5w FinEcon 2024fall v2

Summary

TLDRThe transcript explains various methods of interest compounding, including annual, semiannual, quarterly, and continuous compounding. It describes how interest accumulates over time, depending on the compounding frequency. Different scenarios are used to illustrate how $100 grows under various compounding conventions, explaining the calculation process for each. The transcript also touches on concepts such as present value, discounting, and yield to maturity in financial markets. Practical examples like simple loans, coupon bonds, and perpetual bonds are used to demonstrate how these financial principles apply in real-world situations.

Takeaways

- 💡 Compounding involves rolling over interest and the initial investment, leading to exponential growth.

- 📅 Annual compounding applies interest once a year, while semiannual compounding does it every six months.

- 📈 Semiannual compounding results in more frequent growth than annual compounding, resulting in a slightly higher end value.

- 🧮 Quarterly compounding (every three months) increases the growth further than semiannual compounding.

- ⚙️ Continuous compounding represents the highest level of compounding, as it occurs infinitely in small increments, using the exponential function.

- 📊 The present value of future cash flows is less than their value today due to the time value of money.

- 💵 Present value calculations are essential in evaluating cash flows from financial instruments like bonds and loans.

- 💰 Simple loans grow based on compounding interest, with future values depending on interest rate and time.

- 🔢 Yield to maturity (YTM) is the interest rate that equates today’s bond value with its future cash flows.

- 📜 Perpetual bonds never mature, meaning they pay consistent interest (coupon payments) indefinitely, with the present value determined by the coupon divided by the discount rate.

Q & A

What is compounding in the context of interest rates?

-Compounding refers to the process where the interest earned on an initial investment is added to the principal, and future interest is calculated on the new total. This includes both the original amount and the accumulated interest.

How does annual compounding work?

-In annual compounding, interest is calculated once a year. For example, if you deposit $100 with a 10% annual interest rate, after one year, your total amount will be $110.

What is semiannual compounding and how does it differ from annual compounding?

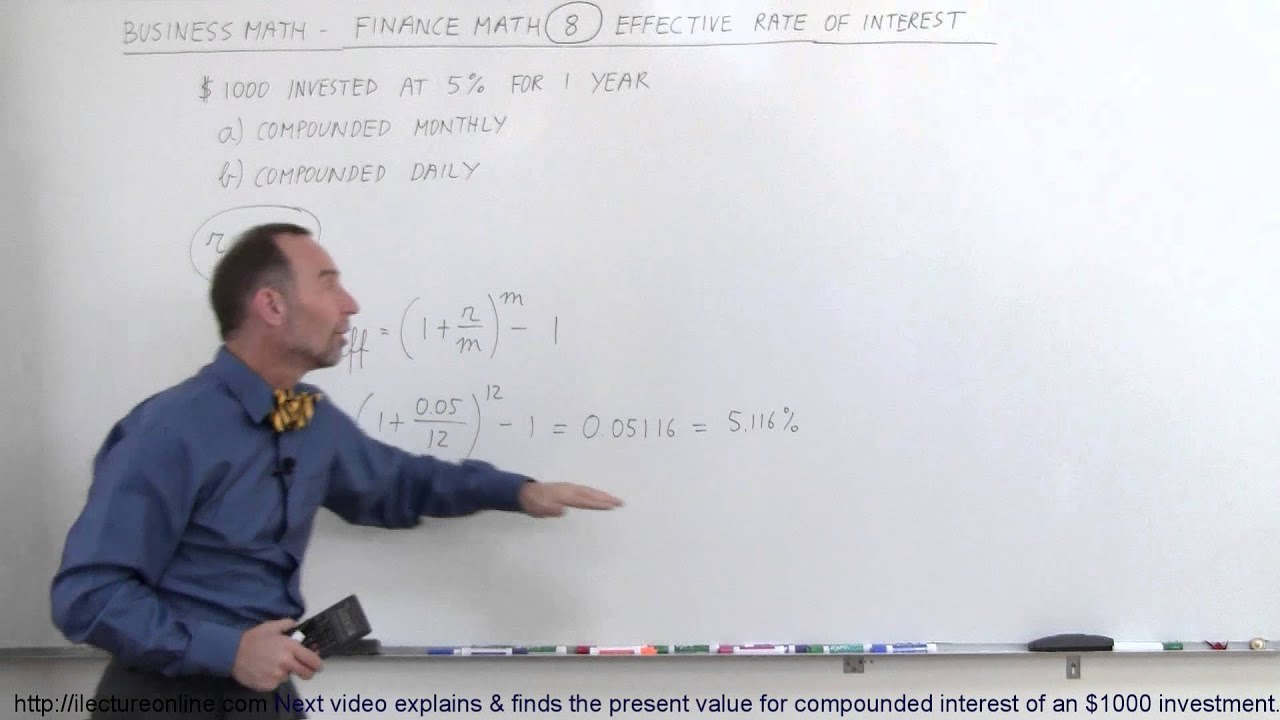

-In semiannual compounding, interest is compounded twice a year, every six months. The interest rate is divided by two for each period. For instance, a 10% annual interest rate becomes 5% for each six-month period.

