Williams R Trading Indicator Back test - Beats the S&P 500!

Summary

TLDRIn this video, the Williams Percent R indicator, developed by Larry Williams, is explored as a powerful momentum tool for traders. The indicator shows whether an asset is overbought or oversold based on a specified look-back period. The video covers how to calculate and use the indicator for identifying trading opportunities in both trending and range-bound markets. Backtested results on the S&P 500 show impressive returns, especially in long trades. While offering valuable insights, the indicator has limitations, such as false signals during low volatility. The video emphasizes the importance of skill and discipline in trading with this tool.

Takeaways

- 😀 The Williams Percent R (Williams %R) is a momentum indicator that helps traders identify overbought and oversold levels in the market.

- 😀 The indicator is typically set with a 14-day lookback period, but can be adjusted based on trading preferences and timeframes.

- 😀 Readings above -20 indicate overbought conditions, while readings below -80 signal oversold conditions, though they don't always predict price reversals.

- 😀 The key to using Williams %R effectively is understanding its behavior in different market conditions and avoiding relying on it as a quick fix.

- 😀 The formula for calculating Williams %R compares the current close relative to the highest and lowest prices in the lookback period.

- 😀 In trending markets, Williams %R can remain in overbought or oversold zones for extended periods, providing opportunities for traders to buy on dips or sell on rallies.

- 😀 Traders can use the indicator to spot potential momentum failure, such as when an uptrend is in danger after the indicator fails to recover above -20.

- 😀 Backtesting on the S&P 500 index showed that a long strategy using Williams %R outperformed a buy-and-hold approach, with a compounded annual return of 11.9%.

- 😀 A shorter lookback period, like the 2-day strategy tested, produced impressive results, though longer-term traders may benefit from adapting the period to their needs.

- 😀 Williams %R can give false signals in sideways markets where price movement is minimal, so traders need to combine it with a holistic view of the chart and price action.

- 😀 Trading is a skill that develops over time, and no indicator is a 'holy grail'—trial, error, and disciplined risk management are essential for success in the markets.

Q & A

What is the Williams Percent R (Williams %R) indicator?

-The Williams Percent R is an oscillating momentum indicator used in trading to show whether an asset is overbought or oversold. It compares the current closing price to the highest and lowest prices over a specified period, typically 14 days.

How is the Williams Percent R indicator calculated?

-Williams Percent R is calculated by comparing the current closing price to the highest and lowest prices in the look-back period. The formula is: (Highest High - Current Close) / (Highest High - Lowest Low) * -100.

What do the levels above -20 and below -80 mean in Williams Percent R?

-A reading above -20 indicates an overbought condition, suggesting the asset is near the high of its recent range. A reading below -80 indicates an oversold condition, suggesting the asset is far from its recent high.

Can overbought or oversold readings in Williams Percent R always predict price reversals?

-No, overbought and oversold levels do not necessarily indicate an imminent price reversal. They suggest the asset is near the high or low of its recent range, but prices may continue in the same direction for some time.

How does Williams Percent R work in trending markets?

-In trending markets, Williams Percent R can remain in overbought or oversold zones for extended periods. In an uptrend, for example, prices may stay in the overbought zone, and in a downtrend, they may remain oversold. The indicator is useful for timing buy-on-dip or sell-on-rise strategies during pauses in the trend.

