Penyesuaian dan Daftar saldo setelah penyesuaian

Summary

TLDRThis video script introduces the concept of accounting adjustments, covering both accrual and cash basis accounting. It explains essential adjustments such as prepaid expenses, unearned revenues, accrued expenses, and the recognition of income and expenses. The script provides practical examples, such as insurance premiums paid in advance, rent received in advance, and wages to be paid later. It also discusses the importance of making regular adjustments to ensure accurate financial reporting. The video concludes with an explanation of how these adjustments are recorded in journals and posted to the general ledger to prepare accurate financial statements.

Takeaways

- 😀 Takeaway 1: Accrual accounting recognizes revenue when it is earned, not when cash is received. This ensures that income and expenses are reported in the correct period.

- 😀 Takeaway 2: The Matching Concept requires that expenses be recorded in the same period as the revenues they helped generate, regardless of when the cash transaction occurs.

- 😀 Takeaway 3: Cash basis accounting recognizes revenue and expenses only when cash is received or paid, making it simpler but less accurate for larger companies.

- 😀 Takeaway 4: For small businesses or service companies, cash basis accounting is often used because of its simplicity and fewer receivables or payables.

- 😀 Takeaway 5: Accrual accounting is essential for larger companies as it provides a more accurate financial picture, capturing outstanding receivables and payables.

- 😀 Takeaway 6: Prepaid expenses (such as insurance) are recognized gradually as expenses over time, even if paid in full upfront, following accrual principles.

- 😀 Takeaway 7: Unearned revenue is recorded as a liability initially and only recognized as revenue when the service or product is provided to the customer.

- 😀 Takeaway 8: Accrued expenses, like salaries, must be recorded as liabilities when services are performed (e.g., wages earned in January but paid in February).

- 😀 Takeaway 9: Adjusting journal entries are necessary at the end of each period to ensure that the accounts reflect accurate financial data, especially for prepaid or accrued items.

- 😀 Takeaway 10: Depreciation is an example of a non-cash expense that reduces the value of an asset over time. Businesses must adjust for depreciation regularly in their financial statements.

Q & A

What is the main purpose of accounting adjustments?

-The main purpose of accounting adjustments is to ensure financial records accurately reflect the company’s financial position at the end of an accounting period. This includes correcting discrepancies and aligning revenues and expenses with the correct period.

What is the difference between accrual and cash basis accounting?

-Accrual basis accounting recognizes revenues and expenses when they are earned or incurred, regardless of when cash is received or paid. Cash basis accounting, on the other hand, records transactions only when cash is actually exchanged.

Why is accrual accounting generally preferred for larger companies?

-Accrual accounting is preferred for larger companies because it provides a more accurate reflection of financial performance by recognizing revenues and expenses in the period in which they occur, even if cash hasn’t been exchanged. This method accounts for receivables and payables, offering a more complete picture of a company’s financial health.

What are prepaid expenses and how are they adjusted?

-Prepaid expenses are payments made in advance for goods or services that will be used in the future. An example is an insurance payment made for one year in advance. Each month, a portion of the prepaid expense is recognized as an expense in the financial statements, adjusting the prepaid asset account.

How do you adjust for unearned revenue?

-Unearned revenue occurs when a business receives payment before providing a service or delivering goods. Initially, the payment is recorded as a liability (unearned revenue). Over time, as the service is performed or goods are delivered, the liability is reduced and revenue is recognized in the financial statements.

Can you explain the matching concept in accounting?

-The matching concept in accounting states that expenses should be recorded in the same period as the revenues they help generate, regardless of when the cash is paid. For example, if employees work in January but are paid in February, their wages are recognized as an expense in January to match the period in which the work was done.

What is the journal entry for prepaid expenses like insurance?

-The journal entry for prepaid expenses involves debiting the prepaid asset account when the payment is made, and then adjusting each month by debiting the expense account and crediting the prepaid asset account to reflect the usage of the service or asset over time.

