ANALISIS TRANSAKSI PERUSAHAAN DAGANG

Summary

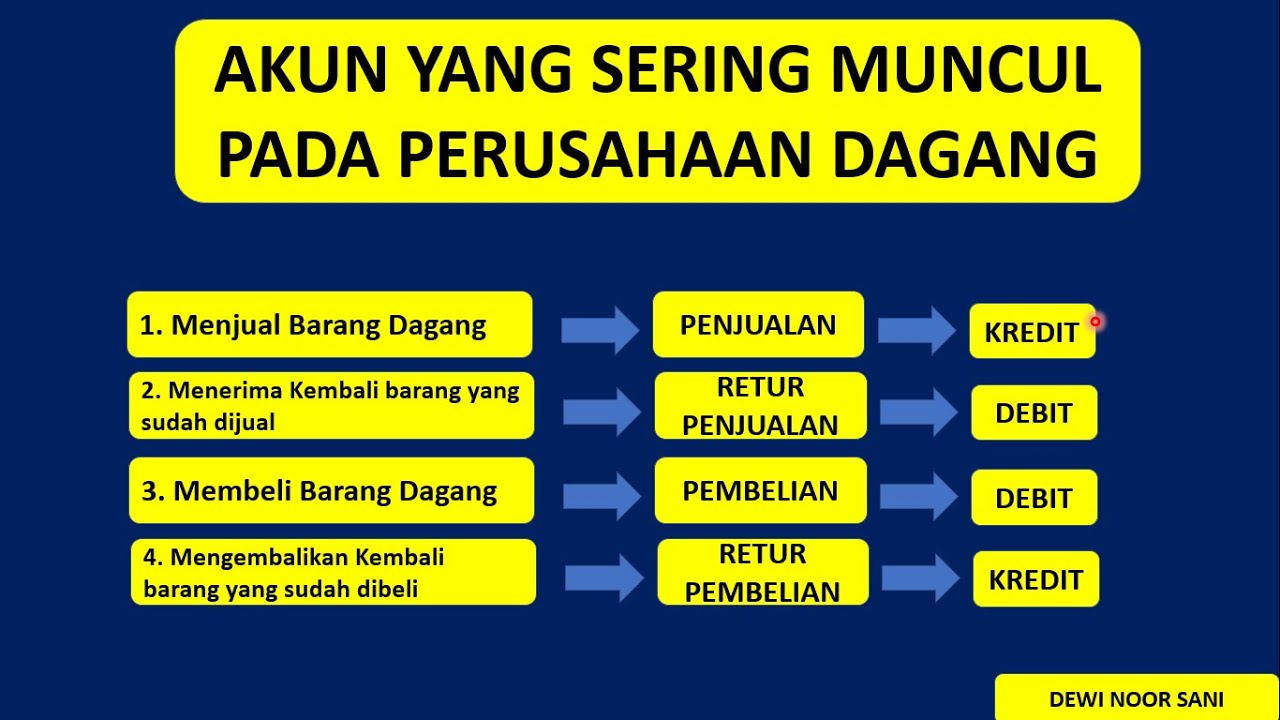

TLDRThis video provides an in-depth explanation of accounting transactions for a trading company, focusing on purchases, sales, and returns. It covers how to handle cash and credit transactions, including purchases with discounts, sales on credit, and returns from both buyers and sellers. The video also offers practical insights into journal entries for each transaction type, providing learners with a clear and organized understanding of accounting practices. It emphasizes the importance of analyzing transactions from both the buyer's and seller's perspectives, offering actionable tips for students and professionals in the field.

Takeaways

- 😀 Understanding the basics of accounting is crucial for analyzing transactions in trading companies.

- 😀 Debits and credits are fundamental in every transaction. For purchases, 'Purchases' is debited, and 'Cash' or 'Accounts Payable' is credited.

- 😀 For sales, 'Cash' or 'Accounts Receivable' is debited, and 'Sales' is credited.

- 😀 In the case of cash purchases with discounts, the correct entry is 'Purchases' debited, and 'Cash' and 'Purchase Discount' are credited.

- 😀 For credit purchases with discounts, debit 'Purchases' and credit both 'Accounts Payable' and 'Purchase Discount'.

- 😀 Sellers must record a sales discount when offering discounts on sales, debiting 'Sales Discount' and crediting 'Accounts Receivable'.

- 😀 It's important to distinguish between regular purchases/sales and those with discounts or returns, as they require separate journal entries.

- 😀 Recording returns involves debiting 'Purchase Returns' for the buyer and 'Sales Returns' for the seller, adjusting the amounts accordingly.

- 😀 Buyers and sellers must carefully track their debits and credits for each transaction to ensure accurate financial reporting.

- 😀 The lesson concludes with encouragement to further study journal entries and transaction analysis, particularly focusing on special journals.

- 😀 Viewers are encouraged to take screenshots of the transaction analysis and document them in their notes for future reference.

Q & A

What is the main focus of the video script?

-The video script primarily focuses on explaining how to analyze accounting transactions for a trading company, covering topics such as journal entries for purchases, sales, returns, and the application of discounts.

What is the correct journal entry for a cash purchase?

-For a cash purchase, the correct journal entry is: Debit 'Purchases' and Credit 'Cash'.

How should a purchase with a discount be recorded in the journal?

