RETURNS INWARDS JOURNAL AND ITS LEDGER ACCOUNTS

Summary

TLDRThe transcript details the accounting process for sales and returns, focusing on a transaction involving the sale of flour and meat. It outlines the initial sales value, the application of a 10% discount, and the subsequent return of goods by the customer, Smith. Key calculations demonstrate how to document these transactions in the return inward book, sales account, and debtor's account. The final balance owed by Smith is calculated, highlighting the importance of accurate accounting entries in reflecting true financial status.

Takeaways

- 📅 On January 3rd, a sale of 10 bags of flour and 20 cartons of meat was recorded.

- 💰 A 10% trade discount was applied to the total amount due from the buyer, Smith.

- 🧾 The sales day book is the first journal prepared to record the sales transaction.

- 🛒 The total amount before discount for 20 cartons of meat was calculated as 400 naira.

- 🔄 Smith returned 2 bags of flour and 4 cartons of meat, which need to be documented in the return inward book.

- 📉 The return inward book must account for the discount applied to the returned goods.

- 📊 The value of the 2 bags of flour returned was calculated to be 20 naira.

- 🥩 The value of the 4 cartons of meat returned was calculated to be 80 naira after applying the price.

- 💵 The net return value after discount for the returned goods was recorded as 90 naira.

- 📚 The ledger accounts were updated to reflect the sales and returns, including the debtor's account for Smith.

Q & A

What was the first transaction discussed in the transcript?

-The first transaction involved the sale of 10 bags of flour and 20 cartons of meat at specified prices.

How is the discount applied in the sales transaction?

-A 10% discount is applied to the total sale amount of 500 Naira, resulting in a payment of 450 Naira.

What items did Smith return, and what were their values?

-Smith returned 2 bags of flour valued at 20 Naira and 4 cartons of meat valued at 80 Naira, totaling 100 Naira before discount.

How is the return inward book prepared?

-The return inward book includes details such as the date, particulars, folio, and the total value of the returned goods, after accounting for any discounts.

What is the total amount recorded in the returns inwards account after discount?

-After applying a 10% discount to the total return value of 100 Naira, the net amount recorded in the returns inwards account is 90 Naira.

What steps were taken to prepare the sales journal?

-The sales journal is prepared by recording the sale transaction, including the date, particulars, and the total amount after discount.

What is the significance of transferring amounts to the ledger?

-Transferring amounts to the ledger helps maintain accurate financial records and allows tracking of sales, returns, and outstanding balances.

What is the balance due from Smith after the returns?

-After the return of goods, Smith has an outstanding balance of 360 Naira.

Why is it important to prepare the debtor's account?

-Preparing the debtor's account is crucial for monitoring what is owed to the business and ensuring proper follow-up on outstanding payments.

What overall financial impact does this transaction sequence have?

-The transaction sequence demonstrates the process of selling goods, handling returns, applying discounts, and managing debtor accounts, all of which impact the business's financial health.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Myob Accounting UD. Buana || Input Transaksi No. 11 - 25 || Part. 5

