Introduction to Business Finance

Summary

TLDRThis lesson covers the fundamentals of business finance, focusing on the acquisition and management of funds for businesses. It introduces key financial management concepts, including wealth maximization, economic value added, and decision-making related to financial stability, investments, and market conditions. The lesson explains both traditional and modern financial approaches, highlighting factors that affect earnings, stability, and growth. It also discusses the importance of capital budgeting, cash flow, dividend distribution, and strategies businesses use to scale operations efficiently.

Takeaways

- 📊 Business finance involves acquiring and conserving capital funds to meet financial needs and achieve the overall objectives of the business.

- 💰 The primary objective of business finance is to maximize wealth, increasing the value of the business and its shareholders' value.

- 📈 Economic value added (EVA) measures the difference in return over the company's cost of capital; a negative EVA indicates value destruction.

- 👥 Stakeholders include customers, employees, investors, suppliers, and communities, all of whom have an interest in the business's outcomes.

- 🧑💼 Financial management deals with acquiring and using funds efficiently, and involves both traditional (funding from lending bodies) and modern approaches (analyzing financial decisions comprehensively).

- 📊 The three major financial decisions in business include investment, financing, and dividend decisions, each affecting the company’s financial health and strategic direction.

- ⚠️ Risk management is a key aspect of financial decisions, especially when choosing between debt and equity for funding, as larger risks are linked to certain financing sources.

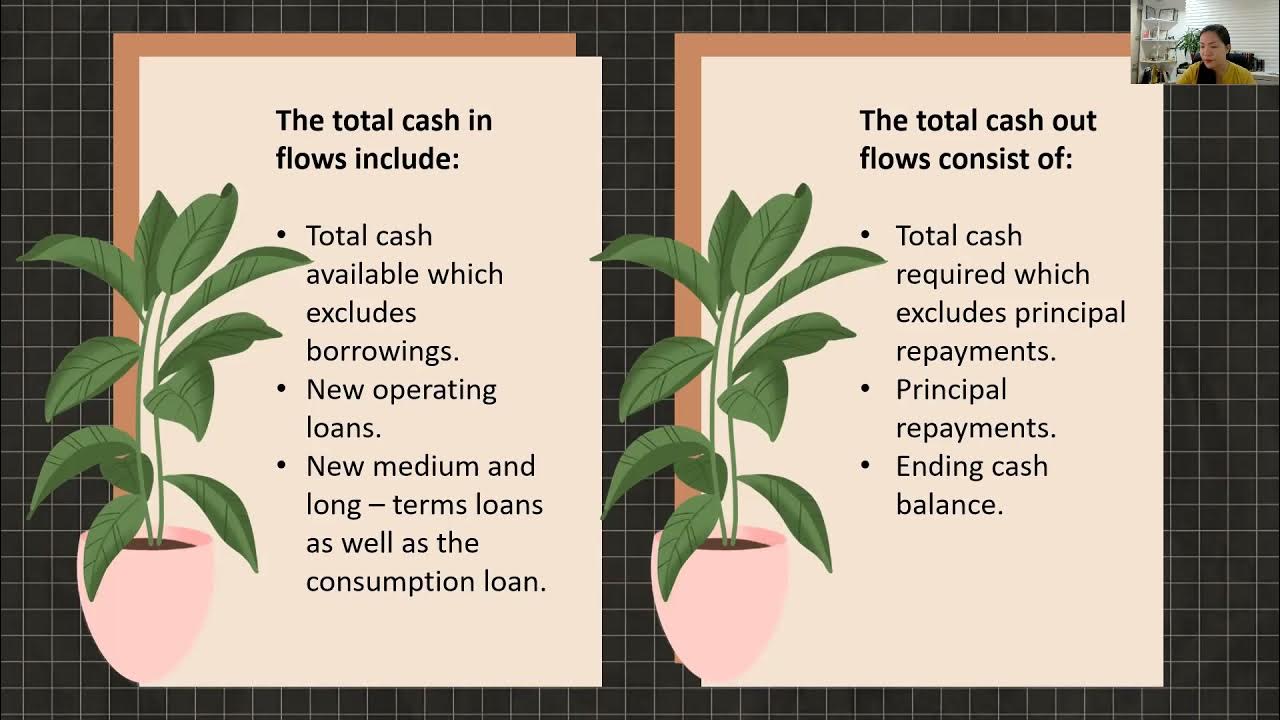

- 💵 Cash flow management is crucial for day-to-day operations and ensuring that investments and expenses are sustainable.

- 🛠 Capital budgeting is the process of selecting assets in which to invest, ensuring that investments generate returns and support long-term growth.

- 💼 Factors affecting earnings stability, dividend growth, and market conditions must be analyzed to maintain financial health and ensure business growth.

Q & A

What is the primary focus of business finance?

-Business finance focuses on the acquisition and conservation of capital funds to meet the financial needs of a business. It also aims to support the overall objectives of business enterprises.

What is the main objective of financial management in business?

-The main objective of financial management is to maximize wealth by increasing the value of the business, which in turn increases the value of shares held by stockholders.

What is economic value added (EVA) and why is it important?

-Economic value added (EVA) is the incremental difference between the rate of return on an investment and the company's cost of capital. It is important because it shows whether a business is generating value from its invested funds. A negative EVA indicates that the management is destroying value.

Who are considered stakeholders in a business?

-Stakeholders are individuals, groups, or parties who have an interest in an organization and its actions. Examples include customers, employees, investors, suppliers, and communities.

What are the traditional and modern approaches to financial management?

-The traditional approach to financial management focuses on arranging funds from lending bodies and managing financial instruments like bank loans. The modern approach involves conceptualizing and analyzing all aspects of financial decisions within a strategic framework.

What are the three major decisions in financial management?

-The three major decisions in financial management are: 1) financing decisions, which involve selecting cost-efficient sources of funds, 2) investment decisions, which involve selecting the best assets to invest in, and 3) dividend decisions, which determine how to distribute profits to shareholders.

How does market condition influence financing decisions?

-Market conditions, such as economic booms or recessions, influence financing decisions. During boom periods, businesses may issue equity, while in depressions, they may avoid raising equity due to unfavorable conditions.

What factors should businesses consider when making investment decisions?

-Businesses should consider the rate of return, cash flow, interest rates, and capital budgeting procedures when making investment decisions to ensure maximum returns from their assets.

What factors affect the stability of earnings in a business?

-Factors affecting the stability of earnings include the dependability of earnings, the organization's growth potential, access to capital markets, and legal constraints.

What is meant by the 'scale of operation' in business finance?

-The 'scale of operation' refers to the size of a business's operations, measured by its maximum output. A scalable business can handle growing workloads or sales efficiently, becoming more cost-effective as it grows.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Meaning Of Business Finance | Introduction To Business Finance | Business Finance B.com B.B.A and XI

Financial Planning Definition, need of financial planning, financial planning and tax management mba

Financial Statements (September 30, 2021)

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour | Big Think

MEDIA PROMOSI DALAM PEMASARAN / Materi Produk Kreatif dan Kewirausahaan kelas XI

Shalahuddin Al Qadr, S.Ak || Manajemen Usaha Koperasi

5.0 / 5 (0 votes)