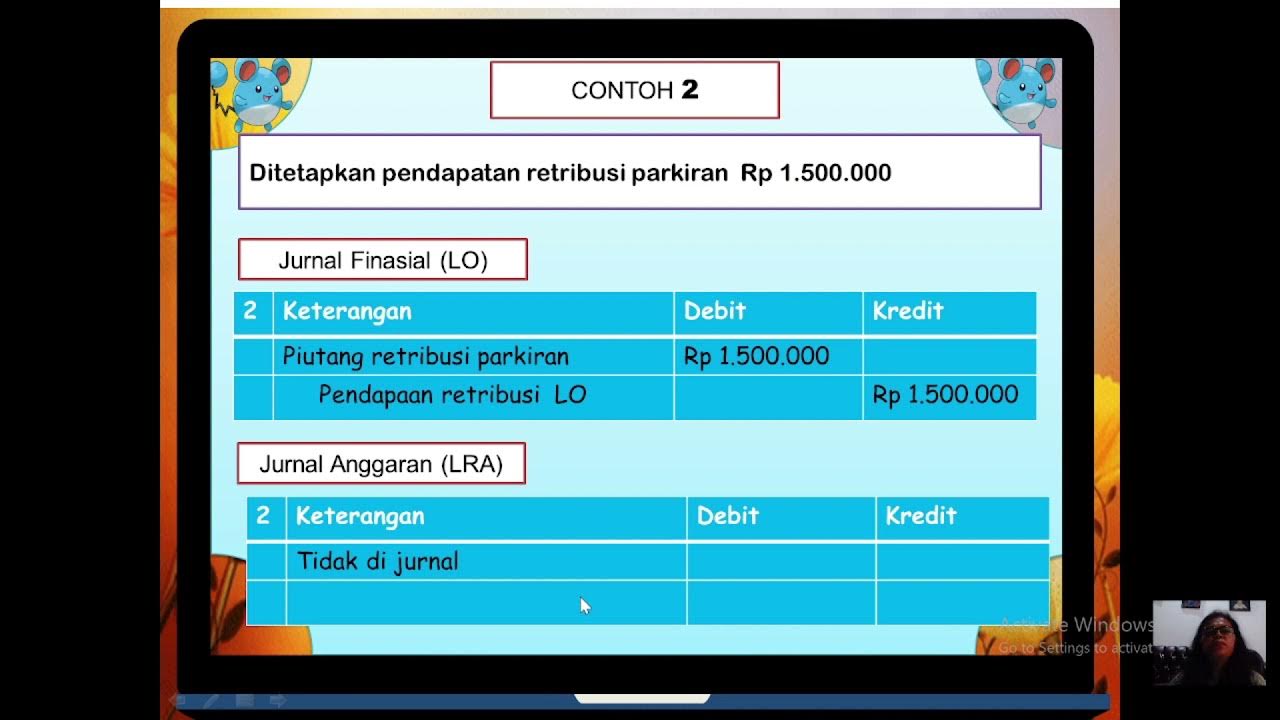

What is the journal entry for unearned revenue when payment is received in advance?

-When payment is received in advance, the journal entry is to debit cash and credit unearned revenue. As the service is provided or goods are delivered, the journal entry is adjusted by debiting unearned revenue and crediting revenue.

What does the term 'accrued expenses' mean and how are they handled in accounting?

-Accrued expenses are costs that have been incurred but not yet paid. These are recorded at the end of a period to ensure expenses are recognized in the correct period. For example, wages that employees have earned but are not yet paid are accrued as an expense, with a corresponding liability account (e.g., accrued wages).

What are the necessary steps after making journal entries for adjustments?

-After making journal entries for adjustments, the next steps are to reflect the adjustments in the general ledger, update the trial balance, and prepare the financial statements (balance sheet and income statement) that show the accurate financial position of the company.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)