Crypto.com CEO: Bitcoin May See Selling Ahead of Halving

Summary

TLDRThe transcript discusses the business environment in Hong Kong for digital assets and the recent regulatory framework changes, including the approval of Bitcoin and Ethereum ETFs. It highlights the company's strategy for entering the Korean market, emphasizing regulatory compliance and a focus on digital asset access. The conversation also covers expectations for the spot Bitcoin ETF and its impact on market structure, the upcoming Bitcoin halving event, and the company's growth plans, including user base expansion and strategic hiring. Additionally, it touches on the company's approach to sports sponsorships and brand building.

Takeaways

- 📈 Hong Kong's regulatory environment for digital assets has improved, with a new framework and conditional approval of Bitcoin and Ethereum ETFs.

- 🌏 The company is pleased with the support for market development in Hong Kong and sees it as a positive change.

- 🇰🇷 Entering the Korean market has been challenging, but the company has prepared for two years and aims to provide a competitive product offering.

- 🚀 Post-launch, the company plans to continue providing access to digital assets globally in a regulatory compliant manner, with a focus on the Korean market.

- 💳 The company is known for its crypto card program and aims to launch it locally in Korea as soon as possible.

- 📊 The demand for the spot Bitcoin ETF was larger than expected, indicating a positive structural setup for the market.

- 💹 Bitcoin halving is expected to have a long-term positive impact on the market by reducing supply, which could lead to price increases.

- 🔄 The crypto market structure is evolving, with an expected shift from retail to institutional investment driving prices.

- 🌐 The company is scaling up and has almost completed its regulatory licensing across major markets, positioning it for growth.

- 🏢 The company is hiring thoughtfully and strategically to ensure it remains a nimble and fast-moving entity in the rapidly developing cryptocurrency space.

- 🏆 Multi-year relationships with sports properties like F1 and UFC have established the company as a trusted global brand, and future partnerships will be selective.

Q & A

What changes in the Hong Kong environment regarding digital assets have been noted?

-There has been a new regulatory framework introduced in Hong Kong, and recently, conditional approval of Bitcoin and Ethereum ETFs has been granted, indicating general support for market development in the region.

How does the Hong Kong market compare to Korea in terms of interest in crypto among retail investors?

-South Korea is known for its high interest in crypto among retail investors and is one of the largest crypto markets globally, with a very active user base. Hong Kong, on the other hand, has shown a positive shift towards supporting the development of digital assets.

What preparations has the company made for its launch in Korea?

-The company has spent nearly two years preparing for the Korean launch, acquiring two licenses and undergoing a prolonged product buildout to offer a competitive product to Korean consumers.

What can users in Korea expect from the company post-app launch?

-Users in Korea can expect the company to continue providing access to digital assets on a global level in a regulatory compliant manner, and they are also looking forward to launching their crypto card program in Korea as soon as possible.

What is the long-term impact of the spot Bitcoin ETF on the market?

-The spot Bitcoin ETF is expected to bring structural changes to the market, with increased large scale inflows against the backdrop of reduced Bitcoin supply, potentially leading to a shift from retail to institutional investment driving Bitcoin prices.

How does the Bitcoin halving event in April impact the market?

-The Bitcoin halving event reduces the amount of new Bitcoin coming into the market by miners, which, while not immediately impactful, will make a substantial difference over a six-month period and is considered a positive development for the market.

What is the company's strategy for growth in the next six to twelve months?

-The company is focusing on scaling up, having almost completed their regulatory licensing in all major markets. They are also mindful of remaining a nimble, fast-moving company to capture opportunities, while continuing their efforts in brand building as a trusted place for cryptocurrency interactions.

How does the company plan to counter aggressive strategies from competitors like Chinese exchanges?

-The company has a different strategy focusing on building a solid foundation of regulatory compliance and brand trust. They aim to be the go-to place for people interacting with cryptocurrency, and are well-positioned to take advantage as some competitors facing regulatory issues.

What are the hiring plans of the company in relation to its expansion and long-term plans?

