Giải thích BẢNG CÂN ĐỐI KẾ TOÁN - Ví dụ BCĐKT của Vinamilk và Vingroup

Summary

TLDRThis video provides a comprehensive guide to understanding financial statements, particularly focusing on the balance sheet. It explains the key sections, such as short-term and long-term assets, liabilities, and owner's equity, with detailed examples from Vinamilk’s financial report. The video simplifies complex financial terms, making them accessible to individuals with no prior knowledge of finance, accounting, or economics. It also explores concepts like cash equivalents, receivables, inventory, tangible and intangible assets, and payables. The video concludes with an invitation to follow upcoming analysis tutorials on PayP's YouTube channel.

Takeaways

- 😀 The balance sheet is divided into two main sections: assets and capital. Assets are further split into short-term and long-term assets, while capital consists of debt and equity.

- 😀 Short-term assets include cash and cash equivalents, which represent liquid assets such as physical cash, demand deposits, and term deposits under three months.

- 😀 Short-term financial investments are bank deposits or investments with terms between 3 months and 1 year.

- 😀 Receivables from customers represent amounts owed by customers for goods or services delivered but not yet paid for.

- 😀 Prepaid expenses are payments made in advance for goods or services that will be used in the future, such as software maintenance or internet subscriptions.

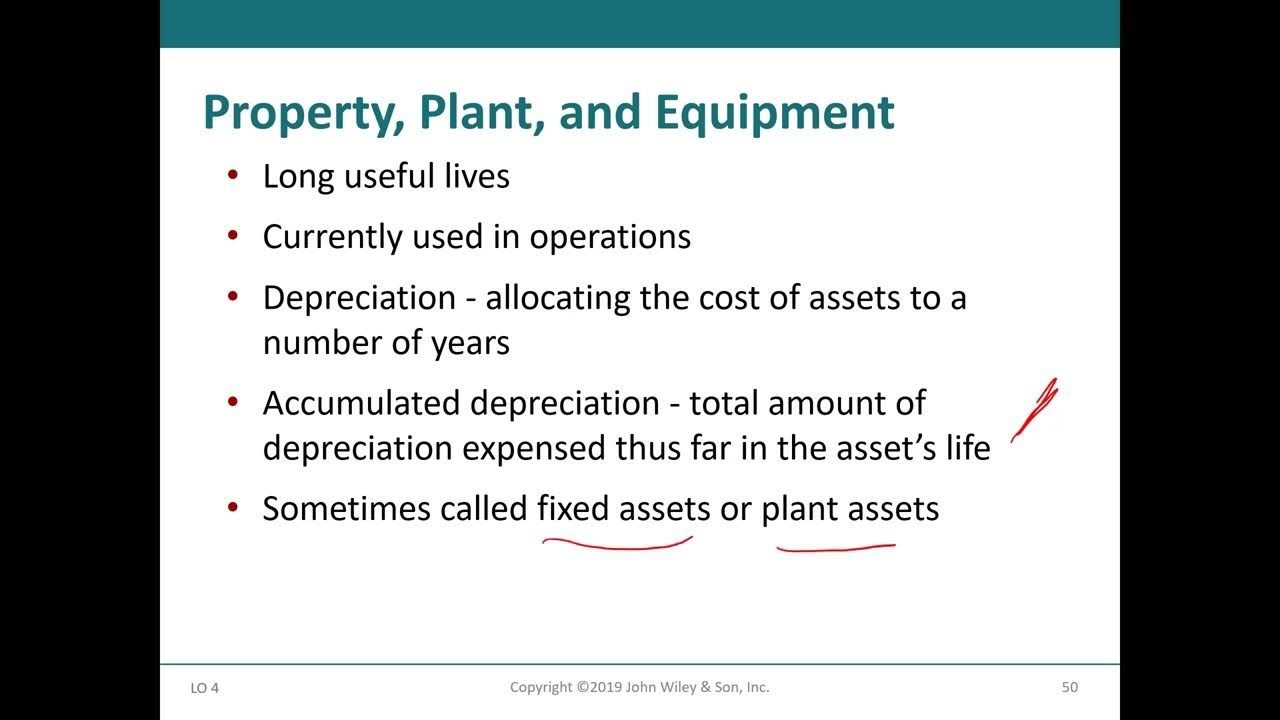

- 😀 Long-term assets include tangible fixed assets (e.g., machinery, office equipment), intangible fixed assets (e.g., land ownership, trademarks), and investment real estate (e.g., properties for leasing).