-For a purchase with a discount, the journal entry should be: Debit 'Purchases', Credit 'Cash', and Credit 'Purchase Discounts'.

What is the journal entry for a credit sale?

-In the case of a credit sale, the journal entry should be: Debit 'Accounts Receivable' and Credit 'Sales'.

How is a return of goods recorded by the buyer?

-A purchase return by the buyer should be recorded as: Debit 'Accounts Payable' and Credit 'Purchase Returns'.

What is the journal entry for a sales return?

-For a sales return, the journal entry is: Debit 'Sales Returns' and Credit 'Accounts Receivable'.

How should a cash payment be recorded for a credit purchase?

-For a cash payment of a credit purchase, the journal entry would be: Debit 'Accounts Payable' and Credit 'Cash'. If there is a discount, the entry would include 'Purchase Discounts'.

What are the key differences between cash and credit transactions in accounting?

-Cash transactions involve immediate payment or receipt, while credit transactions involve deferred payment or receipt. In journal entries, 'Cash' is used in cash transactions, while 'Accounts Payable' or 'Accounts Receivable' are used in credit transactions.

What should be done when applying a discount to a sale?

-When applying a discount to a sale, the journal entry should include a debit to 'Sales Discounts' and a credit to 'Sales'. This reflects the reduction in the sale price due to the discount.

Why is understanding transaction analysis important in accounting?

-Understanding transaction analysis is crucial because it ensures that all financial activities are accurately recorded in the company's books, allowing for correct financial reporting and decision-making.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Karakteristik Perusahaan Dagang

Accounting for Merchandising Operations

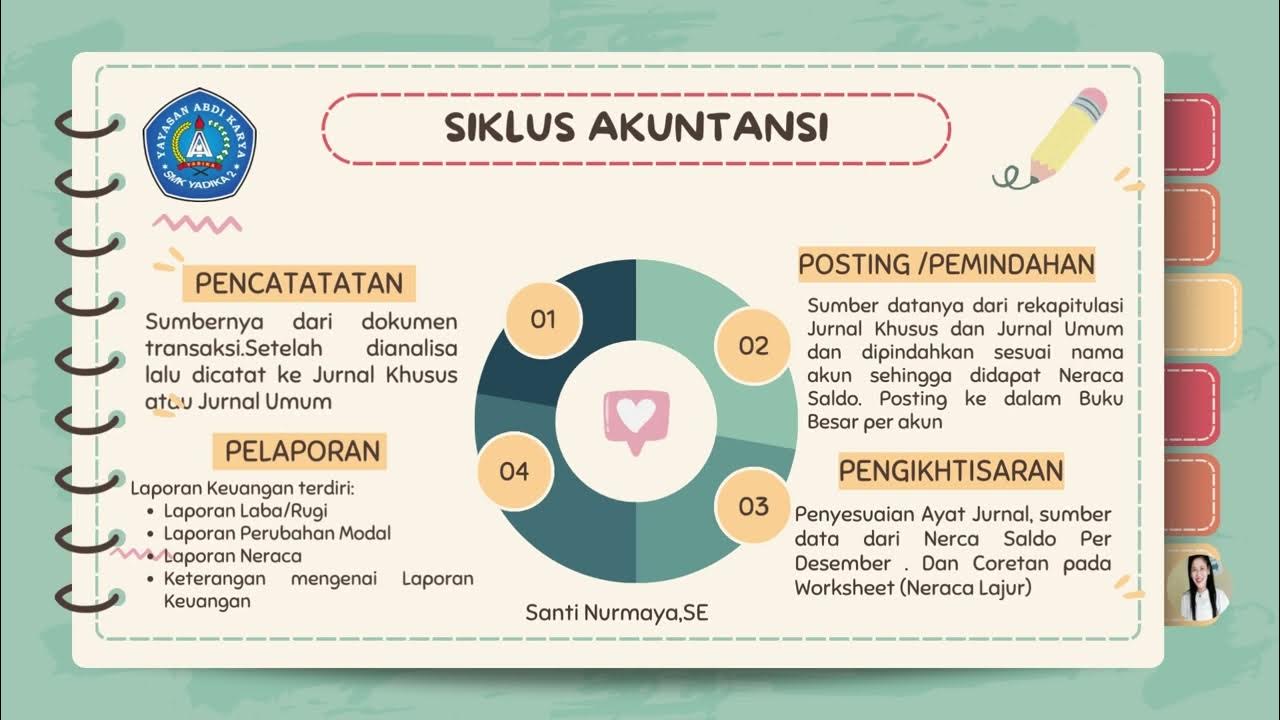

Mengelola Jurnal Khusus dan umum,Buku Besar, Laporan Keuangan Perusahaan Jasa,Dagang dan Manufaktur.

SIKLUS AKUNTANSI PERUSAHAAN DAGANG | KARAKTERISTIK PERUSAHAAN DAGANG (KLS XII SMT GENAP) - FREE PPT

RAZONETES E PARTIDAS DOBRADAS - CONTABILIDADE BÁSICA - DÉBITO E CRÉDITO - CONTAS T 📊☑️

JURNAL UMUM PERUSAHAAN DAGANG (tips & trik menganalisis Posisi Debit Kredit pada Perusahaan Dagang)

5.0 / 5 (0 votes)