Build a solid stock portfolio with these cash kings

Summary

TLDRThis video explores the importance of cash metrics for analyzing the financial health of companies, focusing on three key metrics: cash on the balance sheet, cash flow from operations (CFO), and free cash flow (FCF). It highlights Indian companies excelling in these areas, such as Reliance Industries and Tata Motors. The video explains how these metrics can be used to assess liquidity, operational efficiency, and financial flexibility. However, it cautions investors not to rely solely on cash metrics and to consider other factors for informed investment decisions.

Takeaways

- 😀 Cash is as essential to a business as oxygen is to an individual, according to Warren Buffett.

- 😀 The video explores three critical cash-related metrics for evaluating companies: cash on the balance sheet, cash flow from operations (CFO), and free cash flow (FCF).

- 😀 High cash on the balance sheet indicates a company's strength and its ability to handle urgent financial needs like debt obligations and capital investments.

- 😀 Reliance Industries, Tata Motors, and OMC are among the top 25 companies with the highest cash holdings in India.

- 😀 Cash holdings as a percentage of market cap provide a different perspective, with companies like Nama Wealth Management and ICICI Securities leading the list.

- 😀 Cash flow from operations (CFO) is crucial for determining whether a company’s profits are converting into actual cash. A higher CFO than net profit is a positive sign.

- 😀 Companies with a high CFO to net profit ratio include Pamle Pharma, JBL, and NOA, indicating efficient cash flow management.

- 😀 The price-to-cash-flow (P2CF) ratio is a useful valuation tool, and lower ratios suggest undervaluation. BPCL, HPCL, and Vedanta have low P2CF ratios.

- 😀 Free cash flow (FCF) reflects how much cash is available after operating expenses and capital expenditure, highlighting a company's financial flexibility.

- 😀 Companies like Indian Oil, BPCL, and Tata Motors are top performers in terms of absolute free cash flow, providing them with the ability to reinvest or pay dividends.

- 😀 Too much cash on hand can be a negative indicator, suggesting mismanagement or lack of strategic investment, which incurs opportunity costs for shareholders.

- 😀 Cash-related metrics are valuable starting points for stock research, but they should not be relied upon in isolation. Other financial metrics should be considered alongside them.

Q & A

What did Warren Buffet say about the importance of cash in a business?

-Warren Buffet compared cash in a business to oxygen for an individual, emphasizing its critical role in ensuring the financial health and survival of a company.

What are the three main cash-related metrics discussed in the video?

-The three main cash-related metrics discussed are: Cash on the Balance Sheet, Cash Flow from Operations (CFO), and Free Cash Flow (FCF).

Why is cash on the balance sheet an important metric for businesses?

-Cash on the balance sheet indicates a company’s ability to meet urgent financial requirements such as debt obligations and capital investments, serving as a financial cushion in times of need.

Which companies topped the list for having the highest cash on their balance sheets?

-Reliance Industries, Tata Motors, and ONGC topped the list with cash holdings of ₹97,000 crore, ₹46,000 crore, and ₹37,000 crore, respectively.

What does Cash Flow from Operations (CFO) signify, and why is it important?

-CFO represents the cash generated from a company's core business operations. It's crucial because it helps verify whether the company’s profits are translating into actual cash, which is less prone to manipulation than accounting profits.

Which companies showed the best CFO to net profit ratios in the video?

-The top companies in terms of CFO to net profit ratios were Pamel Pharma (56 times), JBL Pharma (13 times), and Sha (11 times).

How can the Price to Cash Flow (P2CF) ratio help investors assess stock valuation?

-A low P2CF ratio suggests that a stock may be undervalued, providing potential investment opportunities, especially for companies that have strong cash flows but are priced lower than their earnings might suggest.

What role does Free Cash Flow (FCF) play in evaluating a company?

-FCF indicates the cash available after a company covers its operating expenses and capital expenditures. It's a measure of financial flexibility and a sign of how much cash can be used for dividends, debt repayment, or business expansion.

Which companies had the highest Free Cash Flow (FCF) values in the video?

-Indian Oil, BPCL, TCS, and Tata Motors had the highest FCF values, ranging from ₹30,000 crore to ₹62,000 crore.

What is the Price to Free Cash Flow (P2FCF) ratio, and how does it relate to valuation?