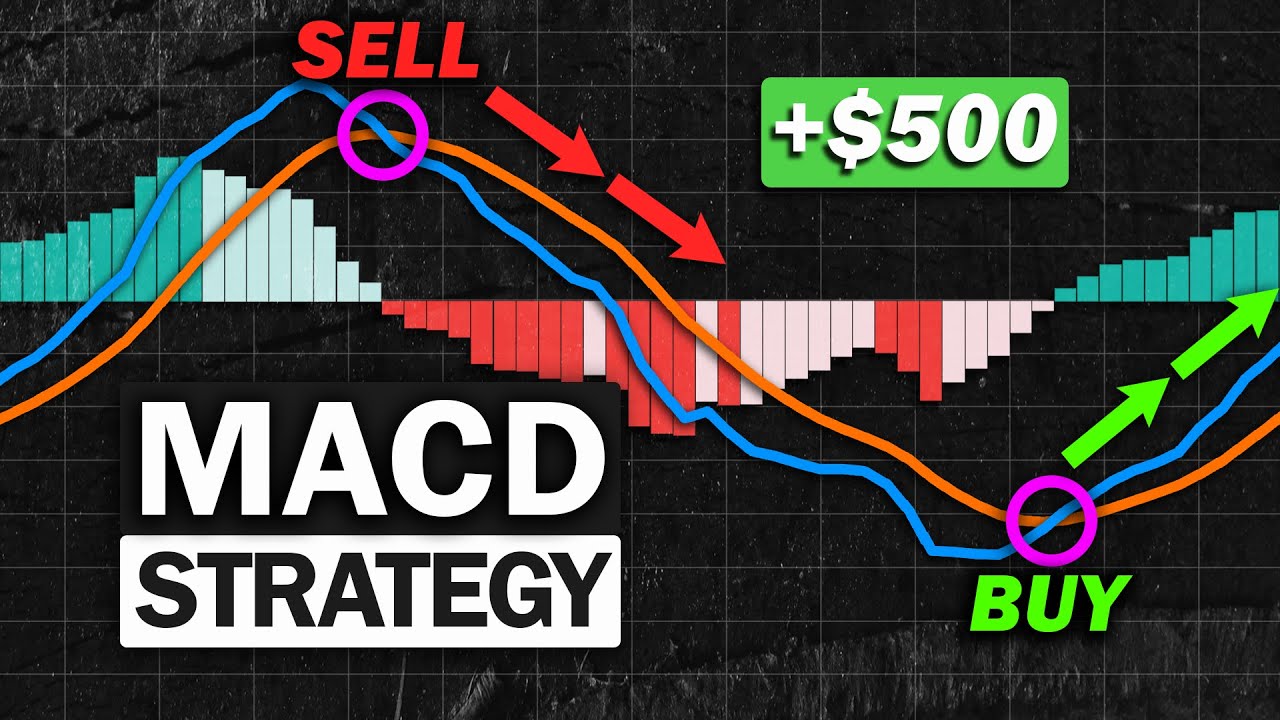

What trading strategy was backtested using Williams Percent R, and what were the results?

-The 2-day Williams Percent R trading strategy was backtested on the S&P 500 Index, returning a compound annual growth rate of 11.9% over 598 trades, outperforming the buy-and-hold strategy, which returned 10.3%. The strategy used a market exposure of only 22%, offering higher risk-adjusted returns.

What is a momentum failure, and how does Williams Percent R help identify it?

-A momentum failure occurs when an asset fails to maintain its trend after a pullback. If, in an uptrend, Williams Percent R falls below -20 and does not recover, it signals that the uptrend might be in danger. Similarly, if a downtrend fails to reach -80, it suggests the downtrend may be weakening.

What are some limitations of the Williams Percent R indicator?

-One limitation is that it can produce false signals in markets with minimal price movement, as the indicator quickly shifts between overbought and oversold levels. Additionally, in strong trends, the indicator can stay in overbought or oversold zones, misleading traders into taking counter-trend positions.

Why should traders avoid playing reversals without confirming with price action?

-Traders should avoid playing reversals until the market confirms them with lower lows and lower highs in price action. Relying solely on Williams Percent R could result in entering trades based on misleading overbought or oversold readings without understanding the broader market context.

What is the speaker's personal trading strategy, and how does it differ from using indicators like Williams Percent R?

-The speaker's personal trading strategy focuses on breakout trading, identifying key market structure breaks on weekly charts. This strategy combines breakouts with momentum and fundamental data, offering a more consistent and passive approach, unlike more active methods involving frequent use of indicators like Williams Percent R.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)