- 😀 Investment real estate is real estate retained by the business for purposes other than its primary business, such as renting out spaces or properties.

- 😀 Long-term unfinished assets are those that are not yet completed or operational, such as dairy cows under 16 months old or an unfinished factory.

- 😀 Long-term financial investments refer to capital invested in affiliated companies for more than a year, usually with ownership between 5-20%.

- 😀 The capital section of the balance sheet includes owner's equity, which consists of issued shares, surplus capital, treasury shares, and undistributed profits after tax.

- 😀 Non-controlling shareholders' interests are accounted for in the owner's equity section, representing the share of profit attributable to minority shareholders in subsidiaries.

Q & A

What is the purpose of a balance sheet in financial reporting?

-A balance sheet provides a snapshot of a company's financial position at a specific point in time. It is used to assess the company's assets, liabilities, and equity, helping stakeholders understand its financial health.

What are the two main sections of a balance sheet?

-The balance sheet is divided into two main sections: assets and capital. The assets section is further divided into short-term and long-term assets, while the capital section includes debt and equity.

What does 'short-term assets' include?

-Short-term assets typically include cash and cash equivalents, short-term financial investments, receivables, inventory, and other short-term assets such as prepaid expenses.

What does 'cash and cash equivalents' mean in a balance sheet?

-Cash and cash equivalents refer to the money a company has in hand, including physical cash, demand deposits at a bank, and term bank deposits of less than 3 months.

What is the significance of receivables in a balance sheet?

-Receivables represent amounts that are owed to the company, typically by customers who have purchased goods or services but have not yet paid. This also includes expected interest on deposits or dividends from associated companies.

Why is inventory included in short-term assets?

-Inventory includes raw materials, unfinished products, and finished goods that are either in production or ready to be sold. It is classified as a short-term asset because it is expected to be sold or used within a year.

What are prepaid expenses in the context of short-term assets?

-Prepaid expenses are costs that have been paid in advance for goods or services to be received in the future, such as prepaid insurance or internet subscriptions. These costs are not yet incurred but are accounted for as short-term assets.

What are long-term assets in a balance sheet?

-Long-term assets include tangible fixed assets (like buildings and machinery), intangible fixed assets (such as trademarks or land use rights), investment properties, and long-term financial investments. These assets are expected to provide value over a longer period.

How are intangible fixed assets different from tangible fixed assets?

-Intangible fixed assets are non-physical assets such as intellectual property, brand names, and land use rights, while tangible fixed assets are physical items like buildings, machinery, and equipment.

What is the role of owner's equity in a balance sheet?

-Owner's equity represents the residual interest in the assets of the company after deducting liabilities. It includes share capital, retained earnings, and other equity items like treasury shares or non-controlling interests.

What is the significance of non-controlling shareholder benefits in owner's equity?

-Non-controlling shareholder benefits represent the portion of equity that belongs to minority shareholders of subsidiaries. It is the share of profits and assets attributable to those shareholders, reflecting their stake in the business.

How does the short-term payables section in a balance sheet work?

-Short-term payables include amounts the company owes to suppliers or creditors for goods and services received but not yet paid for. It also includes advance payments from customers or taxes owed to the government.

Why is the concept of 'unrealized revenue' important in financial reporting?

-Unrealized revenue refers to money that the company has collected from customers but has not yet delivered goods or services for. This represents future income the company will recognize when the product or service is delivered.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The KEY to Understanding Financial Statements

The Financial Statements & their Relationship / Connection | Explained with Examples

Belajar Analisa Fundamental Saham dari 0 - Cara Baca Laporan Keuangan

Assets, Liabilities & Equity: Made Easy!

Financial Accounting 1: 13- Sections Of A Classified Statement Of Financial Position (شرح بالعربي)

7. The connection between balance sheet, P&L statement and cash flow statement

5.0 / 5 (0 votes)