RAZONETES E PARTIDAS DOBRADAS - CONTABILIDADE BÁSICA - DÉBITO E CRÉDITO - CONTAS T 📊☑️

Summary

TLDRThis video provides an in-depth explanation of 'razonetes' (T-accounts) in accounting. It simplifies the concept, showing how they help track debit and credit transactions visually. The presenter highlights the importance of understanding debit (left side) and credit (right side) placements in T-accounts. The method of double-entry bookkeeping, essential for modern accounting, is introduced, with an emphasis on balancing debits and credits. The video uses practical examples, such as company startup costs and asset purchases, to demonstrate these concepts. Viewers are encouraged to practice using exercises for mastery.

Takeaways

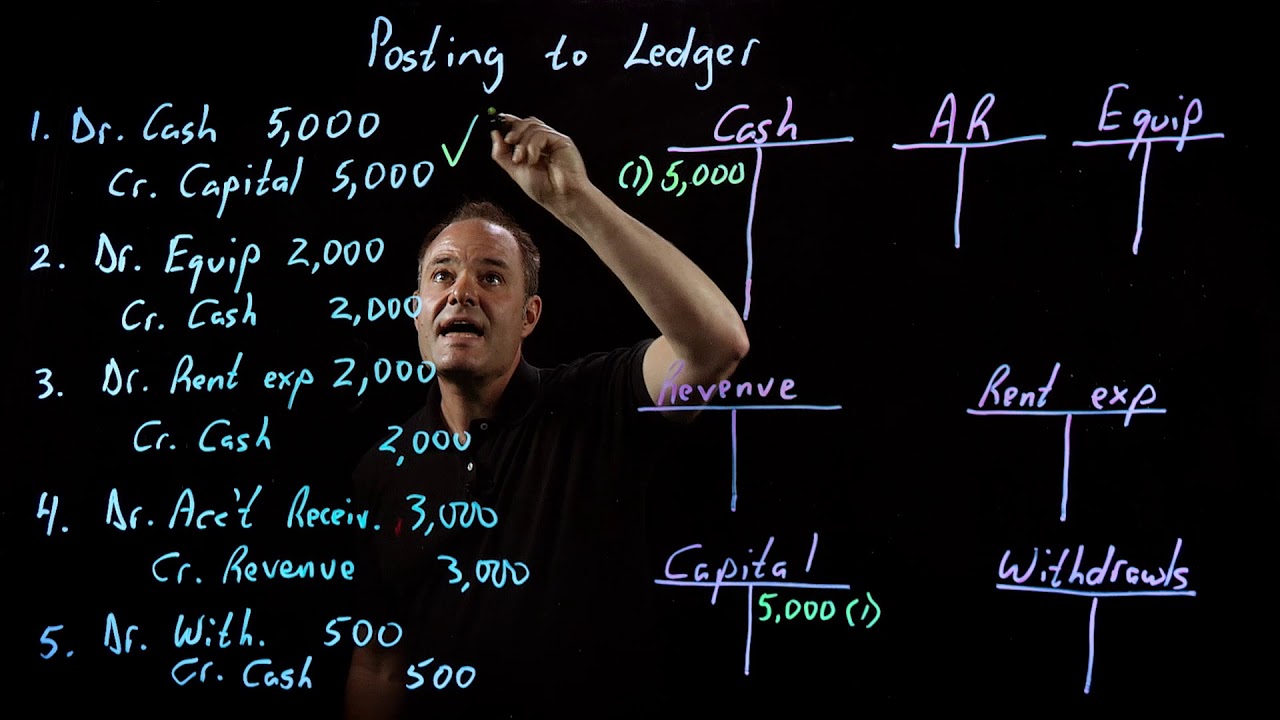

- 📚 Razonetes (T-accounts) are key tools for solving accounting problems and represent the visual format of accounts.

- 📝 The T-account has the account name at the top, debit values on the left, and credit values on the right.

- 📊 Razonetes follow the same logic as a balance sheet, where assets are on the left (debit side) and liabilities & equity are on the right (credit side).

- 🔄 Accounts on the asset side increase with debits, while liability and equity accounts increase with credits.

- 💡 The double-entry method, established by Luca Pacioli in 1494, is fundamental to accounting and ensures that every debit has a corresponding credit.

- 💡 Debits in accounting are not the same as debits in real-life transactions; debits represent the application of resources, while credits represent their origin.

- 💰 When recording a transaction, total debits must always equal total credits, following the double-entry method.

- 🏦 Example: Opening a company with $12,000 results in a debit to the cash account and a credit to the capital account.

- 🛋️ Example: Purchasing assets (furniture) results in a debit to the furniture account and a credit to the cash account.

- ✅ Consistent practice with razonetes is key to mastering their use, and balance sheets help track the changes in a company’s financial position.

Q & A

What is a 'razonete' in accounting?

-A razonete is a visual representation of an account used to record financial transactions. It is structured in the form of a 'T', with debits on the left side and credits on the right.

How do you differentiate between debit and credit in a razonete?

-In a razonete, debits are always recorded on the left side, and credits are recorded on the right side. This structure helps in tracking how an account is affected by transactions.

What is the purpose of using razonetes in accounting?

-Razonetes help visualize and track financial records, making it easier to see how each account is impacted by different transactions. They simplify the process of recording debits and credits for various accounts.

What is the relation between razonetes and the balance sheet?

-Razonetes represent individual accounts that make up the balance sheet. The accounts on the left side of the balance sheet (assets) are recorded as debits in razonetes, while the accounts on the right side (liabilities and equity) are recorded as credits.

What is the difference between an asset and a liability in terms of debit and credit?

-Asset accounts increase with debits (left side of the razonete), while liability and equity accounts increase with credits (right side of the razonete).

What is the double-entry method in accounting?

-The double-entry method records every transaction as both a debit and a credit. This ensures that the total debits always equal the total credits, maintaining the balance in financial records.

Why is the double-entry method important?

-The double-entry method ensures accuracy in accounting by providing a check system where every debit has a corresponding credit. This prevents discrepancies and maintains financial balance.

What are the key principles to remember when using razonetes?

-Key principles include: debits are recorded on the left and credits on the right, the total debits must always equal the total credits, and assets typically have debit balances while liabilities and equity have credit balances.

How would you record the opening of a company with $12,000 in capital using razonetes?

-You would credit $12,000 to the capital account (since it is equity) and debit $12,000 to the cash account (an asset), showing the increase in both accounts.

How would you record the purchase of furniture for $5,000 in cash using razonetes?

-You would debit $5,000 to the furniture account (an asset) and credit $5,000 from the cash account (since cash decreases), reflecting the purchase transaction.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

AKUNTANSI KEUANGAN MENENGAH - Bagian 2

T Accounts Explained SIMPLY (With 5 Examples)

PLAN CONTABLE- ELEMENTO 3: Activo Inmovilizado - CUENTA 30 y 31- TEORÍA Y PRÁCTICA

CONTABILIDADE PÚBLICA PARA CONCURSOS - AULA 02 - PARTE 02/03 - NOÇÕES DE PCASP

04. Financial Accounting - Theory

Accounting Fundamentals | Posting to the Ledger

5.0 / 5 (0 votes)