Lecture 4.4 How People Trade

Summary

TLDRThis video explores the complexities of the U.S. equity markets, covering the various ways retail investors access stocks, including brokers, mutual funds, and exchange-traded funds (ETFs). It delves into how orders are sometimes internalized by brokers and the role of the National Market System (NMS) in regulating competing exchanges like NYSE and NASDAQ. The video also discusses market liquidity, trading costs, and the crucial role of the DTCC in clearing trades. The GameStop incident highlights the risks of margin requirements and central clearing, offering a real-world example of market challenges faced by brokerages.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Vowel Sounds

For Oom Piet - Poem Analysis

Decoding Intel's Confusing Processor Names: Core i3, i5, i7, i9 Explained!

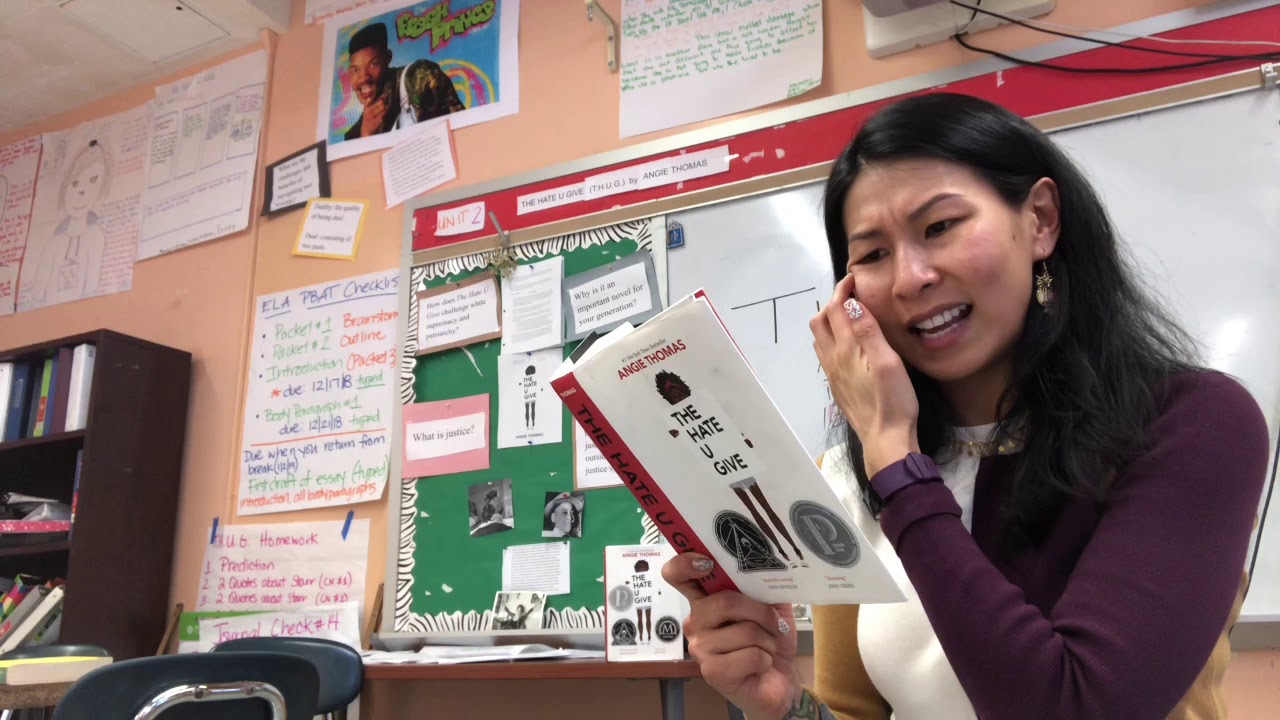

The Hate U Give Chapter 1 - Read by Ms. Nisa

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

Complements of Sets

5.0 / 5 (0 votes)