Cash and Cash Equivalents

Summary

TLDRThis video explains the concept of cash and cash equivalents as presented on a balance sheet. It defines cash as both physical currency and demand deposits accessible at any time. Cash equivalents are highlighted as short-term, highly liquid investments that can be converted to cash within three months, such as certificates of deposit. The video also discusses restricted cash, which may be earmarked for current or non-current obligations, affecting its classification on the balance sheet. Understanding these distinctions is crucial for accurately interpreting a firm's financial position.

Takeaways

- 😀 Cash includes any currency the firm possesses, as well as demand deposits.

- 😀 Demand deposits are funds in a corporate bank account that can be accessed on demand.

- 😀 Cash equivalents refer to highly liquid investments that can be converted into cash within three months.

- 😀 Highly liquid investments have little risk and are not speculative in nature.

- 😀 Examples of cash equivalents may include certificates of deposit (CDs) or similar short-term investments.

- 😀 Restricted cash refers to funds that cannot be freely used due to specific obligations.

- 😀 If restricted cash is for a current obligation, it is classified as a current asset within cash and cash equivalents.

- 😀 Non-current restricted cash is related to obligations that do not need to be settled in the near term.

- 😀 Non-current restricted cash is classified under non-current assets, separate from cash and cash equivalents.

- 😀 Firms may show a line item for restricted cash under the cash and cash equivalents section on their balance sheet.

Q & A

What does 'cash and cash equivalents' refer to on a balance sheet?

-'Cash and cash equivalents' refer to the most liquid assets a firm holds, including actual cash and short-term investments that are easily convertible to cash.

What is included in the cash component of cash and cash equivalents?

-The cash component includes any currency the firm has on hand and demand deposits, which are funds in a corporate bank account that can be withdrawn at any time.

What qualifies as a cash equivalent?

-A cash equivalent is a highly liquid investment with a maturity of three months or less, such as certificates of deposit (CDs) that carry little risk.

Why is liquidity important for cash equivalents?

-Liquidity is crucial because cash equivalents must be easily accessible and quickly convertible to cash, ensuring the firm can meet its short-term financial obligations.

What is restricted cash?

-Restricted cash is cash that cannot be freely used due to legal or contractual obligations, often set aside for specific purposes or future liabilities.

How is restricted cash classified if it is meant for a current obligation?

-If restricted cash is designated for a current obligation, such as a payment due within four months, it is classified as a current asset and included in cash and cash equivalents.

What happens to restricted cash that is tied to non-current obligations?

-Restricted cash related to non-current obligations is classified as a non-current asset and reported separately from cash and cash equivalents.

Can restricted cash affect a firm's liquidity assessment?

-Yes, restricted cash can impact the liquidity assessment as it reduces the amount of cash readily available for operational needs.

Why might a firm have restricted cash?

-A firm may have restricted cash due to debt covenants, legal requirements, or other contractual obligations that necessitate setting aside funds.

How does the classification of cash and cash equivalents impact financial reporting?

-The classification of cash and cash equivalents is vital for accurate financial reporting, as it reflects the firm's liquidity position and ability to meet short-term obligations.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