-The company is hiring thoughtfully and strategically, with several hundred openings outside of customer service. They scaled customer service by about 700 people recently to meet new demand and increase traffic.

Will the company continue with sports sponsorships such as F1 and UFC?

-The company values their multi-year relationships with these properties and will continue to be selective in their sponsorships, ensuring that they align with the brand's identity and contribute to its growth.

What is the company's stance on its user base and market penetration?

-The company is approaching a hundred million users and has hit 250 during this cycle. They believe they are still in the early stages of the market cycle and are focused on scaling their business in a sound and compliant manner.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

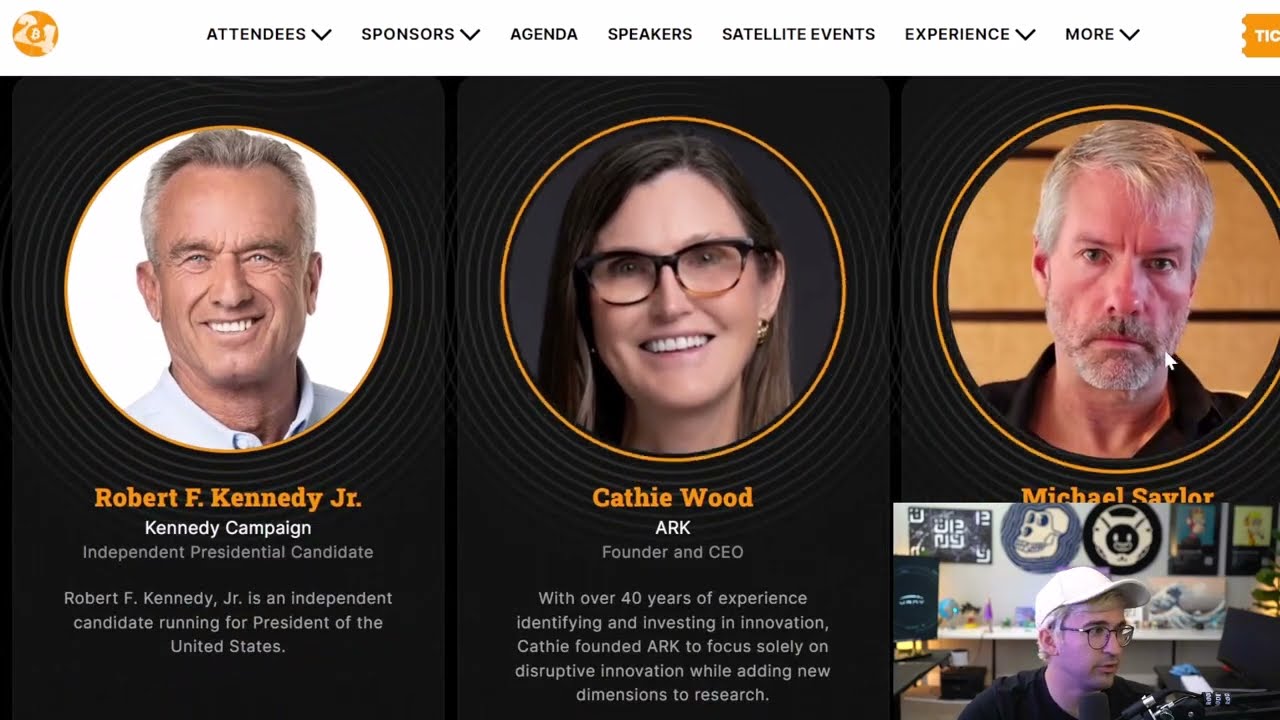

Michael Saylor: I Was Wrong, What's Coming For Crypto Is BIGGER!

Bloomberg Crypto 05/28/2024

Brace For Bitcoin Price Correction, Here's What's Next | iTrust CEO Kevin Maloney

🌟 Bitcoin Makes History with Dual Milestones! 🚀

THIS WEEK IS HUGE FOR CRYPTO

⚠️ RECORD de VENTAS en BITCOIN pero AGUANTA los 56K | Noticias y Actualidad Criptomonedas y Economia

5.0 / 5 (0 votes)