How does quarterly compounding work?

-Quarterly compounding divides the year into four periods, with interest being compounded every three months. A 10% annual interest rate is divided by four, so 2.5% is applied every quarter.

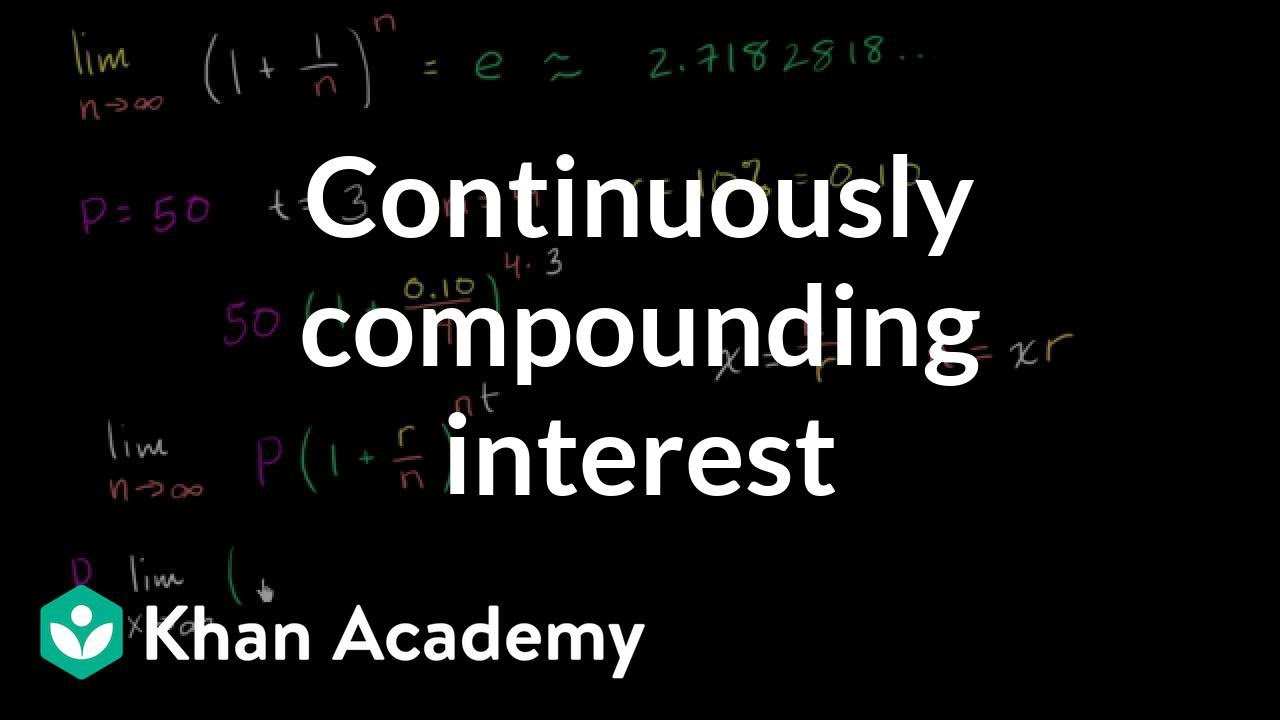

What is continuous compounding?

-Continuous compounding occurs when interest is compounded at every possible instant, effectively growing the balance continuously. The formula involves using the exponential function, where the total is calculated using the expression A = P * e^(rt), with 'e' being Euler's number.

What is the concept of present value?

-Present value is the current worth of a future cash flow, discounted at an appropriate interest rate. A dollar today is worth more than a dollar in the future due to the potential to earn interest over time.

How is the present value of a cash flow calculated?

-The present value is calculated by discounting future cash flows using a discount factor. The formula is PV = Cash Flow / (1 + r)^t, where 'r' is the interest rate and 't' is the time period.

What is a fixed payment loan?

-A fixed payment loan is a loan where the borrower repays the principal and interest in equal installments over the life of the loan. The payments consist of both the repayment of the loan and interest costs.

How does a coupon bond work?

