MON PROCESSUS DE PRISE DE TRADE FOREX DE A à Z

Summary

TLDRIn this video, Eliot discusses the intricacies of trading, emphasizing the importance of a structured approach and mental discipline. He outlines a systematic trading process that includes preparation, analysis, and execution, highlighting the distinction between market and limit orders. Eliot shares insights into common pitfalls traders face, particularly the lack of reflective thinking and discipline, which can hinder profitability. He encourages viewers to deepen their knowledge and understanding of market dynamics, dispelling the myth that trading is easy. The video serves as a call to action for aspiring traders to engage with further educational content.

Takeaways

- 😀 Trading involves a multi-step process that includes analysis, positioning, and execution.

- 📊 Technical analysis is critical for understanding market movements and making informed trading decisions.

- 🔍 Fundamental analysis helps traders grasp the underlying reasons behind market trends and price movements.

- 📝 Defining a clear trading plan is essential for success, encompassing risk management and entry/exit strategies.

- 💡 The execution of trades should align with personal price levels, using market or limit orders based on conditions.

- 🚦 Limit orders are preferred by the speaker for better pricing, while stop orders are used for anticipated market impulses.

- 🤔 Effective trading requires significant mental energy and reflection, not just reactions to market changes.

- ⚠️ Many traders lack discipline and critical thinking, leading to poor performance and misunderstanding of the trading process.

- 📈 Continuous learning and engagement with educational resources can enhance trading skills and knowledge.

- 👥 The importance of analyzing market participants and their behaviors can provide insights into market dynamics.

Q & A

What is the primary focus of the trading process discussed in the video?

-The primary focus is on the trader's process of position-taking, including research, analysis, execution, and risk management.

How does the speaker determine when to enter a trade?

-The speaker assesses whether the market is at the desired entry price. If it is, they may execute a market order; if not, they consider using limit or stop orders.

What types of orders does the trader prefer to use?

-The trader primarily uses limit orders (90% of the time) for better execution prices and less frequently utilizes stop orders (10% of the time) due to their increased risk.

Why does the speaker believe that many traders fail to achieve profitability?

-The speaker believes that many traders lack discipline and proper reflection, often reacting impulsively to market movements without a strategic approach.

What does the speaker suggest is necessary for successful trading?

-The speaker suggests that successful trading requires significant mental energy, careful reflection, and a solid understanding of market dynamics, fundamentals, and participant analysis.

How important is fundamental analysis in the trading process according to the speaker?

-Fundamental analysis is considered very important, as it helps traders understand the reasons behind market movements and make informed decisions.

What are the implications of using market orders compared to limit and stop orders?

-Market orders allow for immediate execution at current market prices, while limit and stop orders provide more control over entry prices, although they may result in missed opportunities if the market does not reach those prices.

What does the speaker mean by 'chasing the market'?

-Chasing the market refers to the tendency of traders to enter trades based on impulsive reactions to price movements rather than a calculated strategy, which can lead to poor outcomes.

What does the speaker encourage viewers to do at the end of the video?

-The speaker encourages viewers interested in trading, finance, and investment to explore more educational content on their YouTube channel and engage with the material.

How does the speaker differentiate between different types of price movements in trading?

-The speaker differentiates between anticipated impulses and corrections, using specific order types (buy/sell stops for impulses, limit orders for corrections) based on their expectations of market behavior.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Unlocking Trading Secrets: Proper risk management strategies in 2024

ICT Twitter Space: How To Build Your Own Profitable Trading Model from Scratch

Analisa Forex Hasilkan Profit Puluhan Juta tanpa Modal

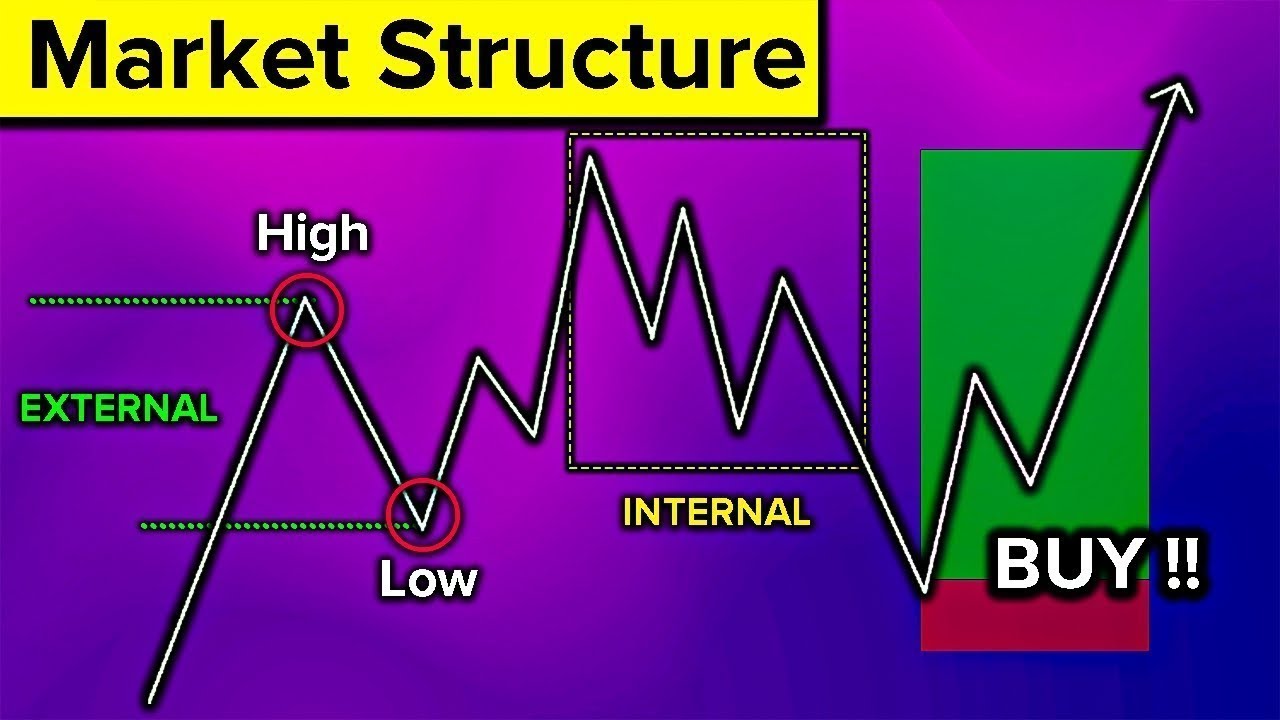

Market Structure Simplified (For Beginner to Advanced Traders)

Rethink before you type | Trisha Prabhu | TEDxTeen

Weekly Forecast - January 4th, 2026

5.0 / 5 (0 votes)