The Only Trading Strategy You'll Ever Need

Summary

TLDRIn this video, the creator shares a highly profitable 3-step trading strategy based on market structure, supply and demand zones, and risk-to-reward ratios. The first step focuses on correctly identifying trends, emphasizing the importance of validating lows and highs. The second step involves recognizing supply and demand zones to guide trading decisions. The third step stresses the importance of maintaining a risk-to-reward ratio above 2.5:1. By following these principles, traders can maximize profits and minimize risks, all while trading in the direction of the trend. The strategy's high accuracy and long-term profitability are highlighted through real-world examples.

Takeaways

- 😀 The strategy focuses on pure price action, with no indicators or patterns, backtested thousands of times for long-term profitability.

- 😀 Step 1 of the strategy is understanding market structure, specifically identifying trends (uptrends and downtrends) through higher highs and higher lows.

- 😀 A common mistake traders make is misinterpreting a price break as a trend reversal without confirming whether the low is valid by checking if it breaks the previous high.

- 😀 A valid low is only confirmed when it breaks the previous high; if it doesn't, the trend remains the same.

- 😀 In an uptrend, you should only look for long trades, and in a downtrend, only short trades should be considered.

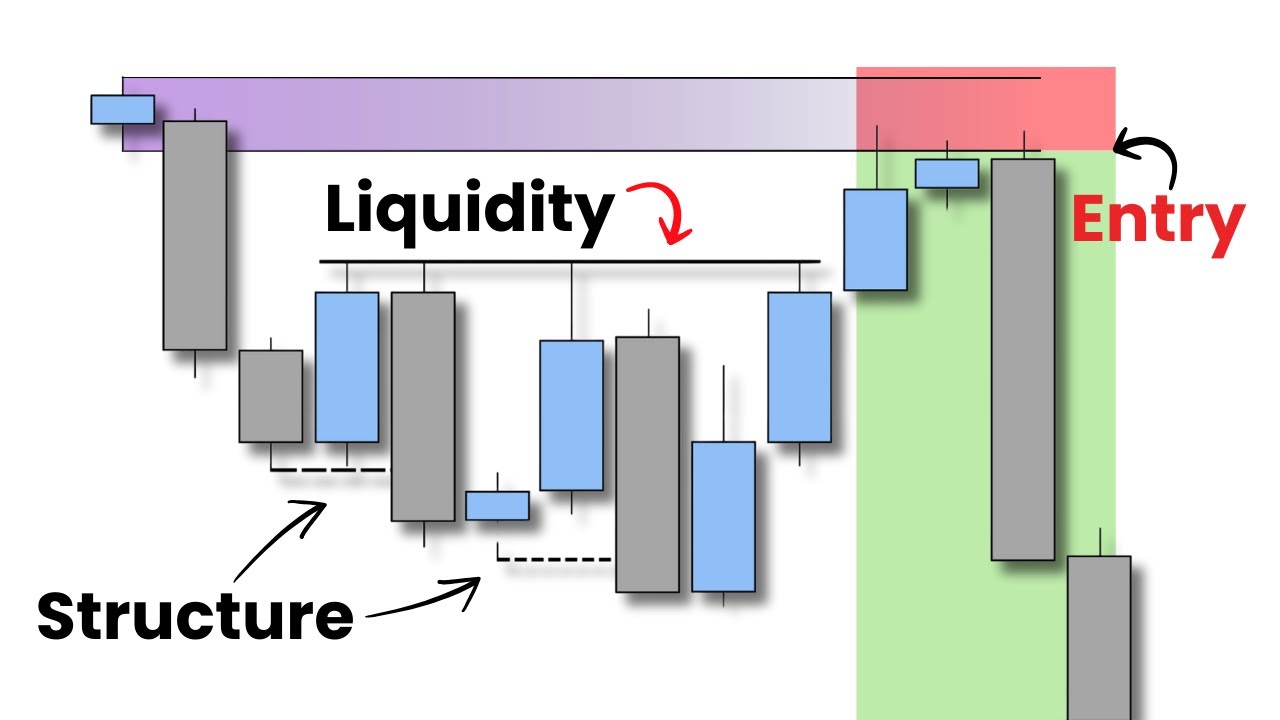

- 😀 Step 2 involves identifying supply and demand zones. In an uptrend, look for demand zones to buy; in a downtrend, look for supply zones to sell.

- 😀 A demand zone is where price showed significant upward movement, indicating high buying interest, and it is a good area to enter long trades.

- 😀 A supply zone is the opposite: a zone where a large downward move indicates strong selling interest, and it is a good area for short trades.

- 😀 Always trade in the direction of the trend to increase the probability of winning trades. This means never short in an uptrend or go long in a downtrend.

- 😀 Step 3 emphasizes risk-to-reward ratio. Only take trades with a minimum risk-to-reward ratio of 2.5:1 to ensure profitability in the long term.

- 😀 The strategy is highly accurate when combining the steps of trend identification, supply/demand zones, and maintaining a strong risk-to-reward ratio.

Q & A

What is the first step of the trading strategy in the script?

-The first step of the strategy is understanding market structure. This involves identifying whether the market is in an uptrend or downtrend based on price action, specifically higher highs and higher lows for uptrends, and lower lows and lower highs for downtrends.

Why is market structure so important in this trading strategy?

-Market structure is critical because if traders misinterpret it, the entire strategy could fail. Understanding when a trend is still valid or when it may reverse is key to making accurate trade decisions.