-The P2FCF ratio is a valuation metric where lower values indicate that the stock may be undervalued. Companies like BPCL and Indian Oil had the lowest P2FCF ratios, making them potentially attractive investment options.

Why should cash-related metrics not be viewed in isolation when evaluating stocks?

-While cash-related metrics are important, they should be considered alongside other financial indicators and metrics. Too much cash can indicate missed growth opportunities, while little free cash flow might suggest a company is in a growth phase rather than financial trouble.

What advice does the video provide regarding the use of cash-related metrics for stock evaluation?

-The video advises using cash-related metrics as a starting point for research, but combining them with other financial and qualitative factors to make more informed investment decisions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

EBITDA vs Net Income Vs Free Cash Flow (Analyst Explains)

Cash Flow vs. Profit: What’s the Difference? | Business: Explained

WARREN BUFFETT AND THE INTERPRETATION OF FINANCIAL STATEMENTS

How To Analyze a Cash Flow Statement

KD 3 10 MENGANALISIS LAPORAN KEUANGAN SEDERHANA || PRODUK KREATIF DAN KEWIRAUSAHAAN

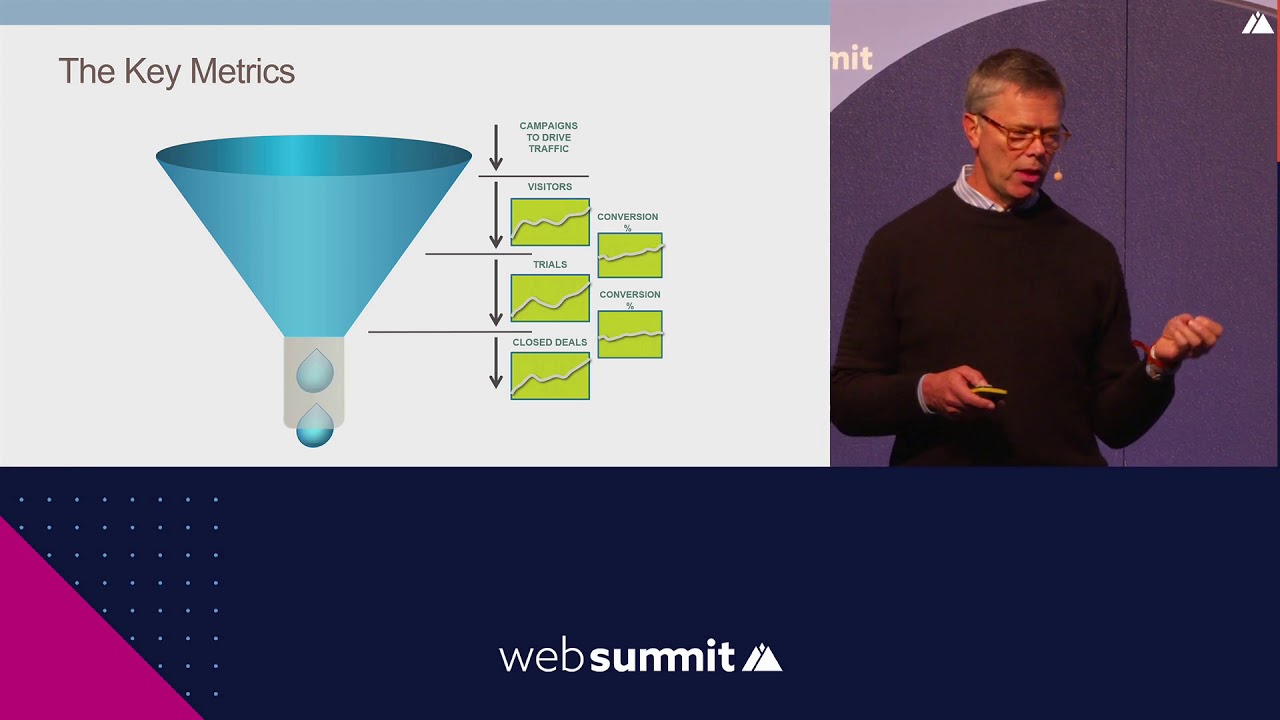

The SaaS business model & metrics: Understand the key drivers for success

5.0 / 5 (0 votes)