Medicare Basics: Parts A, B, C & D

Summary

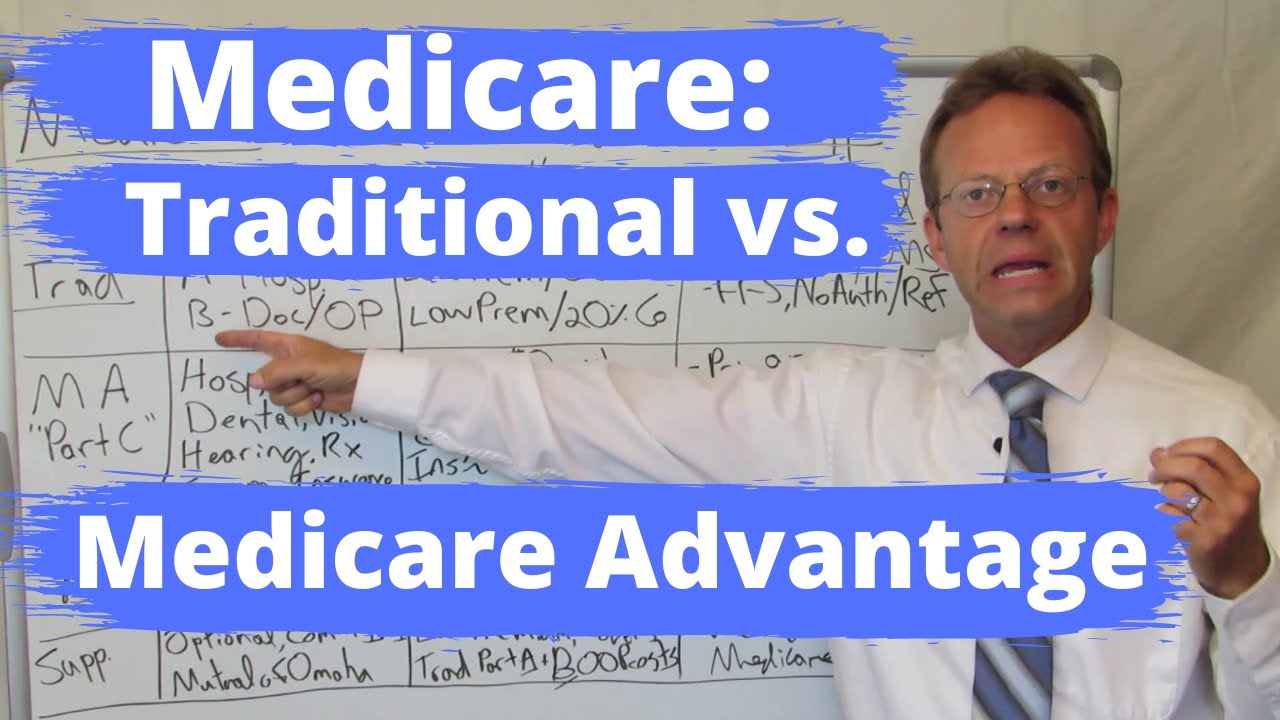

TLDRCarol Carstensen from Medicare Made Clear offers a comprehensive overview of Medicare, a federal health insurance program for those aged 65 and above or with qualifying disabilities. She explains the different parts of Medicare, including hospital insurance (Part A), medical insurance (Part B), Medicare Advantage (Part C), and prescription drug coverage (Part D). Each part has its own coverage and costs, with Original Medicare (Parts A and B) covering basic services but not prescription drugs, dental, vision, or hearing care. Medicare Advantage plans provide broader coverage, including additional benefits like dental and vision, and have an annual out-of-pocket limit for financial protection. The choice of plan depends on personal health needs, budget, and lifestyle.

Takeaways

- 👵 Medicare is a federal health insurance program for individuals aged 65 and older, and certain individuals with qualifying disabilities.

- 🏥 Part A of Medicare covers hospital insurance, including inpatient care, skilled nursing facilities, room, meals, nursing services, and medical supplies.

- 🩺 Part B covers medical insurance, such as doctor visits, outpatient care, preventive services, and medical equipment at home.

