (2) By-products that need further processing before sale, and (3) By-products that can be sold at a higher price after additional processing.

What is the method without cost allocation for by-products?

-In the method without cost allocation, by-products do not receive a share of the joint production costs. Revenue from by-products is treated as either other income, a reduction in sales revenue, or a reduction in production costs, depending on the company's accounting choice.

What are the potential treatments for by-product revenue under the 'method without cost allocation'?

-The by-product revenue can be treated in four ways: (1) as other income, (2) as an addition to main product sales, (3) as a reduction in the cost of goods sold, or (4) as a reduction in production costs.

What is the significance of consistency in applying cost allocation methods for by-products?

-Consistency is important because once a company chooses a method for allocating by-product revenue, it must apply that same method consistently across accounting periods. Changing methods between periods is not allowed.

What is the 'method with cost allocation' for by-products?

-The method with cost allocation involves allocating a portion of the joint production costs to by-products. This can be done using two sub-methods: the replacement cost method and the reversal method.

What is the replacement cost method for by-product cost allocation?

-In the replacement cost method, by-products are assigned costs based on what they would cost if purchased externally. The costs are then subtracted from the total joint costs to calculate the costs for the main product.

How does the reversal method for by-product cost allocation work?

-In the reversal method, by-products receive an allocation of joint costs initially. When the by-product is processed further, these allocated costs are reversed, and the by-product is assigned a final cost based on its further processing.

How are by-products accounted for in profit and loss statements?

-By-product revenue is typically recorded in the profit and loss statement based on the treatment chosen: as other income, as an addition to sales, or as a reduction in production or sales costs, depending on whether the method includes cost allocation or not.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Harga Pokok Produk Bersama & Produk Samping Dlm Akuntansi Biaya

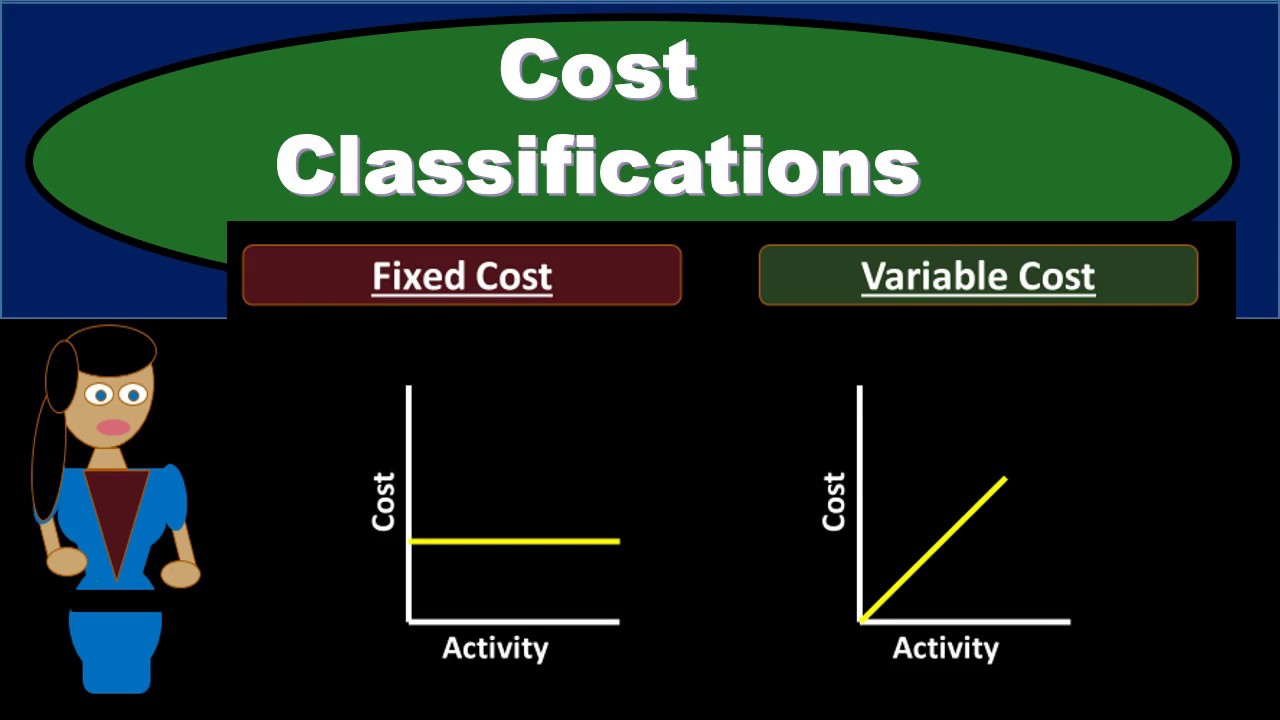

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs

2023 Meet 4 Akuntansi Management : Harga Pokok Produk - Variable Costing and Full Costing

2023 Meet 3 Akuntasi Manajemen : Konsep dan Prilaku Biaya

Cost Accounting, Costing, Why cost accounting is necessary?

ANALISIS PERILAKU BIAYA

5.0 / 5 (0 votes)