What is a Credit Score? A Credit Education for Filipinos by CIBI Information Inc.

Summary

TLDRA credit score, ranging from 300 to 850, is a three-digit number predicting one's creditworthiness. It's calculated using an algorithm that considers payment history, debt, credit length, new accounts, and credit types. Lenders use it to assess risk and determine loan eligibility, interest rates, and credit limits. High scores can lead to better financial services. CIB I's 'My Score' helps institutions understand members' credit standing, offering programs to improve their quality of life. To know your credit score, update your record, comply with credit information regulations, and access it through CIB I's website.

Takeaways

- 🔢 A credit score is a three-digit number that predicts your likelihood of repaying loans.

- 🏦 Lenders use credit scores to determine if you qualify for a loan and what interest rate or credit limit to offer.

- 📊 Credit scores are calculated using an algorithm that considers your payment history, debt, credit exposure length, recent account openings, and credit types.

- 📈 A credit score assesses your creditworthiness by evaluating key areas of your financial behavior.

- 🌐 Credit scoring is a global method used by lenders for over three decades.

- 📉 The credit score range is from 300 to 850, with 850 being the highest possible score.

- 💰 A higher credit score entitles an individual to better interest rates or credit services.

- 🚗 Credit scores are one reason why individuals in advanced countries can easily purchase cars or build assets.

- 📄 Credit scores are derived from credit reports provided by credit bureaus or entities like CIB I.

- 🔍 CIB I's credit score, called 'My Score,' helps institutions understand members' credit standing and improve their quality of life.

- 📝 To know your credit score, update your credit record, ensure compliance with credit information regulations, and obtain your score from CIB I.

Q & A

What is a credit score?

-A credit score is a three-digit number that predicts your likelihood of paying back loans, which lenders use to determine if you qualify for a loan or what interest rate or credit limit to give you.

How does a credit score help lenders?

-A credit score helps lenders assess an individual's creditworthiness by considering their payment history, amount of debt, length of credit exposure, recent account openings, and types of credit.

What is the range of a credit score?

-A credit score ranges from 300 to 850, with 850 being the highest possible score.

What benefits does a high credit score provide?

-A high credit score entitles an individual to better interest rates or credit services, making it easier to buy cars or build assets.

How long have lenders been using credit scores?

-Lenders have been using credit scores as a quick and accurate method for more than three decades.

Where do credit scores come from?

-Credit scores are derived from credit reports provided by credit bureaus or special accessing entities like CIB I.

What is the credit score called at CIB I?

-At CIB I, the credit score is called 'My Score'.

How has My Score helped institutions at CIB I?

-My Score at CIB I has helped many institutions by providing better knowledge of members' credit standing, allowing them to offer programs and services aimed at improving members' quality of life.

What are the three steps to get your credit score from CIB I?

-The three steps are: 1) Update your credit record, 2) Submit your entity to ensure compliance with the credit information corporation, and 3) Get your credit score by visiting their website.

Is credit scoring limited to banks and financial institutions?

-No, credit scoring is not limited to banks and financial institutions; it is also used by commercial businesses for KYC and pre-employment processes.

What is the significance of a credit report?

-A credit report provides detailed information about an individual's credit history, which is used to calculate their credit score and assess their creditworthiness.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

What is a Credit Score and How is it Calculated?

3.1. Credit Scoring | DATA SCIENCE PROJECT

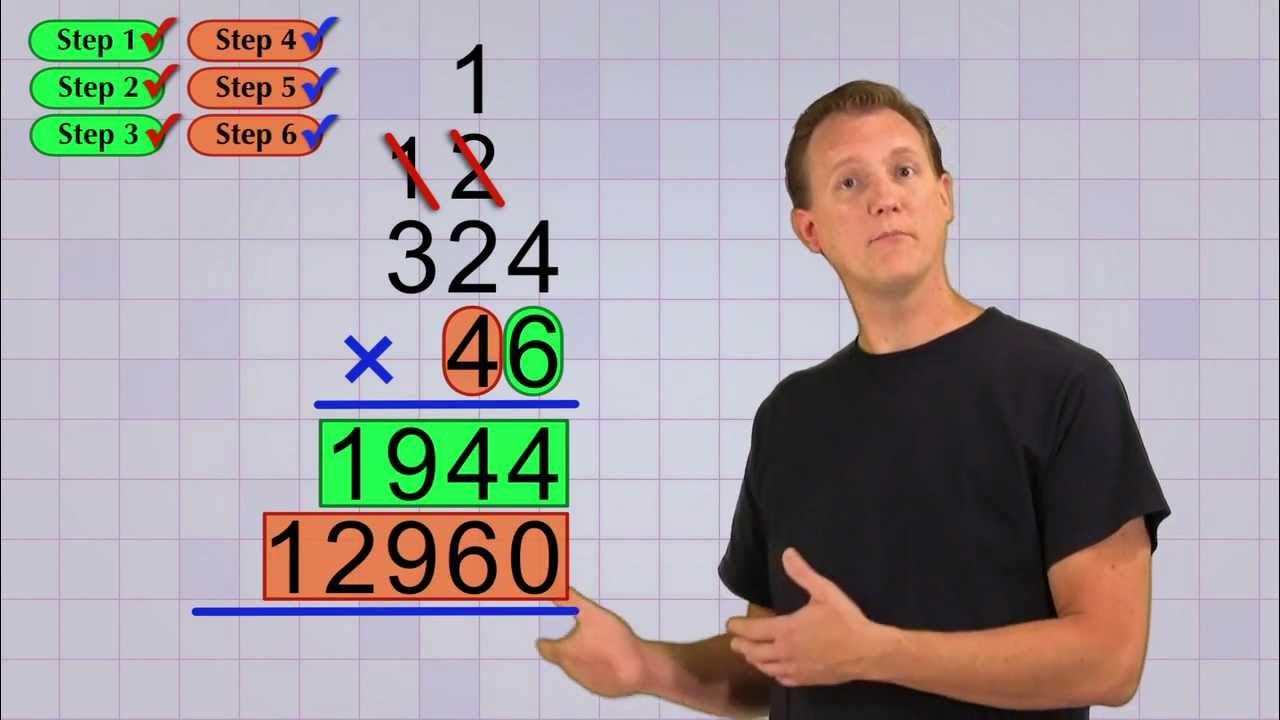

Math Antics - Multi-Digit Multiplication Pt 2

Psychological Pricing | How Apple Uses a Psychological Pricing Strategy

Análise de crédito: O que é e como funciona? - Serasa Ensina

PN Gadgil Jewellers IPO Opens Today, Comapny Targets Rs 10,000 Cr Revenue In FY27 | CNBC TV18

5.0 / 5 (0 votes)