What mistake do many traders make when identifying trends?

-Many traders make the mistake of thinking a downtrend has begun when a low is broken. However, a low is only considered valid if it breaks the previous high. If it doesn’t, the trend is still bullish, even if price makes a new low.

What is the key rule for identifying a valid low?

-A valid low is only confirmed when the price breaks the previous high. If this does not happen, the low cannot be considered valid, and the trend remains as it was.

What are supply and demand zones in the context of this strategy?

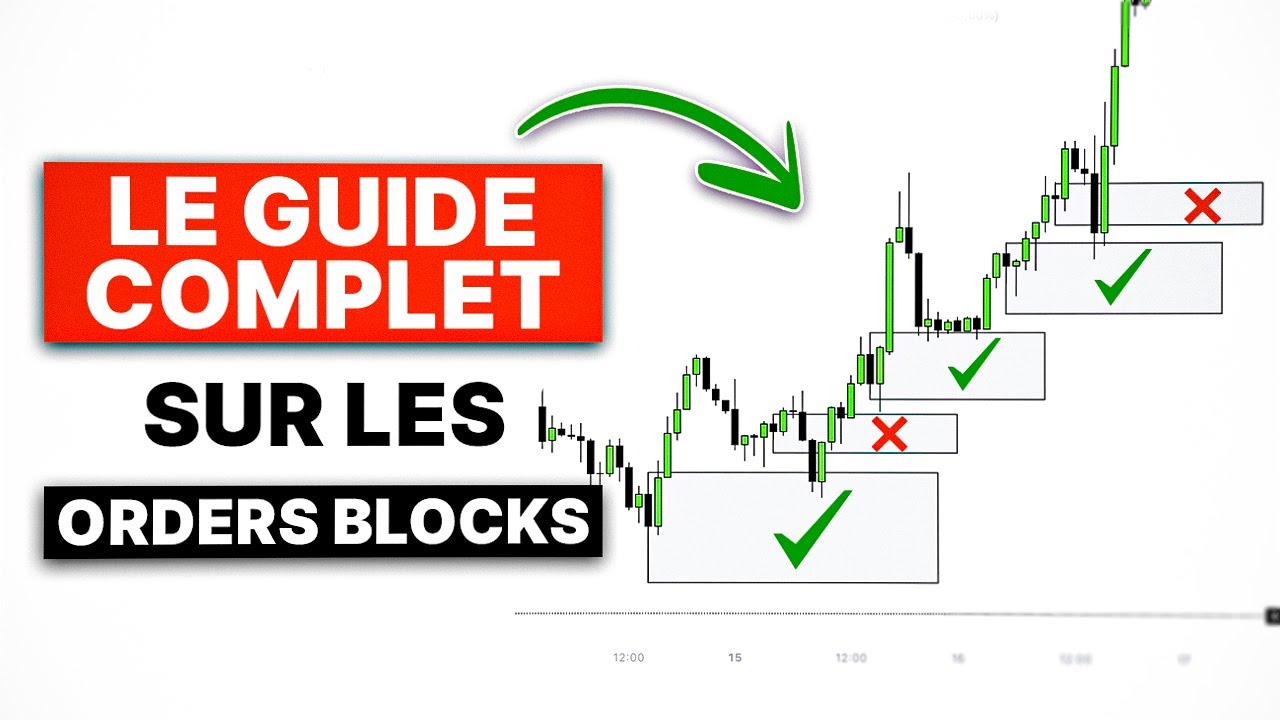

-Supply zones occur in downtrends and represent areas where sellers are active, while demand zones occur in uptrends and represent areas where buyers are active. Traders aim to buy from demand zones and sell from supply zones.

How do traders use supply and demand zones to make trade decisions?

-Traders look for price to return to a demand zone in an uptrend, and when it does, they enter long positions, expecting price to move upwards. In a downtrend, they look for price to return to a supply zone and enter short positions, expecting the price to move downwards.

How do you identify demand zones on a chart?

-Demand zones are identified by finding areas of consolidation or sideways movement before a sharp upward move. The candle right before the impulse move is marked, and this forms the demand zone.

What is the risk-to-reward ratio, and why is it important?

-The risk-to-reward ratio is a measure of the potential profit relative to the potential loss on a trade. It is important because trades with a risk-to-reward ratio lower than 2.5:1 are considered not worth taking, as the risk outweighs the potential reward.

What should a trader do if the risk-to-reward ratio is under 2.5:1?

-If the risk-to-reward ratio is under 2.5:1, the trade should be avoided, regardless of whether the other criteria in the strategy are met.

Why is it crucial to only trade in the direction of the trend?

-Trading in the direction of the trend increases the probability of a successful trade. By focusing on long trades in an uptrend and short trades in a downtrend, traders align their positions with the market’s overall momentum, which raises the likelihood of winning trades.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Liquidity + Structure = Profit

Teknik Agresif Order Block + Konfirmasi SNR || SL Tipis & Sangat Akurat || + Backtest Market Crypto

Full Guide To The MMXM - Step By Step with Trading Plan

A ÚNICA Estratégia de DayTrading que Você Vai PRECISAR! 🤯

Supply & Demand Zones That Work Hosted by Sam Seiden

Voici Comment Identifier Facilement des Orders Blocks en Trading (Guide 2024)

5.0 / 5 (0 votes)