Lesson 018 - Adjusting Entries 2: Prepaid Expenses (Insurance)

Summary

TLDRThis lesson focuses on prepaid insurance and insurance expense adjustments. The instructor discusses a more complex example of how companies manage insurance policies paid in advance and calculate the insurance expense for each period. The lesson walks through multiple policies and explains how to allocate insurance expenses over different periods, as well as how to determine prepaid insurance balances for financial statements. The example covers calculations for policies from 2020 to 2023, emphasizing key concepts in adjusting entries for insurance. The next session will cover deferred revenue.

Takeaways

- 🎶 The video begins with an introduction to lesson 18, focusing on prepaid insurance and insurance expense.

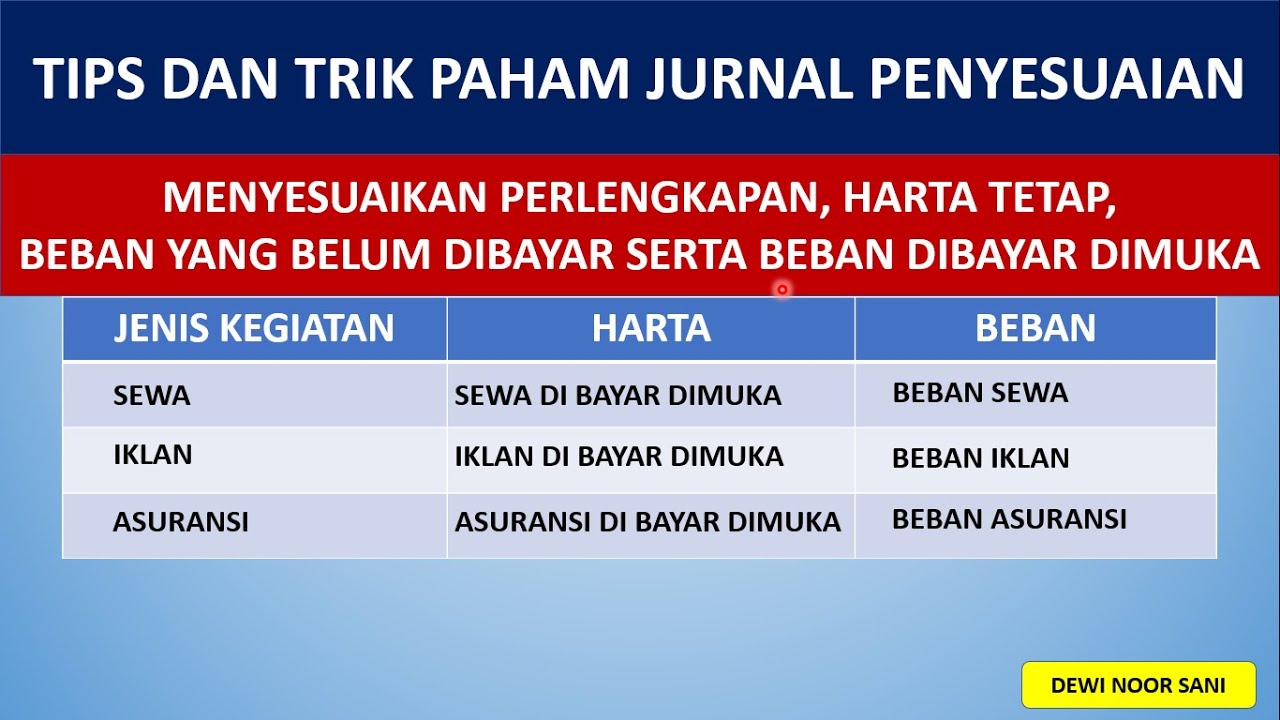

- 🧾 The lesson builds on the previous discussion of adjusting entries, specifically prepaid insurance policies.

- 📅 A company has purchased multiple insurance policies in advance, and the focus is on how to calculate insurance expense for each reporting period.

- 💡 The main objective is understanding how prepaid insurance and insurance expense are reported in financial statements.

- 🔢 The video provides an example with three insurance policies, each with different coverage periods and amounts.

- 📊 The calculation involves determining the insurance expense for each year by multiplying the insurance amounts by the fraction of the coverage period within the year.

- 📝 The 2020 insurance expense is calculated by prorating each policy's cost based on the months covered in that year, leading to a total insurance expense of 8,980.

- 📉 Prepaid insurance is calculated by subtracting the total insurance expense for 2020 from the total prepaid amount, resulting in a remaining prepaid insurance balance.

- 📆 The same process is repeated for the years 2021, 2022, and 2023, adjusting for the remaining months of coverage.

- 📑 By the end of 2023, all prepaid insurance is used up, and the balance of prepaid insurance becomes zero.

Q & A

What is the main topic discussed in the lesson?

-The lesson discusses prepaid insurance, insurance expense, and how to account for them in the financial statements, focusing on how companies handle insurance policies paid in advance.

What is prepaid insurance, and how is it accounted for?

-Prepaid insurance refers to insurance premiums paid in advance for coverage in future periods. It is initially recorded as an asset on the balance sheet and expensed gradually as the coverage period elapses.

How do you calculate insurance expense for a specific period?

-To calculate the insurance expense for a specific period, you multiply the total insurance premium by the fraction of the coverage period that has elapsed. For example, if an insurance policy covers 12 months and 9 months have passed, the expense would be 9/12 of the total premium.

What are the details of the three insurance policies purchased by the company in the example?

-The three policies are: Policy M for $7,440 covering April 1, 2022 to March 31, 2023, Policy N for $12,000 covering July 30, 2022 to July 30, 2023, and Policy L for $16,200 covering November 1, 2022 to October 31, 2023.

How is the total insurance expense for 2020 calculated in the example?

-The total insurance expense for 2020 is calculated by multiplying the premiums of each policy by the fraction of the year they were active. Policy M is active for 9 months (5,580), Policy N for 5 months (2,500), and Policy L for 2 months (900). The total is $8,980.

What is the prepaid insurance balance on December 31, 2020?

-The prepaid insurance balance on December 31, 2020, is $26,660, calculated as the total insurance purchased ($35,640) minus the insurance expense recognized in 2020 ($8,980).

How do the policies affect the financial statements in 2021?

-In 2021, Policy M has 3 months remaining ($1,860), Policy N has 12 months ($6,000), and Policy L has 12 months ($5,400), resulting in a total insurance expense of $13,260. The prepaid insurance balance at the end of 2021 is $13,400.

What is the insurance expense for 2022, and how is it calculated?

-The insurance expense for 2022 is $8,900. This is calculated based on the remaining coverage of Policy N for 7 months ($3,500) and Policy L for 12 months ($5,400). Policy M had expired by the start of 2022.

What is the remaining prepaid insurance balance at the end of 2022?

-The remaining prepaid insurance balance at the end of 2022 is $4,500, calculated as the previous balance of $13,400 minus the insurance expense of $8,900 recognized in 2022.

What is the final insurance expense for 2023, and what happens to the prepaid insurance balance?

-The insurance expense for 2023 is $4,500, based on the remaining coverage of Policy L for 10 months. At the end of 2023, the prepaid insurance balance is zero since all policies have expired.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)