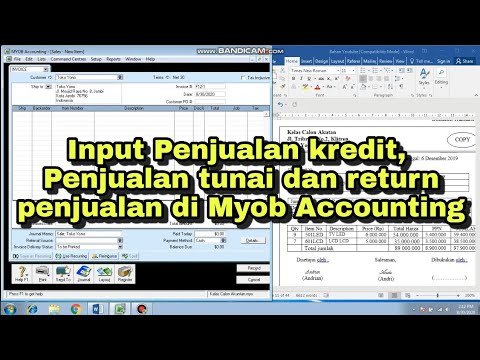

CARA INPUT TRANSAKSI PENJUALAN KREDIT, PENJUALAN TUNAI DAN RETURN PENJUALAN DI MYOB ACCOUNTING

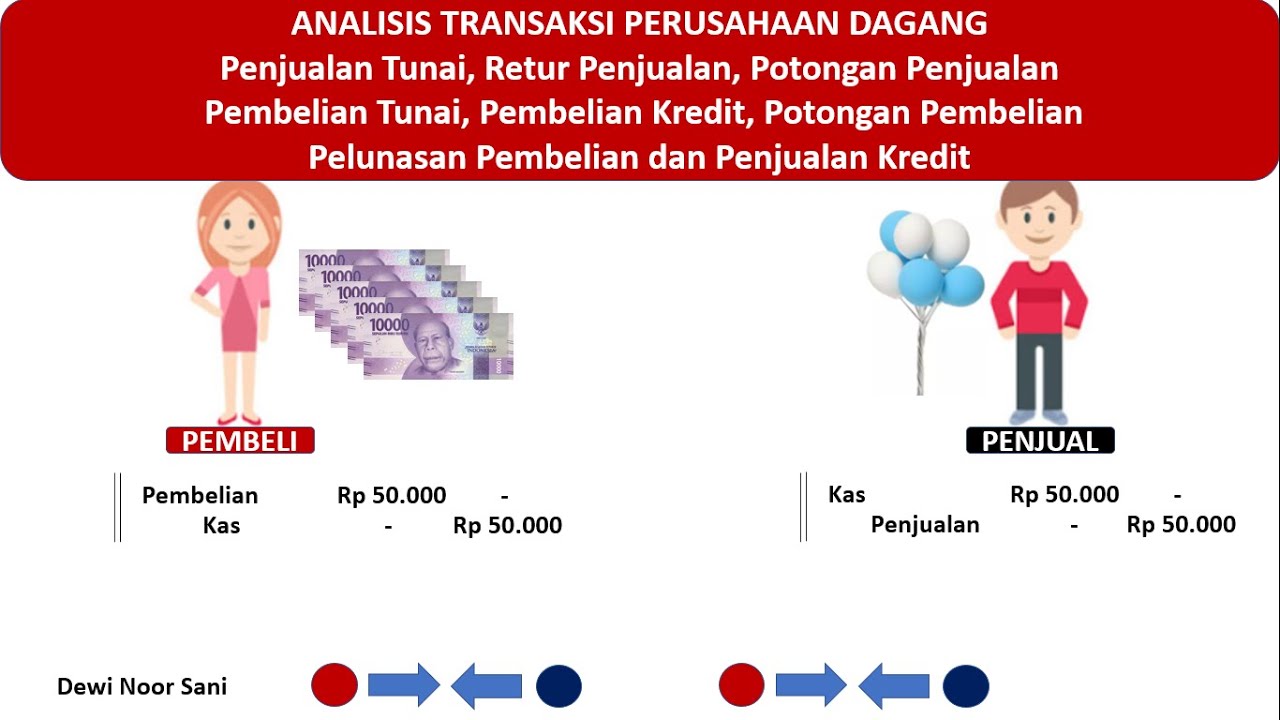

ANALISIS TRANSAKSI PERUSAHAAN DAGANG

AKM 1: 3-2 Pengakuan Piutang Dagang

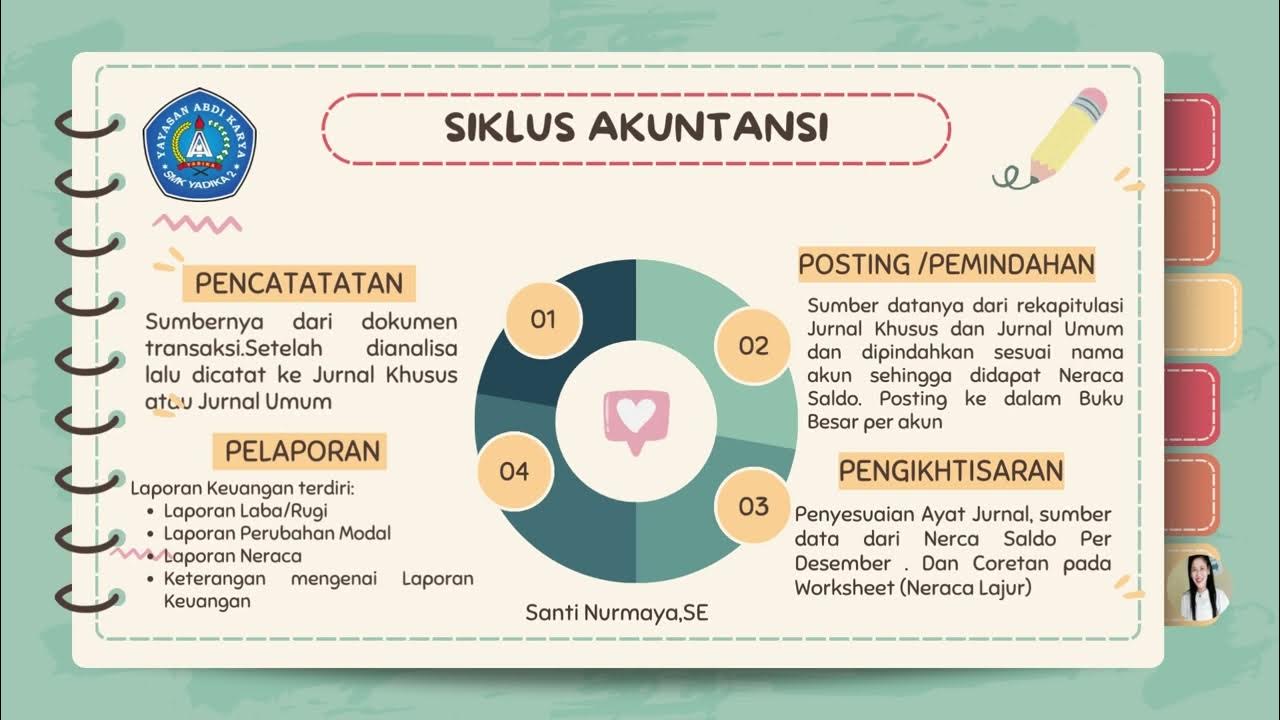

Mengelola Jurnal Khusus dan umum,Buku Besar, Laporan Keuangan Perusahaan Jasa,Dagang dan Manufaktur.

Ep. 3 Add Sales

5.0 / 5 (0 votes)