End-of-Day Bull and Bear Traps - Al Brooks

Summary

TLDREn este video, Al Brooks explora el concepto de 'trampas' en el trading, específicamente trampas al final del día. Expone cómo las trampas ocurren cuando un breakout no se sostiene y se reverte en lugar de continuar en la dirección iniciada. Analiza diferentes escenarios, incluyendo trampas en tendencias alcistas y bajistas, y cómo los traders pueden identificar y utilizar estas situaciones para tomar decisiones más informadas en el mercado. Brooks enfatiza la importancia del contexto y la necesidad de observar la conducta del mercado leading up to the breakout para predecir con mayor precisión el resultado de un potencial movimiento.

Takeaways

- 🔍 Un 'trampa' en el mercado es simplemente un breakout que falla.

- 🌟 Las 'trampas' pueden ocurrir al final del día, en un rango de trading o en una tendencia alcista o bajista.

- 📉 Las 'trampas alcistas' son rallys al final del día que parecen continuar subiendo pero en realidad se revierten hacia abajo.

- 🔻 Las 'trampas bajistas' son sell-offs al final del día que parecen continuar bajando pero en realidad se revierten hacia arriba.

- 📊 La regla del 80%: Si el mercado está en un rango de trading, el 80% de las intentos de breakout fallarán.

- 📈 En un trend, el 80% de los intentos de reversión de la tendencia fallarán, incluso si el intento de reversión parece muy fuerte.

- 🛑 Si ves una barra de tendencia en el gráfico, no es suficiente con solo ver el breakout, debes conocer el contexto previo al breakout.

- 🔄 Las trampas ocurren cuando hay un cambio repentino en la dirección del mercado que hace que los traders muestren una señal de compra o venta, pero la tendencia se revierte en su contra.

- 📌 Los traders deben estar alerta a las barras que cierran cerca de sus niveles mínimos o máximos, ya que pueden ser indicadores de trampas.

- ⏰ Las trampas pueden ocurrir en cualquier momento del día, pero se enfocan en los que suceden al final del día debido a la toma de decisiones de profit taking.

- 🔄 Si bien las trampas pueden engañar a los traders, también pueden ser señales de un cambio real en la tendencia del mercado.

Q & A

¿Qué es un 'trap' en el contexto del trading?

-Un 'trap' es un breakout que falla. Se refiere a una situación en la que parece que comienza una nueva tendencia, pero en realidad se reverte en la dirección opuesta.

Cuál es la diferencia entre un 'bull trap' y un 'bear trap'?

-Un 'bull trap' es un rally al final del día que parece continuar hacia arriba pero en realidad se reverte hacia abajo, mientras que un 'bear trap' es un sell-off al final del día que parece continuar hacia abajo pero en realidad se reverte hacia arriba.

¿Qué sucede si el mercado está en un rango de trading?

-Si el mercado está en un rango de trading, el 80% de las veces los intentos de breakout fallarán y se mantendrá el rango de trading continuo.

Qué es la 'regla del 80%' mencionada por Al Brooks?

-La 'regla del 80%' de Al Brooks indica que si el mercado está en un rango de trading, el 80% de las veces los intentos de breakout fallarán, y si está en una tendencia y está tratando de revertirse, el 80% de los intentos de reversión de la tendencia fallarán.

¿Cómo se identifica un 'trap' en un gráfico de precios?

-Para identificar un 'trap' en un gráfico de precios, es necesario observar no solo los breakouts, sino también el contexto que los precede. Si hay una tendencia alcista y se produce un rally que parece ser un inicio de una tendencia bajista, pero en realidad continúa subiendo, ese rally podría ser un 'bull trap'. Del mismo modo, si hay una tendencia bajista y se produce un sell-off que parece ser un inicio de una tendencia alcista, pero en realidad continúa bajando, ese sell-off podría ser un 'bear trap'.

¿Qué es un 'trend bar' y cómo se relaciona con un 'trap'?

-Un 'trend bar' es un candlestick que representa una dirección de tendencia específica, ya sea alcista o bajista. Un 'trap' se produce cuando se espera que un 'trend bar' continúe en esa dirección, pero en cambio se reverte en la dirección opuesta.

¿Qué es un 'gap' en el trading?

-Un 'gap' en el trading se refiere a una brecha en el gráfico de precios donde no hay transacciones en un cierto rango de precios. Esto puede ocurrir debido a noticias o eventos que afectan al mercado y pueden indicar un cambio en la tendencia o una posible oportunidades de trading.

¿Qué es un 'wedge' y cómo se relaciona con los 'traps'?

-Un 'wedge' es una forma de gráfico que se forma cuando los precios se están moviendo en una cierta dirección, pero la volatilidad está disminuyendo, creando una apariencia de forma de cinta. Esto puede indicar un posible cambio en la tendencia o una señal de 'trap' si la forma del 'wedge' se rompe en la dirección opuesta a la tendencia actual.