- 💸 Most people get Part A premium-free if they or their spouse have worked and paid taxes for at least 10 years; Part B has a premium deducted from Social Security or paid directly.

- 💊 Original Medicare (Parts A and B) does not cover prescription drugs, dental, vision, or hearing care, which are additional services.

- 🌐 Part C, or Medicare Advantage, is offered by private companies and includes all Original Medicare benefits, often with additional coverage like drugs, dental, and vision.

- 💲 Medicare Advantage plans may have $0 premiums, and they all have an annual out-of-pocket limit for built-in financial protection.

- 📚 Part D is prescription drug coverage, available through Medicare Advantage or stand-alone Part D plans, with each plan having its formulary and cost structure.

- 🔄 Medicare supplement insurance, or Medigap, helps cover out-of-pocket costs of Original Medicare and is standardized with different plans labeled A through N.

- 🤔 The choice of Medicare plan is personal and depends on whether you want additional benefits, lower monthly premiums, or have specific healthcare providers and travel needs.

Q & A

What is Medicare and who is it designed for?

-Medicare is a federal health insurance program for people aged 65 and older, as well as others with qualifying disabilities, and it requires the individual to be a United States citizen or a legal resident who has lived in the country for at least five consecutive years prior to enrollment.

How does individual insurance work with Medicare?

-Individual insurance with Medicare means that each person needs to qualify, enroll, and choose coverage for themselves, which differs from family health plans provided by employers.

What are the two main parts of Government-sponsored Medicare?

-The two main parts of Government-sponsored Medicare are Part A, which is hospital insurance, and Part B, which is medical insurance.

What does Medicare Part A cover?

-Medicare Part A covers inpatient care in hospitals or skilled nursing facilities, including room, meals, nursing services, equipment, supplies, and operating room costs.

What services are included in Medicare Part B?

-Medicare Part B covers doctor visits, outpatient care, ambulance services, preventive care services like flu shots, and medical devices used at home.

Are there costs associated with Part A of Medicare?

-Yes, Part A has costs which can include a deductible and some copays and coinsurance, but it is premium-free for most people who have worked and paid taxes for at least 10 years.

How is the cost of Medicare Part B handled?

-The cost of Medicare Part B includes a premium, which is usually deducted from one's Social Security check if they receive it, copays, a deductible, and coinsurance.

What additional coverage options are available beyond Original Medicare?

-Beyond Original Medicare, coverage options include Medicare Part C (Medicare Advantage), Part D (prescription drug coverage), and Medicare supplement insurance (Medigap).

What is Medicare Advantage and how does it differ from Original Medicare?

-Medicare Advantage, or Part C, is offered by private insurance companies and covers all Original Medicare benefits, often including prescription drug coverage and additional benefits like dental and vision. It may have a premium and requires choosing providers from within a network.

How does Medicare Part D provide prescription drug coverage?

-Medicare Part D provides prescription drug coverage either through a Medicare Advantage plan or a stand-alone Part D plan. It requires plans to cover all types or classes of drugs normally used by Medicare beneficiaries.

What is Medicare supplement insurance and what does it cover?

-Medicare supplement insurance, or Medigap, supplements Original Medicare by helping to pay some of the out-of-pocket costs associated with Part A and Part B. It is standardized and labeled from A through N, with each letter representing a plan with specific coverage.

How can one decide which Medicare plan is right for them?

-Choosing the right Medicare plan involves considering personal health needs, budget, and lifestyle. Factors to consider include the desire for additional benefits like dental or vision, preference for lower monthly premiums or higher premiums with fewer out-of-pocket expenses, and the need to see specific doctors or travel frequently.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

FEHB and Medicare Explained

Traditional Medicare vs Medicare Advantage vs Medicare Part D vs Medicare Supplement Explained

How To Maximize S Corp Tax Savings

Response to @NYCMayorsOffice After his Older Adult TownHall in Riverdale

The Healthcare System of the United States

5 BEST Health Insurance Plans for 2025 | Top Health Insurance Policies 2025 | HONEST Review | Ditto

5.0 / 5 (0 votes)