-A coupon bond pays periodic interest (the coupon) to the bondholder until maturity. At maturity, the bondholder also receives the face value of the bond. For example, a 10-year bond with a 10% coupon rate and a $1,000 face value pays $100 annually.

What is a perpetual bond and how is its present value calculated?

-A perpetual bond has no maturity date, meaning the bondholder receives interest payments indefinitely. Its present value is calculated using the formula PV = C / r, where 'C' is the coupon payment and 'r' is the interest rate.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

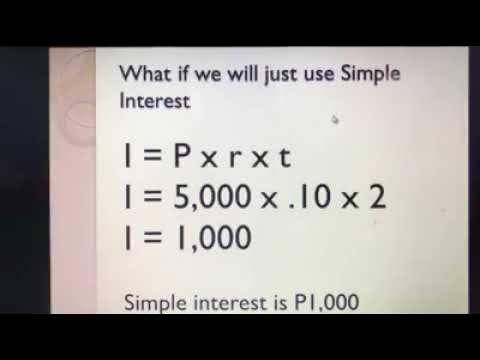

COMPOUND INTEREST LONG METHOD PERSONAL FINANCE L3 Video2

Formula for continuously compounding interest | Finance & Capital Markets | Khan Academy

FINDING THE PRESENT VALUE OF GENERAL ANNUITY || GRADE 11 GENERAL MATHEMATICS Q2

Business Math - Finance Math (8 of 30) Effective Rate of Interest

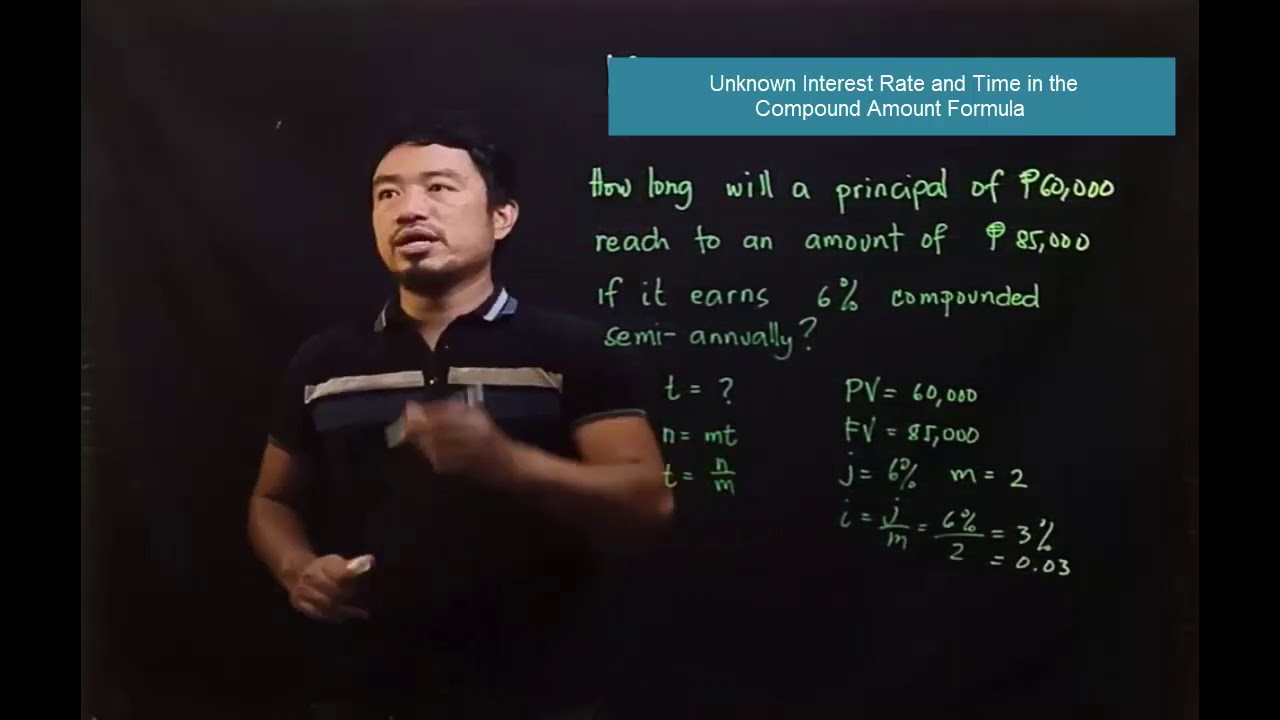

Compound Amount Formula with Unknown Interest Rate and Time

BUNGA MAJEMUK (Matematika Ekonomi) by Dwika Rahmi Hidayanti

5.0 / 5 (0 votes)