¿Qué es un 'double top' o 'double bottom' en el trading?

-Un 'double top' o 'double bottom' es un patrón de gráfico que se forma cuando los precios tocan dos veces un nivel específico de resistencia o soporte, respectivamente. Estos patrones pueden ser indicativos de un posible cambio en la tendencia o una señal de 'trap' si el segundo toque no rompe el nivel y los precios se reverten en la dirección opuesta.

¿Cómo los traders pueden evitar caer en 'traps'?

-Los traders pueden evitar caer en 'traps' analizando cuidadosamente el contexto y la formación de los gráficos, utilizando herramientas de análisis técnico y manteniendo un stop loss adecuado para minimizar las pérdidas. También es importante ser consciente de las noticias y eventos que pueden afectar el mercado y adaptarse rápidamente a los cambios en la tendencia.

¿Qué es 'short covering' y cómo se relaciona con los 'traps'?

-El 'short covering' es cuando los traders que han tomado posiciones de venta (short) compran de vuelta sus posiciones para cerrarlas, generalmente después de que el precio ha subido y están tratando de minimizar sus pérdidas. Esto puede causar un rally o una caída repentina en los precios, y si los traders esperan una continuación de esta acción pero en realidad se reverte, pueden haber caído en un 'trap'.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Broma a TikToker por Tramposo (Broma Telefónica)

Vanguard Is a Wild Success...

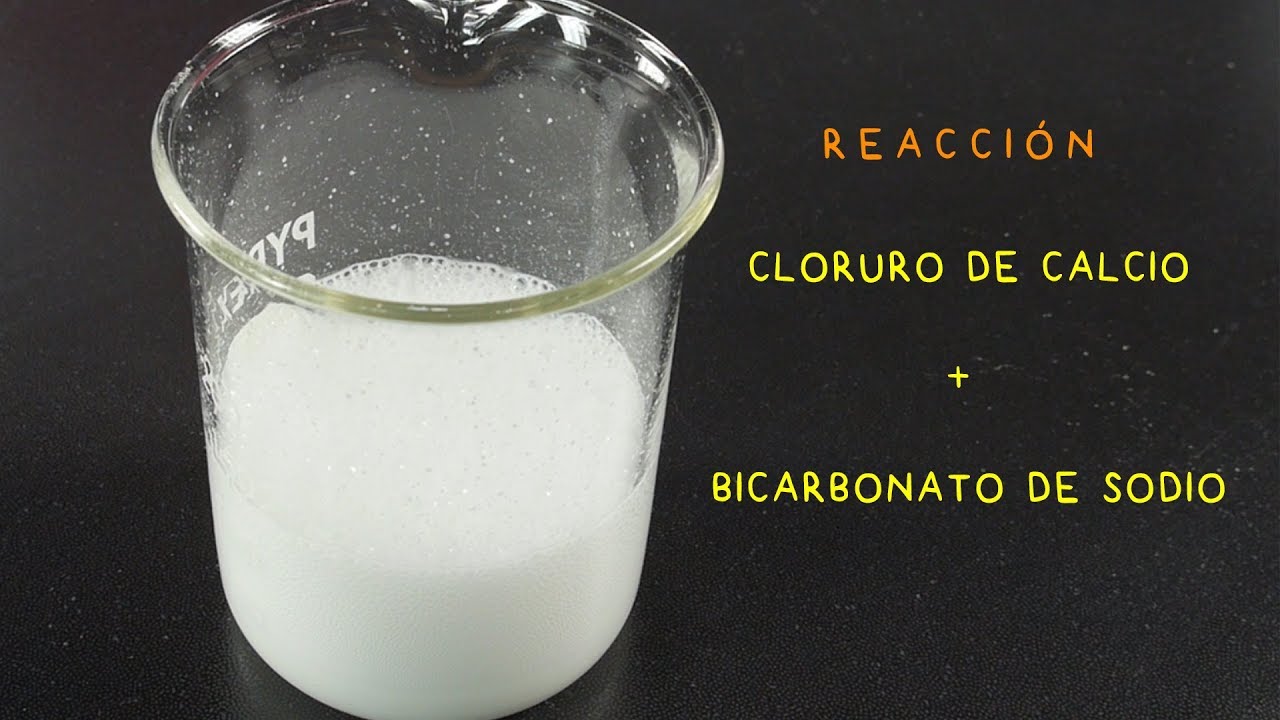

Reaction of Sodium Bicarbonate and Calcium Chloride (NaHCO3 + CaCl2)

El MAYOR PUNTO DÉBIL de LOS NARCISISTAS | Claudia Nicolasa Psicología

Como Cultivar Papaya de Forma Productiva - TvAgro por Juan Gonzalo Angel

¿Qué son las FALACIAS y cómo identificarlas? Tipos de falacias y ejemplos

5.0 / 5 (0 votes)