By The Numbers in Japan! How To Have Your Passive Income Outweigh Your Expenses.

Summary

TLDRIn this video, BSP Hope discusses the importance of understanding numbers, particularly in the context of living and investing in Japan. He shares insights on the percentage of foreign immigrants in Japan, highlighting that Americans make up a small portion of this demographic. He emphasizes the value of passive income, explaining how it can exceed monthly expenses, leading to financial freedom. BSP Hope also stresses the significance of having out-of-market funds for unexpected expenses, suggesting an 18-month reserve as a rule of thumb. His advice is aimed at helping viewers optimize their financial situation in Japan.

Takeaways

- 📊 The speaker emphasizes the importance of understanding numbers, particularly in relation to net worth and investments.

- 🌍 Discusses the percentage of foreign immigrants in Japan, highlighting that they make up only 2.66% of the population, with Chinese and South Koreans being the largest groups.

- 🏆 Points out the rarity of certain nationalities in Japan, such as Americans and Canadians, and how this can impact one's experience living in the country.

- 💼 Shares personal experiences as an American living in Japan, including the perception and treatment of Westerners in Japanese society.

- 💰 Talks about the concept of active and passive income, suggesting that building passive income is crucial for financial stability and growth.

- 📈 Advises on setting financial goals where passive income matches or exceeds monthly expenses, allowing for reinvestment and wealth accumulation.

- 💹 Highlights the significance of reinvesting dividends to grow passive income over time, regardless of market fluctuations.

- 💳 Stresses the need for out-of-market funds for unexpected expenses or opportunities, recommending having 18 months' worth of expenses saved.

- 🌐 Provides investment advice based on personal experience, not professional expertise, and encourages viewers to consider their financial strategies carefully.

Q & A

What is the percentage of foreign immigrants in Japan's population?

-Foreign immigrants make up 2.66% of Japan's population.

Which ethnic group is the largest among foreign immigrants in Japan?

-The largest group among foreign immigrants in Japan is Chinese, followed by South Koreans.

What is the percentage of Americans living in Japan among the foreign population?

-Americans, including those in the military, constitute only 2.1% of the foreign population in Japan.

Why does the speaker emphasize the rarity of certain nationalities in Japan?

-The speaker emphasizes the rarity to highlight the unique position and respect that Western nationals, such as Americans, Brits, and Canadians, often receive in Japan.

What does the speaker mean by 'numbers guy' and how does it relate to his content?

-The speaker refers to himself as a 'numbers guy' because he frequently discusses financial and statistical information, particularly related to investments and net worth.

What advice does the speaker give regarding active and passive income in Japan?

-The speaker advises that one should aim to have passive income that exceeds their monthly expenses, allowing for financial growth and eventual reliance on passive income rather than active income.

How does the speaker define 'habitual spending' and why is it important?

-Habitual spending refers to a consistent, predictable level of monthly expenses that one can manage without constantly monitoring. It's important for understanding one's financial habits and planning investments.

What is the significance of having out-of-market funds according to the speaker?

-Out-of-market funds are significant as they provide liquid assets for unexpected expenses or market downturns without disrupting the investment portfolio or forcing the sale of investments at a loss.

Why does the speaker suggest maintaining a certain percentage of investments in crypto despite market fluctuations?

-The speaker suggests maintaining a consistent percentage in crypto investments to keep the portfolio proportionally balanced, avoiding the temptation to chase short-term market movements.

What is the recommended minimum out-of-market funds one should have according to the speaker?

-The speaker recommends having out-of-market funds that can cover at least 18 months of monthly expenses to ensure financial security during market downturns or emergencies.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Lưu vong bị police Nhật đuổi bắt - Trò khỉ mà ng Việt ở Nhật làm

CARACTERÍSTICAS DO NÚMERO 0 (ZERO) - O INFINITO - NUMEROLOGIA QUÂNTICA

IPCA +10,8%: NÃO CAIA NESSA ARMADILHA do IPCA+

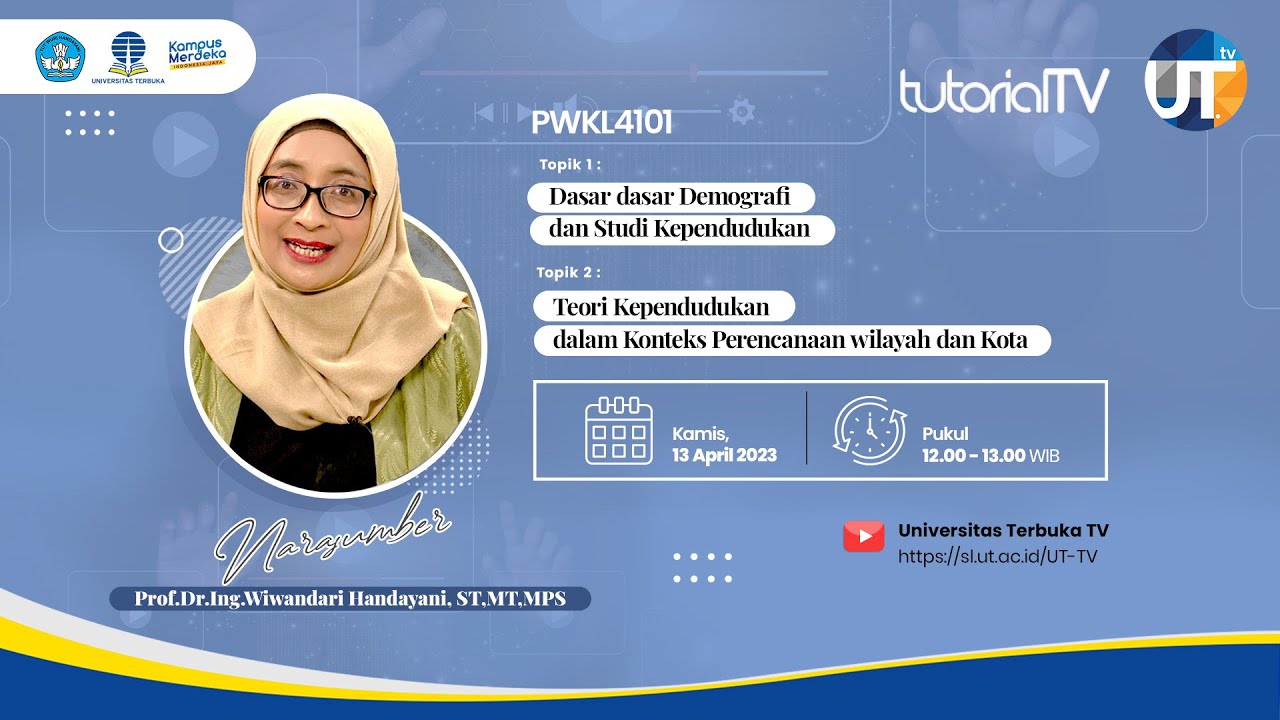

Perencanaan Wilayah dan Kota - Prof. Dr. Ing. Wiwandari Handayani, ST, MT, MPS

Belajar Bahasa Inggris dari Nol (+ Sertifikat 🎖 GRATIS) - Episode 21

How Inflation In America Is Destroying Your Retirement & How You Can Fix it

5.0 / 5 (0 votes)