CARA INPUT DOKUMEN PENYESUAIAN || MYOB UD ABADI PART 7 UKK AKUNTANSI TAHUN 2024

Summary

TLDRIn this tutorial, Semiati Hadi explains the process of entering adjustment documents for accounting in 2023-2024. She guides viewers through various adjustments, including inventory, prepaid expenses, insurance, depreciation, salaries, and tax calculations, using real examples from UD Abadi's financial data. The tutorial covers how to input journal entries for each adjustment in the system, ensuring accurate financial records. The video concludes with instructions on how to print reports, offering a comprehensive guide to handling adjustment entries in accounting.

Takeaways

- 😀 The video provides a tutorial on how to input adjustment documents for accounting, specifically for the year 2023-2024.

- 😀 The process starts with reviewing the trial balance (neraca saldo), which includes asset, liability, equity, income, and expense categories.

- 😀 To access the trial balance, users can navigate through the 'Account List' and 'Report' sections in the system.

- 😀 The first adjustment document involves adding the missing supply inventory (water supply) valued at Rp1,325,000 to the trial balance.

- 😀 In the case of a discrepancy between the trial balance and adjustment data, the journal entry will be reversed or adjusted accordingly.

- 😀 The second adjustment concerns recording the store rental expense for December, which requires a debit to 'Rent Expense' and a credit to 'Prepaid Rent'.

- 😀 The third adjustment is for recording an insurance expense of Rp1,250,000, with the debit made to 'Insurance Expense' and the credit to 'Prepaid Insurance'.

- 😀 The fourth adjustment calculates an estimated bad debt loss at 2.5% of accounts receivable, amounting to Rp6,150,000, adjusting the allowance for doubtful accounts.

- 😀 The fifth adjustment involves the depreciation of equipment for December, recorded as a debit to 'Depreciation Expense' and a credit to 'Accumulated Depreciation'.

- 😀 A payroll adjustment is made for December's salaries, with the expense recorded as a debit to 'Wages and Salaries' and a credit to 'Salaries Payable'.

- 😀 The final adjustments cover VAT (PPN) and income tax calculations for December, including the reversal of VAT income and expense, and calculating the corporate income tax at 0.5% of gross sales.

- 😀 After inputting the adjustment documents, users are instructed to print out the final report, which will be covered in a follow-up tutorial.

Q & A

What is the primary topic of the video?

-The video explains how to input adjustment documents into accounting software, specifically focusing on the process of adjusting journal entries for UD Abadi's financial records for the year 2023-2024.

What is the first data required to input adjustment documents?

-The first data required is the trial balance (Neraca Saldo), which can be accessed from the account list or the report menu within the software.

How do you view the trial balance in the accounting system?

-The trial balance can be viewed by navigating to the 'Account' section, then clicking on 'Account List' or by going to 'Report' and selecting 'TR Balance' from the menu.

What is the correct journal entry for adjusting the inventory of water supplies?

-The journal entry involves a debit to the 'Store Supply' account for the difference in inventory value and a credit to the 'Store Supply Expense' account for the same amount.

How do you record the December rent expense adjustment?

-The December rent expense is recorded with a debit to 'Rent Expense' and a credit to 'Prepaid Rent' (Prep Trend).

What is the proper way to account for insurance expenses in the adjustment documents?

-For insurance expenses, a debit is made to 'Insurance Expense' and a credit to 'Prepaid Insurance' for the specified amount.

How is the allowance for doubtful accounts adjustment calculated?

-The allowance for doubtful accounts is calculated as 2.5% of the accounts receivable balance. If the existing allowance balance is higher than the required amount, the excess is adjusted accordingly.

What is the journal entry for adjusting the depreciation of equipment?

-The journal entry for depreciation involves debiting 'Depreciation Expense' and crediting 'Accumulated Depreciation' for the depreciation amount.

What adjustment is needed for unpaid wages as of December 2022?

-The adjustment for unpaid wages is made by debiting 'Wages Expense' and crediting 'Accrued Wages' (or 'Expend Payable') for the amount owed.

How is the VAT adjustment handled for December transactions?

-The VAT adjustment involves reversing the values of 'PPN Income' and 'PPN Outcome' and transferring the balances to 'PPN Payable'. The difference between the two is recorded in the 'PPN Payable' account.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

JURNAL PENYESUAIAN UD ABADI - PEMBAHASAN SOAL UKK AKUNTANSI PAKET 1 TAHUN 2024

Tutorial Zahir Accounting 6 - Perusahaan dagang

Certificação Winthor - Mód Adicionais| 3405 - Cadastro de Saldo Inicial

Cara Membuat Barcode dan QR Code | Generator Online

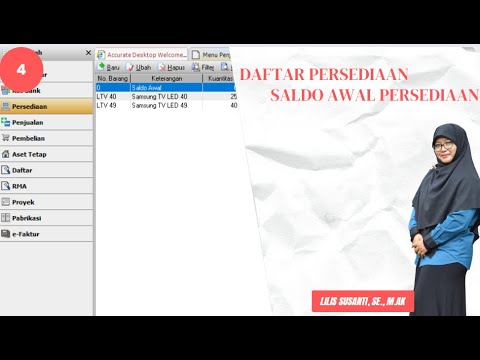

PT Cakrawala - Cara Input Persediaan Barang Dagang Menggunakan Persiapan Mahir Aplikasi Accurate

Pembahasan Soal UKK OTKP Penyimpanan dokumen menggunakan sistem kronologis

5.0 / 5 (0 votes)