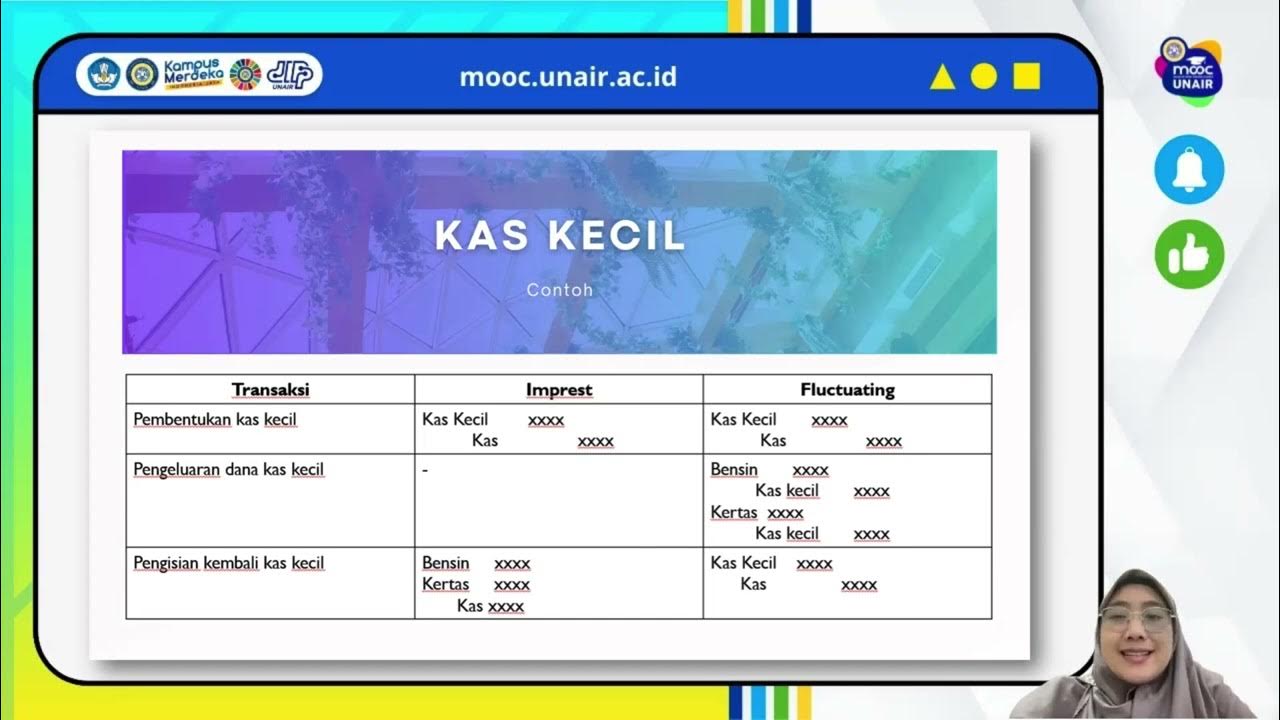

Kas & Setara Kas | MOOC | Materi Akuntansi Perpajakan Seri 2

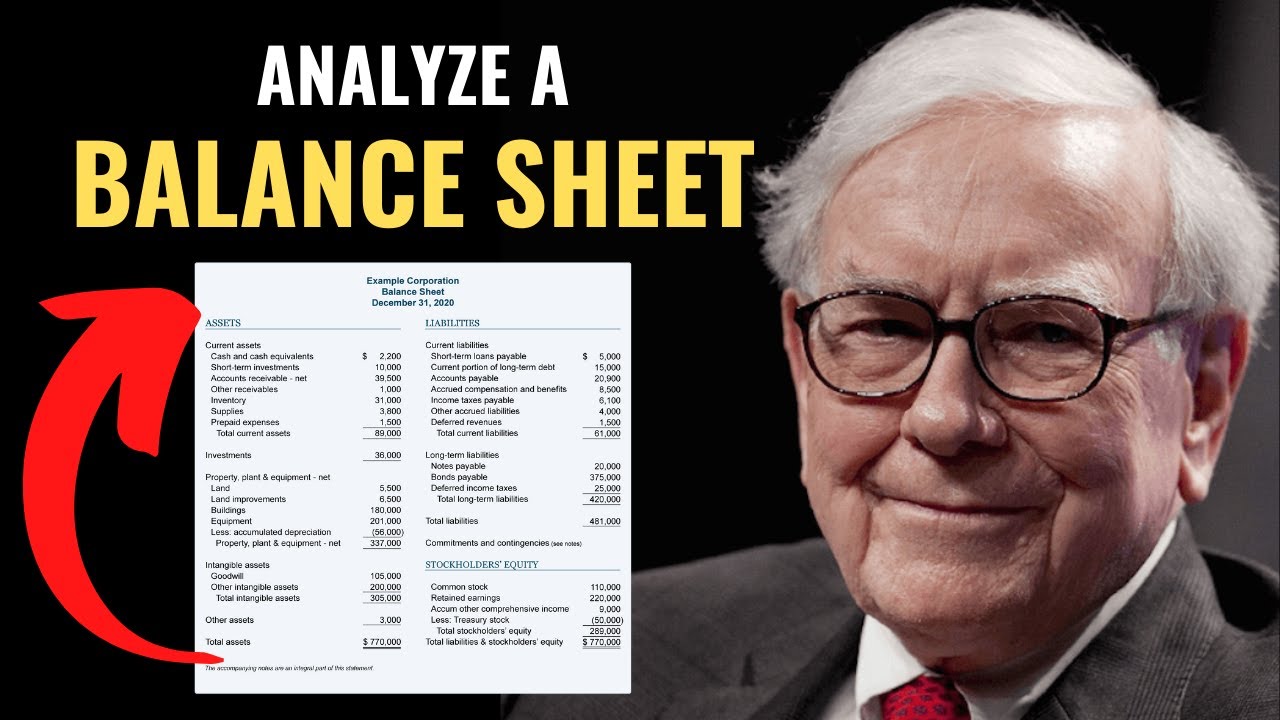

How to Analyze a Balance Sheet Like a Hedge Fund Analyst

PT Jayatama - Cara Menyusun Laporan Arus Kas /Cash Flow Report(Laporan Keuangan)- Soal UKK Akuntansi

The Financial Statements & their Relationship / Connection | Explained with Examples

Giải thích BẢNG CÂN ĐỐI KẾ TOÁN - Ví dụ BCĐKT của Vinamilk và Vingroup

Build a solid stock portfolio with these cash kings

5.0 / 5 (0 votes)