What is Spot Trading? How can I make money from the crypto spot market?

Summary

TLDRIn this video, Wiktoria from the Phemex team explains how to trade cryptocurrencies, focusing on spot trading on the Phemex exchange. Viewers learn about the order book, how to execute market and limit orders, and the importance of liquidity. The video emphasizes strategies for making profits by buying low and selling high, along with the concept of arbitrage. Wiktoria also advises considering cryptocurrencies as long-term investments, highlighting Bitcoin as a prime example. To engage viewers, the video concludes with a question for a chance to win a trading bonus.

Takeaways

- 📈 A cryptocurrency exchange, like Phemex, allows users to buy, sell, and trade digital currencies.

- ⚡ Phemex is highlighted as one of the fastest crypto exchanges, offering both spot and derivatives trading.

- 💱 The spot market enables immediate transactions, with buyers and sellers interacting through an order book.

- 📊 Market orders execute instantly at the best available price, while limit orders allow users to set specific prices for their trades.

- 💧 Liquidity is essential in trading; higher liquidity increases the chances of successfully fulfilling orders.

- 🔍 Effective trading strategies involve analyzing news and trends to identify buy and sell signals.

- ⚖️ Arbitrage opportunities arise when Bitcoin prices differ across exchanges, but timing and fees can complicate this strategy.

- 🛡️ Long-term investment in cryptocurrencies can be beneficial, focusing on the fundamentals of promising projects.

- 💰 Trading successfully involves buying Bitcoin at lower prices and selling at higher prices, though accuracy is challenging.

- 🎉 Viewers are invited to participate in a giveaway by sharing their spot trading exchanges and Phemex UID.

Q & A

What is the main purpose of a cryptocurrency exchange platform?

-A cryptocurrency exchange platform allows users to buy, sell, and trade digital currencies, such as Bitcoin.

What is the difference between spot trading and derivatives trading?

-Spot trading involves buying and selling cryptocurrencies for immediate settlement, while derivatives trading involves contracts that derive their value from the underlying asset but are not traded for immediate delivery.

What is the order book in a spot market?

-The order book is a list of all buy and sell prices from market participants, showing the available quantities of cryptocurrencies and the prices at which buyers are willing to purchase and sellers are willing to sell.

What are market orders and limit orders?

-Market orders are executed immediately at the best available price, while limit orders allow users to specify a price at which they are willing to buy or sell, but do not guarantee execution.

How does liquidity affect cryptocurrency trading?

-Liquidity refers to how easily assets can be bought or sold in the market. Higher liquidity means more options for traders and a greater likelihood of executing buy or sell orders.

What is the significance of the spread in a trading market?

-The spread is the difference between the best sell price and the best buy price. A smaller spread indicates a more efficient market, while a larger spread can signify lower liquidity or higher transaction costs.

What is the basic strategy for making money trading Bitcoin?

-The basic strategy involves buying Bitcoin at a lower price and selling it at a higher price, although it requires careful analysis of market trends and news.

What is arbitrage in cryptocurrency trading?

-Arbitrage involves exploiting price differences for the same asset across different exchanges by buying at a lower price on one exchange and selling at a higher price on another.

What are the risks associated with arbitrage trading?

-Risks include timing issues, as price gaps may close quickly, and additional costs such as transfer and transaction fees that could outweigh potential gains.

What is the recommended long-term investment strategy for cryptocurrencies?

-The recommended strategy is to study the fundamentals of promising crypto projects and hold onto them (referred to as 'hodling'), selling when a target profit is reached, without worrying about short-term price fluctuations.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Bybit tutorial for beginners | how to use bybit exchange

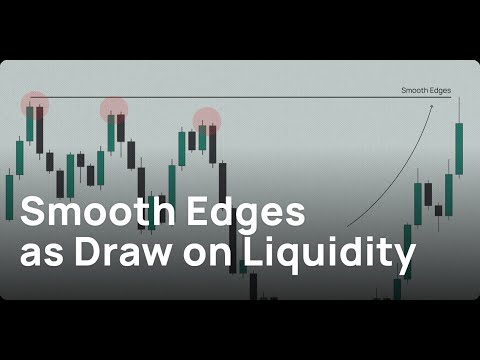

Smooth Edges as my +A Draw on Liquidity

How to Trade Crypto | How to Trade on Pocket Option | Trading Tutorial

How To SNIPE Pump Fun Memecoins & AVOID RUGS

[ATUALIZADO] COMO COMPRAR BITCOIN PELO APP DA BINANCE! Passo a Passo Completo!

BITCOIN & CRYPTO TRADER WAJIB TAHU FENOMENA PSIKOLOGI INI TERUTAMA PARA PEMULA ! #SEMUABISA DI AJAIB

5.0 / 5 (0 votes)