Every ICT Trading Strategy Explained in 13 Minutes!

Summary

TLDRThis video succinctly breaks down eight ICT smart-money trading strategies—Silver Bullet, Cameron’s Model, Inversion FVG, Turtle Soup, Candle Range Theory, Optimal Trade Entry (OTE), Change in the State of Delivery (CISD), and the Power of Three. Each method emphasizes liquidity concepts (sweeps, draws), market structure shifts, and fair value gaps (FVGs) to time entries and stops across multiple timeframes. Practical tips cover stop-loss placement, when to use deeper retracements (OTE), combining higher-timeframe context, and recognizing failed/ inverted FVGs. The guide is actionable, risk-focused, and geared toward traders wanting structured setups and clearer trade management.

Takeaways

- 😀 The Silver Bullet setup combines market structure shift, liquidity sweep, and fair value gap (FVG) to identify reversal opportunities.

- 😀 A bearish market structure shift occurs when the price breaks and closes below the recent swing low, indicating a potential downtrend.

- 😀 Liquidity sweep signals are formed when the price breaks above the day's high or below the day's low and then quickly returns inside the range.

- 😀 Cameron's model involves identifying a draw on liquidity, a stop rate, and an entry point, with fair value gaps marking the potential trade zones.

- 😀 In Cameron's model, the stop rate is found on lower time frames after the liquidity level has been identified on a higher time frame.

- 😀 Inversion FVG occurs when the price disrespects a previously formed fair value gap, indicating a potential reversal in the market direction.

- 😀 The Turtle Soup setup focuses on liquidity raids below recent lows for bullish trades or above recent highs for bearish trades, with fair value gaps confirming entry.

- 😀 Candle Range Theory (CRT) uses the high and low of a single candlestick to identify key liquidity levels that the market targets, forming the basis for entries.

- 😀 The Optimal Trade Entry (OTE) strategy uses Fibonacci retracement levels to identify the best entry points during a price correction.

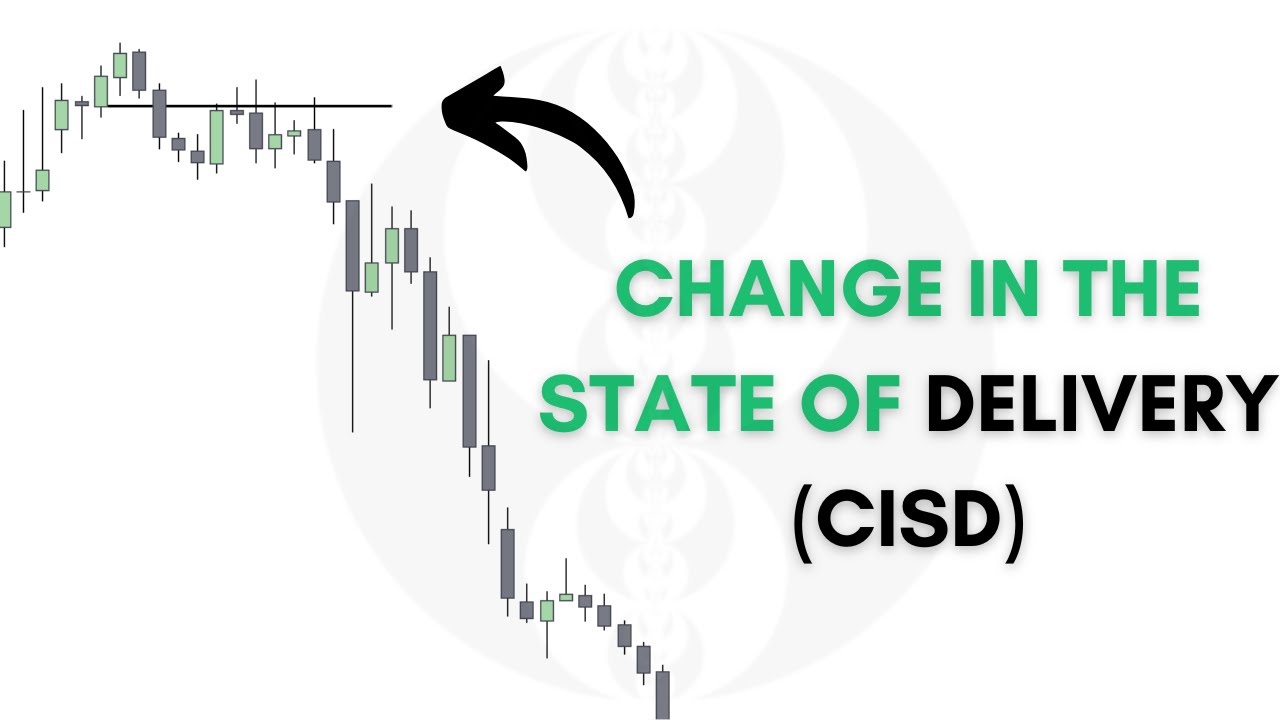

- 😀 The Change in the State of Delivery (CISD) marks a sudden shift in momentum, often signaling a market reversal that can be traded after the price returns to key fair value gaps.

