PT Jayatama - Cara Menyusun Laporan Arus Kas /Cash Flow Report(Laporan Keuangan)- Soal UKK Akuntansi

Summary

TLDRIn this video, the process of preparing a cash flow report using the direct method is thoroughly explained. The presenter walks viewers through creating the necessary journals, including the cash receipt, cash disbursement, petty cash, and adjustment journals. The video covers categorizing cash flows into operational, investing, and financing activities, and explains how to calculate the cash inflows and outflows. It also demonstrates how to ensure accuracy by comparing the ending balance with the balance sheet and trial balance. This detailed tutorial offers a clear and structured approach to generating a comprehensive cash flow report.

Takeaways

- 😀 The cash flow report is created after preparing the profit and loss statement, changes in capital, and balance sheet.

- 😀 Two methods for creating cash flow reports: the direct method (used in this video) and the indirect method.

- 😀 The direct method involves working with journals like the cash receipt journal, cash disbursement journal, petty cash journal, and adjustment journal.

- 😀 The cash receipt journal is categorized into three main sections: operational, investment, and financing activities.

- 😀 Operational activities in the cash receipt journal include receipts from employee receivables and customer payments.

- 😀 Cash disbursements are categorized into operational, investment, and financing activities, focusing on payments like employee salaries, supplier payments, and bank debt repayments.

- 😀 Bank debt payments are classified under financing activities, and the interest payments are categorized under operational expenses.

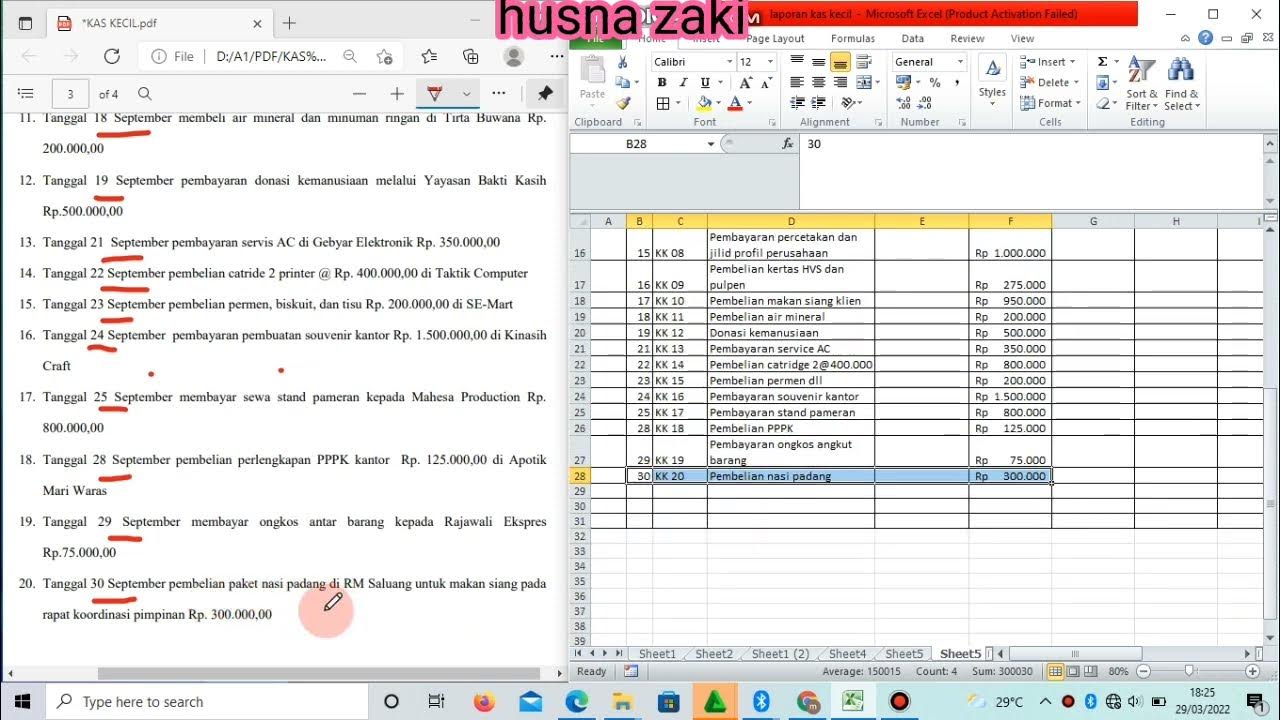

- 😀 Petty cash expenses are recorded in the petty cash journal, and these usually cover small operational costs like equipment purchases.

- 😀 The adjustment journal records any necessary adjustments, such as bank interest income or other income/expenses not covered in the initial journals.

- 😀 After completing all journal entries, the total of the cash flow report is compared to the trial balance to ensure consistency and correctness of cash and bank balances.

- 😀 The final cash flow report is verified by comparing it with the balance sheet, ensuring that all entries match the trial balance and the final figures are accurate.

Q & A

What is the primary objective of the video?

-The primary objective of the video is to explain how to create a cash flow report using the direct method, covering all the necessary journals and processes involved.

What are the two main methods for preparing a cash flow report?

-The two main methods for preparing a cash flow report are the direct method and the indirect method.

What are the key journals required to prepare a cash flow report using the direct method?

-The key journals required are the cash receipt journal, cash disbursement journal, petty cash journal, and adjustment journal.

How are the cash flows categorized in the direct method?

-The cash flows are categorized into three activities: operational activities, investment activities, and financing activities.

What is the purpose of the cash receipt journal in the direct method?

-The purpose of the cash receipt journal is to record all incoming cash flows, such as receipts from customers or employee receivables.

What type of payments are recorded in the cash disbursement journal?

-The cash disbursement journal records outgoing cash flows, including payments for employee salaries, supplier payments, and debt repayments.

What is the role of the petty cash journal?

-The petty cash journal records smaller, everyday expenses, such as minor equipment purchases or operational costs.

How does the adjustment journal affect the cash flow report?

-The adjustment journal is used to record any necessary adjustments, such as income from interest, which could affect the cash flow and must be accurately reflected in the report.

What are the key steps to calculate the ending balance of cash and cash equivalents?

-To calculate the ending balance, you add up the amounts from the various journals (cash receipts, disbursements, and adjustments) and then compare them to the beginning balance, which is found in the balance sheet.

Why is it important to compare the cash flow report with the trial balance and balance sheet?

-Comparing the cash flow report with the trial balance and balance sheet ensures consistency and accuracy, confirming that the recorded cash flows match the financial records.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)