Q & A

What is the 'silver bullet' trading setup in ICT strategies?

-The 'silver bullet' trading setup combines three main concepts: market structure shift, liquidity sweep, and fair value gap (FVG). To trade it, wait for the price to break above the day's high, then return inside the range, taking out buy-side liquidity. After a bearish market structure shift, set a sell limit at the start of the FVG zone and wait for the price to pull back into it.

How can a bearish market structure shift confirm a reversal in the silver bullet setup?

-A bearish market structure shift occurs when the price breaks and closes below a recent swing low, indicating that demand is no longer in control. This signals a potential reversal to the downside, which is confirmed as part of the silver bullet setup.

What role does the liquidity sweep play in the silver bullet strategy?

-The liquidity sweep occurs when the price briefly moves above the key structure of the day, tapping into resting buy-side liquidity. This signals a potential reversal, as the price returns inside the range, indicating that liquidity has been 'swept' before the trend changes.

What is Cameron's model in ICT trading, and how is liquidity used in it?

-Cameron's model involves three steps: identifying a draw on liquidity, a stop rate, and an entry. The draw on liquidity is a key level the market is moving toward, often seen as swing highs/lows or areas with resting liquidity. Traders look for liquidity zones on the hourly chart and then zoom into lower timeframes for stop rates and fair value gap formations to set up their entries.

What is an inversion fair value gap (FVG) and how does it affect trade decisions?

-An inversion FVG occurs when a previously respected fair value gap is violated by the price, signaling a potential reversal. If the price breaks the FVG and continues in the opposite direction, it creates an inversion. Traders may set a sell limit at this point, expecting the price to retrace to the FVG or move further down.

How do you enter a trade using the 'turtle soup' setup?

-The turtle soup setup combines market direction, liquidity raid, and FVG entry. A bullish setup happens when the price raids liquidity below a recent low and rests above a bullish FVG. To enter, wait for rejection at the FVG, then open a buy position with a stop loss placed below the zone, targeting the next key level.

What is Candle Range Theory (CRT), and how does it help identify trade opportunities?

-Candle Range Theory (CRT) involves analyzing the high and low of a candlestick to determine liquidity levels. In the strategy, the first candle defines the range, the second creates a liquidity sweep, and the third provides the entry. In an uptrend, traders look for price sweeps and fair value gap formations for a possible entry.

What are the key Fibonacci retracement levels in the Optimal Trade Entry (OTE) setup?

-The Optimal Trade Entry (OTE) strategy focuses on finding the best correction zone using Fibonacci retracement levels. The key entry zone is between the 0.786 and 0.618 levels, as this area offers a higher risk-to-reward ratio, safer stop-loss placement, and reduces the chance of being stopped out by early market moves.

How does a 'Change in the State of Delivery' (CISD) signal a market reversal?

-A Change in the State of Delivery (CISD) occurs when the market experiences a sudden momentum shift, such as a strong uptrend followed by a sharp drop and the formation of a bearish FVG. This indicates a potential reversal, and traders wait for price to return to the FVG and show signs of rejection before entering a short position.

What are the phases of the 'Power of Three' trading concept?

-The 'Power of Three' concept involves three phases: Accumulation (price consolidation), Manipulation (fake out or breakout), and Distribution (price moves in the opposite direction after liquidity has been swept). Traders look for the manipulation phase to confirm a fake out, then enter trades in the distribution phase, typically using lower timeframes for entries.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT MMXM - My Secret Way to Read Market Maker Moves for Beginners

2023 ICT Mentorship - ICT Silver Bullet Time Based Trading Model

4HR PO3 | MMXM | Standard Deviations | ICT Concepts

Change In The State Of Delivery (CISD) - Reversal Confirmation

Candle Range Theory Explained

ICT OTE Explained Step by Step

5.0 / 5 (0 votes)